Survey research is heavily relied upon by organizations to collect direct feedback from customers. And for good reason! Surveys are an effective way to connect with an audience.

But when you are looking to answer more specific questions about your business, you are likely ready to explore market research methodologies, a useful extension of survey research.

Maybe you want to know:

![]() What is the optimal price of my offering?

What is the optimal price of my offering? ![]() What are the most valuable features of my product?

What are the most valuable features of my product? ![]() What factors are most likely to predict my NPS score?

What factors are most likely to predict my NPS score?

These are just a few of the critical business questions that can be answered using market research methodologies. Today, we'll review some of the most popular experiments:

Product Feature Optimization

Market Research Methodology: MaxDiff Analysis

MaxDiff Analysis, also known as Maximum Difference Scaling, is a methodology used in market research to determine the relative importance of different attributes or features of a product. Researchers can design MaxDiff surveys and analyze the data to identify which attributes are most preferred and which are least preferred by consumers. This enables businesses to prioritize features that matter most to their audience.

And it isn’t just helpful for product development. This information can also inform your go-to-market strategy and marketing messaging, allowing businesses to focus their efforts where they matter most.

For example, if the innovation team of an ice cream company has thirteen potential flavors to bring to the market, and the business is interested in identifying the top three flavors, a maxdiff experiment will immediately show them which flavors are most popular with their market.

Market Research Methodology: Conjoint Analysis

Conjoint Analysis is a powerful methodology used to understand how consumers make decisions when faced with multiple options or attributes. It helps businesses determine the relative importance of different features of a product or service and how these attributes influence consumer preferences and choices.

In conjoint analysis, respondents are presented with a set of hypothetical product profiles or scenarios that vary in terms of specific attributes, such as price, design, specific features, or brand. These attributes are systematically varied across different scenarios to create a range of product combinations. Respondents are then asked to evaluate or rank these product profiles based on their preferences.

By analyzing the choices made by respondents across different scenarios, researchers can estimate the relative importance of each attribute and how it influences overall product preference.

Product Pricing Optimization

Market Research Methodology: Gabor-Granger Pricing Analysis

Gabor-Granger Pricing Analysis is a methodology used to determine the optimal price for a product or service by assessing consumer willingness to pay at different price points.

The results help businesses identify the price sensitivity and demand elasticity in their market. Which, in turn, helps businesses to set prices that maximize revenue and profitability while ensuring customer satisfaction and market competitiveness.

Market Research Methodology: Van Westendorp Price Sensitivity Meter

The Van Westendorp Price Sensitivity Meter (PSM) is a technique used to determine the optimal price range for a product or service by assessing consumer price sensitivity.

It involves asking respondents a series of questions about their willingness to buy a product or service at different price points. Specifically, respondents are asked four key questions: Price Point at which the Product is Seen as cheap, too cheap, expensive, and too expensive.

The results give insights into four key price points:

1) Point of Marginal Cheapness: The price at which a significant proportion of respondents perceive the product as too cheap

2) Point of Marginal Expensiveness: The price at which a significant proportion of respondents perceive the product as too expensive

3) Optimal Price Point: The price range in which most respondents perceive the product as providing good value

4) Indifference Price Point: The price range in which respondents are equally divided between considering the product too cheap and too expensive.

Understanding Consumer Behavior

Market Research Methodology: Key Driver Analysis

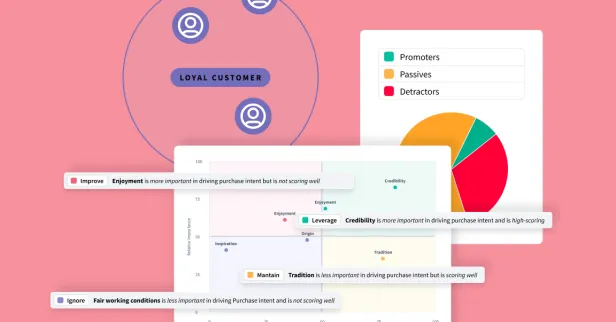

Key Driver Analysis is a methodology used to identify the key factors that influence customer satisfaction, loyalty, or other important business outcomes.

It starts with identifying a set of potential driver variables based on prior knowledge, literature review, or exploratory data analysis. These variables can include product features, customer service quality, pricing, brand reputation, and other factors that may be relevant to shoppers.

Respondents are asked to provide ratings or feedback on various factors that may influence the outcome of interest (like customer satisfaction).

Using statistical techniques such as regression analysis or correlation analysis, you can analyze the relationship between the driver and the outcome. This allows you to quantify the strength and direction of the relationship between each driver variable and the outcome.

By understanding these key drivers, businesses can focus their efforts on addressing the most critical factors to drive positive outcomes.

Moving Beyond Survey Research

As companies rely on consumer research to form go-to-market strategies and optimize their operations, a comprehensive suite of market research methodologies that go beyond traditional survey research is necessary to uncover deeper insights and make more informed decisions.

By leveraging these experiments, businesses can drive innovation, enhance customer experiences, and gain a competitive edge in today's dynamic marketplace.

SightX Market Research Methodologies

SightX is an AI-driven market research platform that offers you a single unified solution for product, brand, marketing, and pricing research. While powerful enough for insights teams at Fortune 500 companies, our user-friendly interface makes it simple for anyone to start, optimize, and scale their research.

And with our new Generative AI consultant, Ada, you can harness the power of OpenAI’s GPT to transform your marketing research and insights. Collaborating with Ada is like having an expert researcher, brilliant statistician, and ace marketer on your team, helping you ask the right questions, choose the best experiments, pick out key insights, and seamlessly apply them to your business.