As both research departments and budgets shrink, it’s becoming increasingly difficult to get the same level of insights with far fewer resources.

Thankfully, DIY market research has the solve.

What is DIY Market Research?

DIY market research simply means that you (the "y" in DIY) do the research yourself, instead of outsourcing it. This can include coming up with a strategy, developing questions, distributing the survey, and analyzing the data.

Generally, this is done online with the help of market research software that streamlines the process.

Who Is DIY Market Research For?

Whether you're a small start-up or a well-established brand, consumer insights can mean the difference between standing out in the crowd or just blending in.

But for some, spending a heavy chunk of their budget to outsource a few research studies isn't an option. This doesn't just apply to small businesses or start-ups, it can also apply to large or mid-market organizations with small insights teams.

While DIY research was once an arduous process full of menial tasks, it has since become an elegant solution to the "do more, with less" problem that so many companies face.

How to Use DIY Market Research

When it comes to practical applications, there are innumerable ways to utilize a DIY approach to market research. Some of the most popular areas of experimentation include:

_Size=sm)_Color=Success.png) Product Research

Product Research

Product research allows you to investigate and test every aspect of your product, from MVP to post-launch upgrades. Evaluate whitespace opportunities, test concepts, and optimize features through experiments like concept tests, conjoint analysis, MaxDiff, and more.

Brand Research

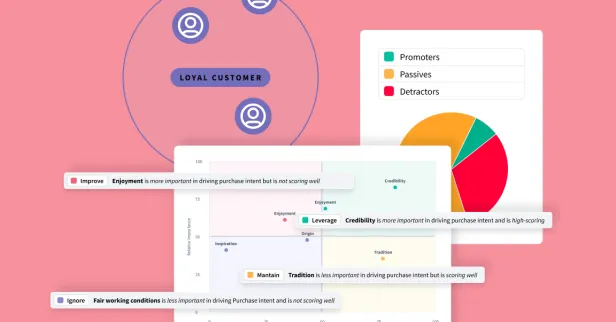

This type of research helps you measure the overall performance of your brand through metrics like brand awareness, usage, purchase, loyalty, and net promoter score (NPS). Similarly, you can use studies like brand tracking or brand health tracking to keep a pulse on the market and understand how your brand performs over time.

Pricing Research

Pricing Research enables you to test price sensitivity in the market and discover what consumers are willing to pay for your offerings through experiments like conjoint analysis, price rating, Gabor-Granger, or Van Westendorp’s Price Sensitivity Meter.

_Size=sm)_Color=Success.png) Marketing & Advertising Research

Marketing & Advertising Research

Just as the name implies, marketing and advertising research allows you to test your messaging, copy, visuals, and other collateral through ad concept testing, heat mapping, conjoint analysis, and more. Receiving feedback directly from your target audience will help you refine your collateral and create more impactful marketing campaigns.

_Size=sm)_Color=Success.png) Customer Experience Research

Customer Experience Research

Also known as user experience research, these studies involve diving into customer feedback to better understand their experiences with your products and brand. Explore user preferences, sentiments, and key drivers of loyalty through market segmentation, Voice of the Customer (VoC) research, customer satisfaction surveys, and more.

_Size=sm)_Color=Success.png) Content Research

Content Research

For those in marketing, media, or entertainment, content research allows you to analyze and integrate audience feedback into your content to maximize its effectiveness. Through experiments like concept testing and conjoint analysis, you can better understand the topics that resonate with your audience(s) and deliver content that expands your influence.

Best Practices for DIY Market Research

While experienced research and insights professionals can often jump right into DIY techniques- it's not exclusive to experts! Even newcomers can thrive with a bit of guidance and support:

Choose the Right Platform

Picking the best platform for your research is crucial for long-term success. An end-to-end solution that allows you to build projects, distribute surveys, and visualize the results in a single hub will significantly simplify and streamline your operations. And if you plan on running more complex research studies in the future, like MaxDiff or Conjoint analysis, automation is key- and will save you a lot of time.

Do Your Homework Before You Begin

Before you dive into any project, you'll need to outline your goals and objectives. Whether it's your first or 101st project, think carefully about what (exactly) you want to find out and how you plan to do so. Similarly, work with all stakeholders involved to lay out your goals, timelines, and roadmap. Presenting all of these items upfront can save you a lot of stress on the back end.

Take Your Time on the Design

A poorly designed survey with poorly worded questions will get you nowhere. But writing effective and unbiased questions is not quite as simple as you'd think. As a general rule of thumb, don't make your surveys too long and keep the questions straightforward. It can also help to have your co-workers test (and retest) your survey until the language and user experience are flawless. If you're looking for some additional guidance on this topic, check out our blog on survey question design here or see our guide to SightX survey logic here.

Don't Be Afraid to Ask for Help

When in doubt- ask the pros! Whether you need simple survey scripting or analysis assistance- take advantage of supportive research services to guide your experience. Not only will this make your projects more effective in the short team, but you can also fill your own knowledge gaps long term.

Test Frequently

Whether you're running a brand tracker or developing a new product, frequent testing can help you verify your data and keep a pulse on the market. While every project will require a different level of iterative testing, it's important to consider how outside factors may be affecting your respondents. Volatile markets, pandemics, and political turmoil can all have a massive effect on consumer psychology. Plus, the more often you flex your research muscles, the stronger they will become.

Take Time for Continuing Education

Grow your basic understanding into a solid foundation with educational content and resources. There are many ways to go about it- be it attending industry trade events, catching relevant webinars, or perusing the SightX Blog- you can’t go wrong.

DIY Market Research with SightX

The SightX platform is the only market research platform you'll ever need: a single, unified solution for consumer engagement, data collection, advanced analysis, and reporting. While powerful enough for insights teams at Fortune 500 companies, the user-friendly interface makes it simple for anyone to start, optimize, and scale their research.

With our new Generative AI research consultant, you can have studies generated in a matter of seconds and get key insights pulled from your data instantly.

Whether you are ready for a total DIY experience or prefer some guidance and support- we’ve got you covered. Reach out today to get started!