If you've worked in the insights space for long, you’re likely familiar with both conjoint and maxdiff analysis. They are widely used across market research, most often for product and message testing.

And while both can help you to better understand what consumers value most about your product or service, each has a unique approach and output that can be beneficial depending upon your use case.

So today, we'll explore what each of these experiments can help you accomplish, how they are similar, what makes them different, and which you should choose for your specific use case!

Before we dive in, let’s cover a few terms we’ll use throughout this piece:

![]() Attributes- Also known as the features of a product or service. These are the aspects of your offering that will be evaluated in a maxdiff or conjoint analysis. For example, the attributes of a pre-packaged cold brew product could be price, flavor, packaging sustainability, or the amount of caffeine.

Attributes- Also known as the features of a product or service. These are the aspects of your offering that will be evaluated in a maxdiff or conjoint analysis. For example, the attributes of a pre-packaged cold brew product could be price, flavor, packaging sustainability, or the amount of caffeine.

![]() Levels- These are simply the options related to each attribute that you will be testing. Continuing the example above, the levels of our flavor attribute could be plain, vanilla, or hazelnut.

Levels- These are simply the options related to each attribute that you will be testing. Continuing the example above, the levels of our flavor attribute could be plain, vanilla, or hazelnut.

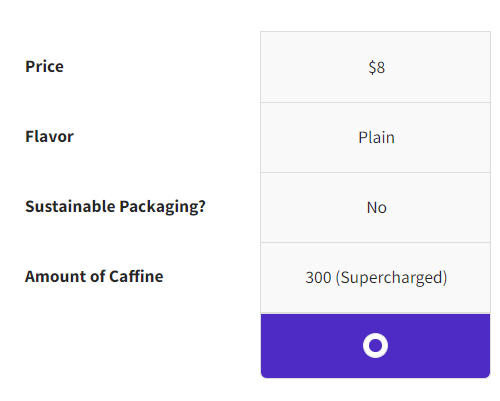

![]() Profile or Card- This is the hypothetical product (or service) offering generated during a conjoint experiment. It’s the total package of your attributes with randomized levels displayed. Below is a sample profile for our cold brew product:

Profile or Card- This is the hypothetical product (or service) offering generated during a conjoint experiment. It’s the total package of your attributes with randomized levels displayed. Below is a sample profile for our cold brew product:

What are Conjoint & MaxDiff Analysis?

Conjoint Analysis

In market research, a conjoint analysis is a technique used to measure the value of your product's features- both individually and as a package.

It does this by giving respondents a choice between 2-3 profiles, each with the same attributes but with randomized levels. Using our cold brew product; a question from a conjoint analysis exploring price, packaging sustainability, flavor, and the amount of caffeine would look something like this:

MaxDiff Analysis

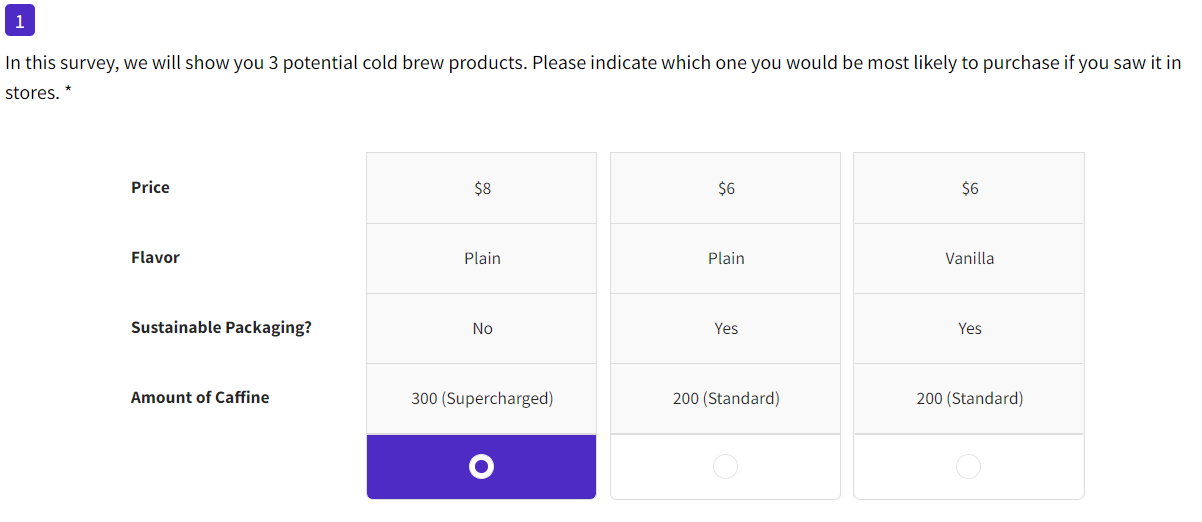

On the other hand, MaxDiff analysis allows respondents to quantify their preferences by rating your product’s attributes as least or most important to them. A sample question from a MaxDiff exploring similar attributes of our cold brew product might look something like this:

How are MaxDiff and Conjoint Similar? And How Are They Different?

Similarities

Both Conjoint and MaxDiff analysis force respondents to make tradeoffs, simulating a real-world buying decision. While each experiment has its own way of doing this, they will both give you a better understanding of which attributes are most important to your audience.

Differences

The output of a MaxDiff will show you a ranking of your attributes from best to worst. This gives you a quick and easy way to understand which individual features are the most valuable to consumers and which matter least.

.png)

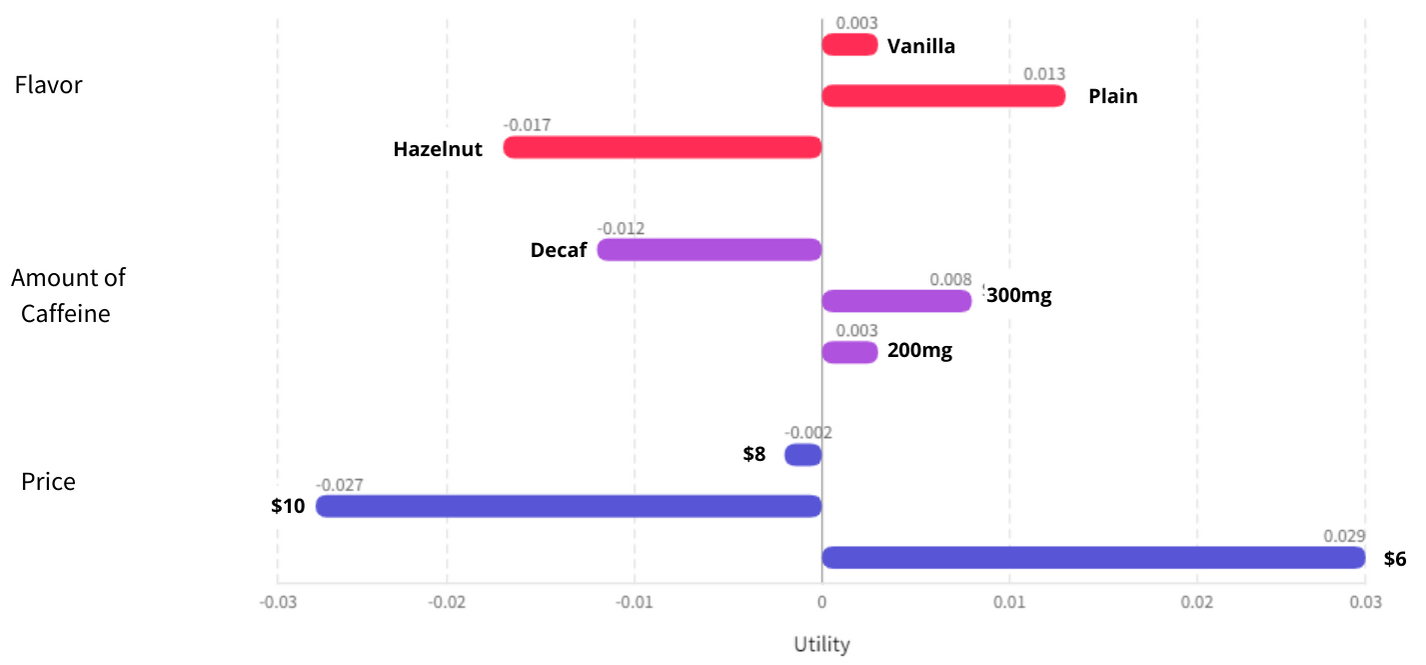

On the other hand, the output from a conjoint analysis will not only show you the importance of each attribute but also the popularity of each level within your attributes. Ultimately this will help you to better understand the optimal package to capture the largest market share.

So, the next time you're trying to evaluate which methodology is right for your use case, just think about your goals:

![]() IF you’re looking to better understand your product’s attributes individually, we’d suggest a MaxDiff.

IF you’re looking to better understand your product’s attributes individually, we’d suggest a MaxDiff.

Alternatively...

![]() IF you're interested in finding the best overall package of attributes for your product, we'd suggest a conjoint.

IF you're interested in finding the best overall package of attributes for your product, we'd suggest a conjoint.

And if you need a little guidance to get you started with either of these techniques, check out our blog on MaxDiff Analysis or these expert tips on conjoint analysis!

Automated MaxDiff & Conjoint Analysis with SightX

The SightX platform is the next generation of automated market research tools: a single, unified solution for consumer engagement, understanding, advanced analysis, and reporting. Allowing insights, marketing, and CX teams to start, optimize, and scale their insights workflow.

Remove the guesswork from your current insights strategy by going directly to the source. Reach out today to start a trial, or let us know what you need and we’ll set up a tailored platform demo!