AI Powered Consumer Due Diligence

Find hidden risks and uncover non-obvious opportunities in deal evaluation

Find hidden risks and uncover non-obvious opportunities in deal evaluation Capture data from leading indicators of future performance coming directly from consumers in any target market, especially where traditional financial and operational data fall short. Capture insights that are higher quality, 10x more cost-effective, and come at light speed relative to agencies and consulting firms that don’t directly leverage their own AI powered software. Gain more accurate valuations in pre-sales scenarios, or when making big bets on product launches, new market entries, rebranding efforts, or large-scale transformations. Gather feedback from any target consumer, including B2B. Understand what must be true to win top-of-funnel conversions, estimate CAC, LTV, and map customer journeys. Verify anecdotes about customer satisfaction with statistically representative data. Key Features: Uncover the ideal price range for a new product offering or pinpoint a price point to maximize likelihood of purchase. Take the guesswork out of going to market. Visualize the effect that price changes have on demand. Quantify price elasticity relative to competitors. Key Features: Determine if a one-size-fits-all GTM approach is ideal, or if market segmentation would result in a maximized TAM. Predict adoption and causally understand usage across the entire product lifecycle. Optimize features to expand reach with the right combination of offerings and messages. Key Features: Avoid overestimating product and service features that don’t matter, and avoid underestimating the features that do. Improve operating margin by eliminating offerings that customers don’t care about. Key Features: Place a monetary value on net willingness to pay for branded vs. unbranded products & services. Measure KPIs like brand awareness, perception, loyalty, and preference to uncover what actions will drive revenue. Benchmark and track brand performance over time as value creation activities are implemented post-investment. Key Features: Understand the demographics of each market segment to drive product adoption and optimize ROAS. Estimate the impact of introducing a new product on sales of the rest of a product & service portfolio. Key Features: With every tool required to get immediate insights into any consumer question arising in deal assessment or due diligence. Each Consumer Due Diligence Report is priced based on objectives & feasibility. Every user has access to all of our software capabilities & interactive dashboards during the defined period of time we agree on, and all static reports are owned by you in perpetuity. Retainer & subscription credits can be purchased in bulk, with additional discounts depending on the amount. Review Consumer Due Diligence Report objectives and related milestones timeline. Scope feasibility & price sample, services. Hosted platform onboarding & guided tour of our interactive dashboards with your dedicated Customer Success Pro. We work with you to customize a plan for things like project milestone check-ins and ongoing support.AI Powered Consumer Due Diligence

Consumer Due Diligence

See What Others Don't

Faster, More Accurate Insights

Develop More Accurate Valuations

How Consumer Due Diligence Helps Investors

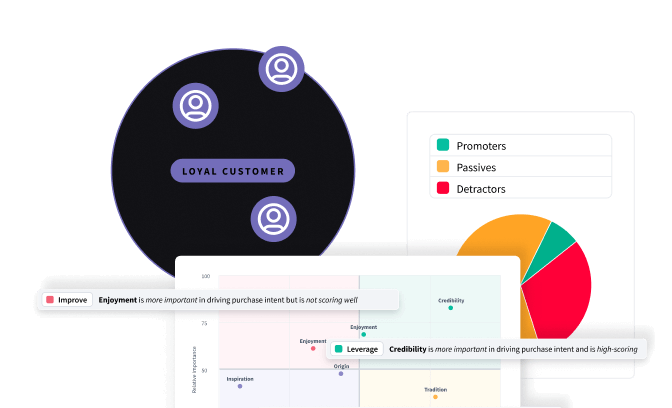

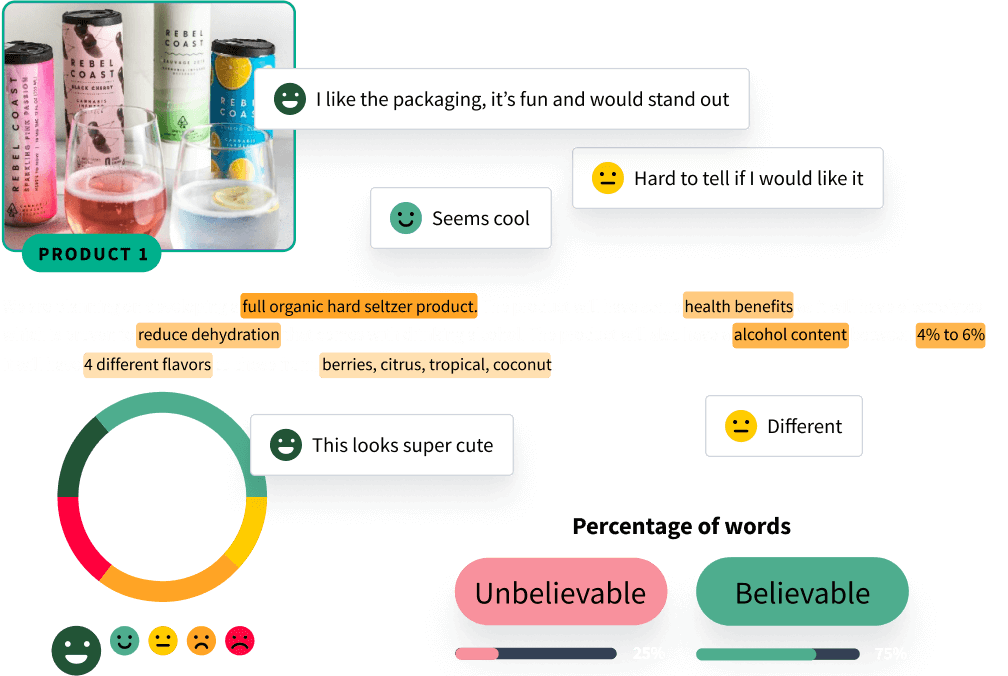

Know the Customer

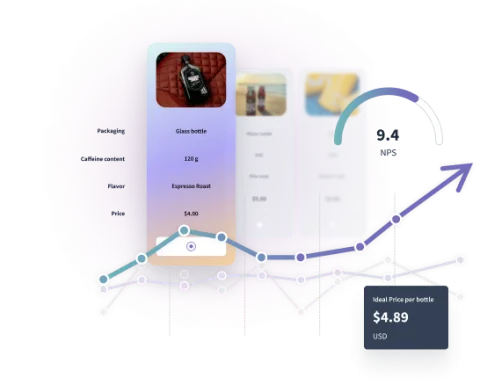

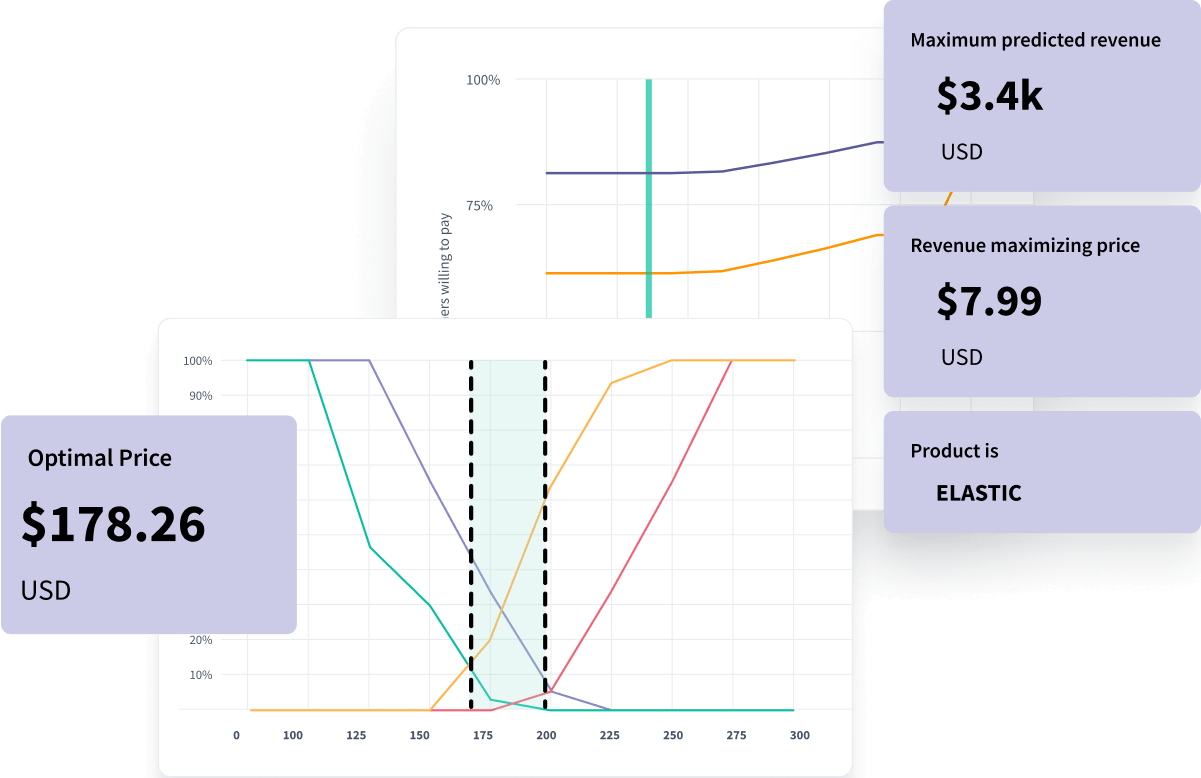

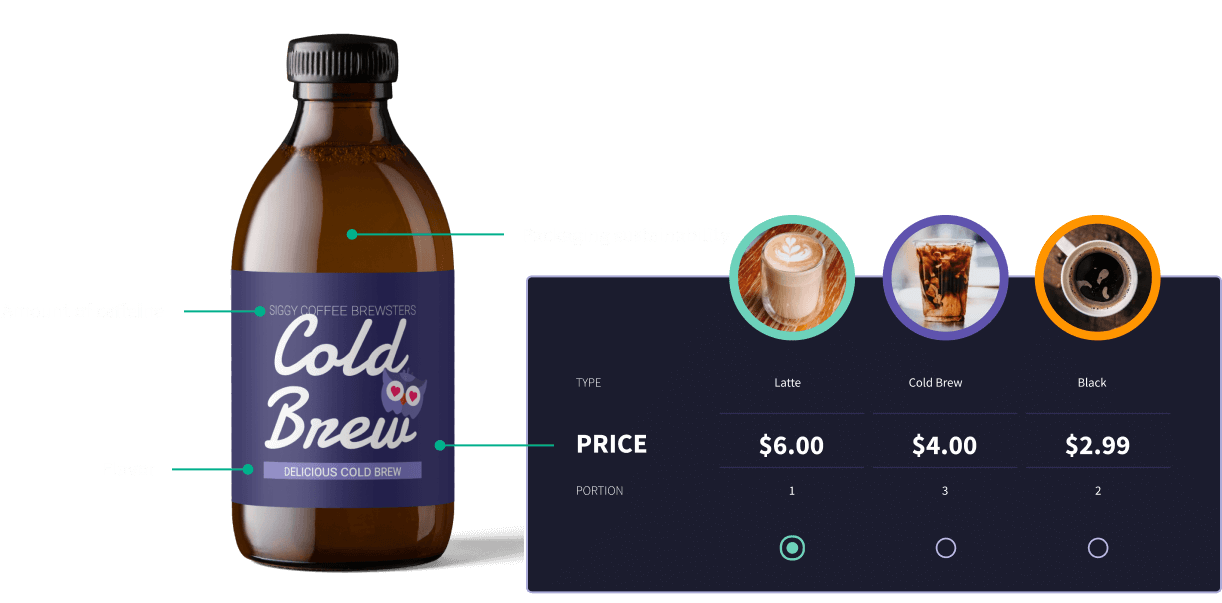

Maximize Revenue without Compromising Demand

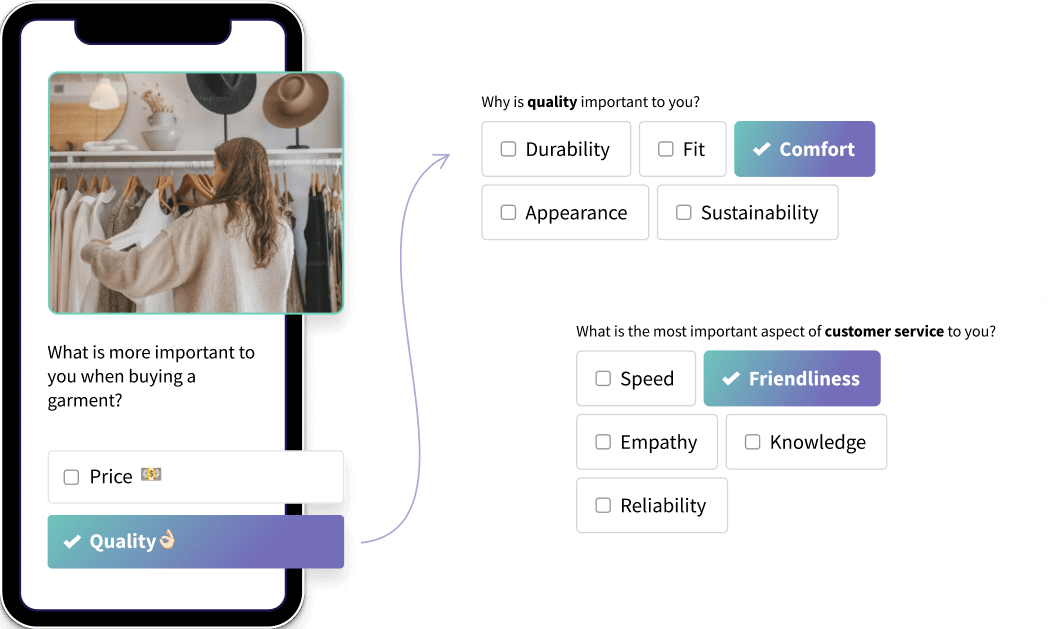

Appraise Product Potential

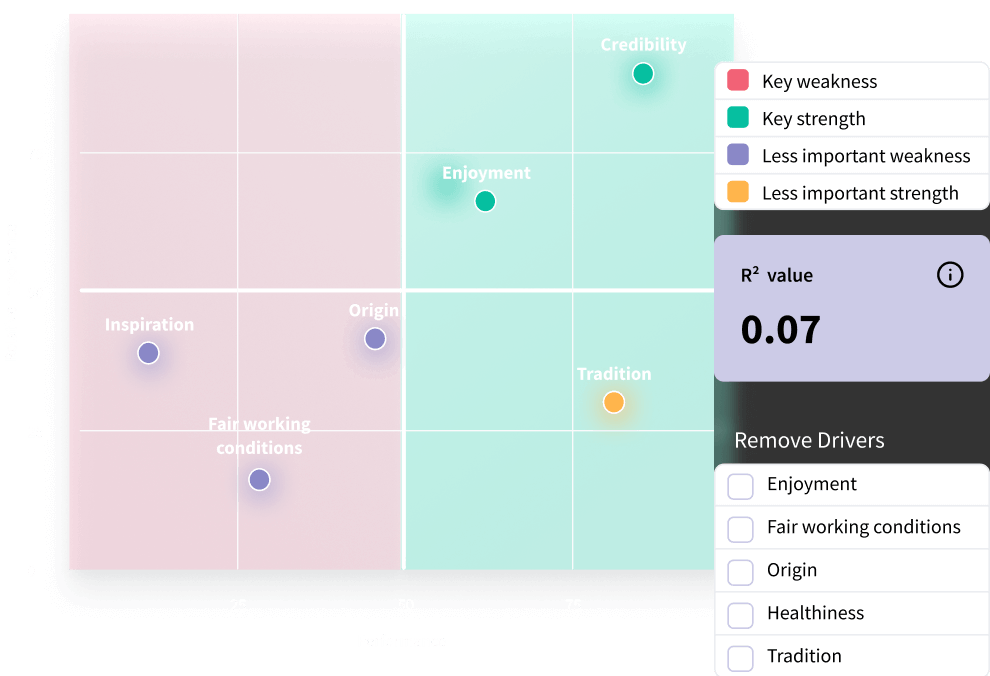

Optimize Products & Product Lines

Quantify Brand Equity

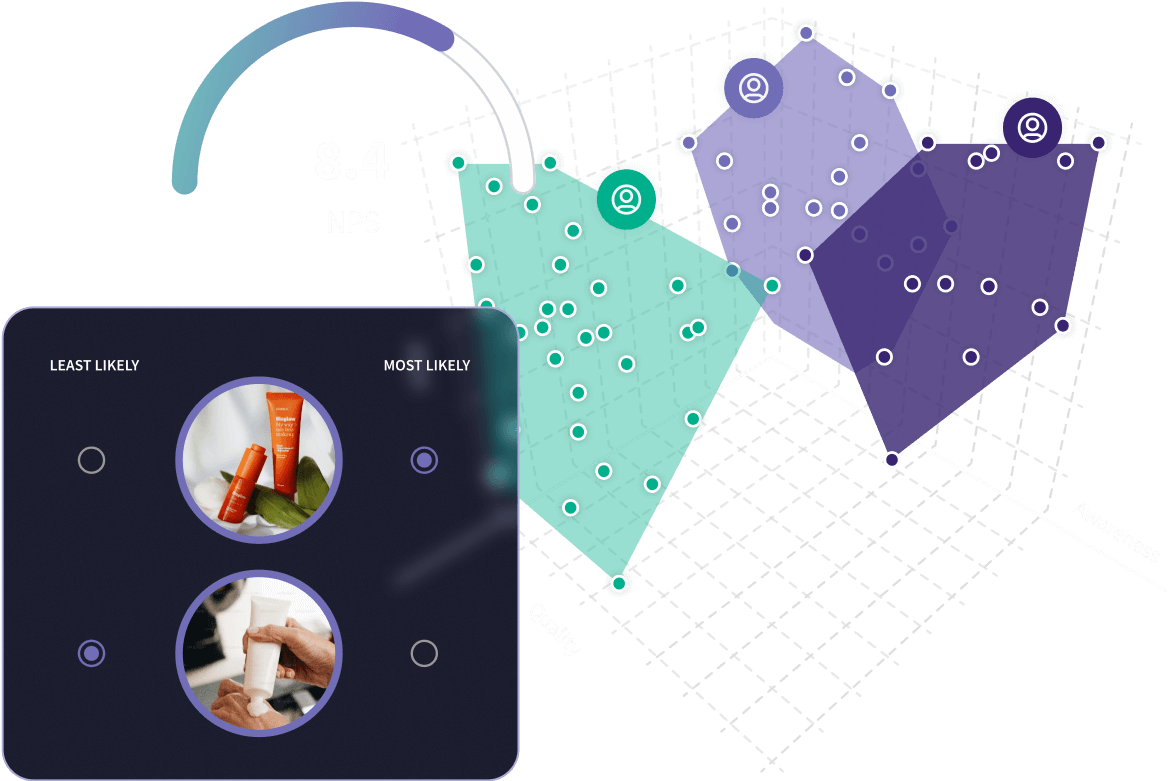

Size Market Share and Projected Competitive Landscape of Potential Product Variations

SightX is the #1 rated consumer insights platform for institutional investors

Invest with Confidence by

Seeing What Others Don’tHow it works

Pricing

Timeline