Consumer Segmentation: Maybe You Could Be Doing It Better

Naira Musallam, PhD • 28 Jun 2018

Have you ever considered that your customers may be more diverse than your marketing?

How well do you really know them? What do your target segments look like? Do your marketing campaigns reflect what you know about them?

When it comes to consumer segmentation, most brands divide their customers into groups based on common predetermined characteristics, allowing them to change their messaging depending upon the segment. But how can you know for sure if those are the most accurate segments to engage?

If your sole method of understanding your customers is through demographic segmentation, then at best your understanding is limited and, at worst, it’s incomplete or misleading.

Because of this fact, we believe in letting the data itself reveal the customer personas that naturally exist.

First, Some Context

Today, we live in a “post demographic” world. Simply put, this means consumers have changed. The way we all interact with brands has evolved considerably in recent years. Consumers continually construct and reconstruct their own identities, rebelling against top-down driven “norms” handed to them by the advertisements of old. The clear delineations between consumers based on gender, age, income, education, or ethnicity are not as useful as they once seemed.

Take, for example, a young woman working in finance with a high level of disposable income and a middle-aged man working in education with a lower level of disposable income. From the outside it might seem that these two wouldn’t have much in common. However, they very well may have more values or experiences in common than demographic data alone would suggest.

In this world, where commonality is not defined by demographics, the ramifications of sub-standard consumer segmentation are massive; ultimately leading to mediocre brand messaging, marketing campaigns, and advertising.

Real World Applications

Suppose you conduct a market research project to understand how likely consumers are to purchase a new household good. For this project, you collect data from 1,000 respondents, from general demographic information to price, brand image, and quality sensitivity.

Traditional consumer segmentation methods may have revealed that females are much more likely to purchase your new household product than their male counterparts . Or perhaps when you cut the data according to age, you found out that Gen Z cared more about brand image than Gen X did.

But, is that truly the only way these consumers are similar? Age and gender alone? Let’s circle back to our original suggestion and let the data to do all the talking. We can do this by using a type of machine learning algorithm known as unsupervised learning. This allows us to segment the data according to how the data behaves and cluster consumers into the most homogenous and efficient groups.

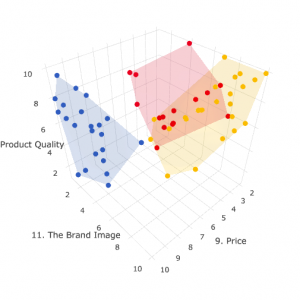

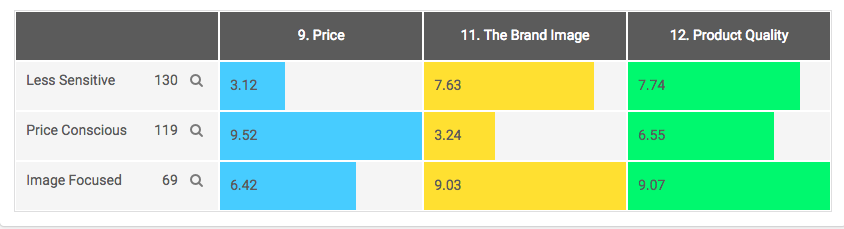

The results may show something like the graph below; a three-dimensional cluster analysis where the similarities shared in each group are based on how important quality, image, and price were, not based on a predetermined demographic split. With this information mapped out, each persona tells us a different story.

The first cluster, denoted in red on the graph above, scored low on sensitivity to price, but higher on product quality and brand image. The second cluster, in blue, scored much higher on price sensitivity, lower on caring about product quality and lower on brand image, while the third cluster, in yellow on the graph, scored medium on price, and the highest on caring about both product quality and brand image.

The interesting part? Each cluster is a mix of demographic variables!

All of these unique personas can tell us what these consumers value and, by extension, what type of messaging resonates with them.

Best Practices to Keep in Mind

Remember, the purpose of learning is growth. So collecting the right data is only half of the equation, you’ve then got to make sure you use that data in the right ways. To do just that, keep in mind the following:

- Demographics never tell us the whole story. To understand your audience, you have to collect data related to who they are, what they value, and what motivates them.

- Consumer behavior is constantly shifting and evolving. If you want to keep pace, conduct market segmentation frequently to ensure your marketing is up to date and on target for results.

- By collecting data about consumer’s online habits, you can refine your strategies further. Just make sure to adapt your marketing plan to meet the motivations of these newly discovered market segments.

- Complement traditional consumer segmentation with machine learning processes, like those applied by SightX. Every statistical method comes with its own set of assumptions. Even "no assumption" is an assumption.

- Always be open to learning from the data you collect, whether it confirms your strategy or challenges your thinking.

When it comes down to it, staying relevant to your audience is the only way to build long-term brand equity and loyalty. SightX allows you to use multiple tools to create and discover your consumer segments. Manually develop predetermined segments, or let our platform automatically create them for you based on behavioral or psychographic data.

It really can be that simple.