Transforming Your Customer Experience with Agile Insights

Customer experience (CX) is everything.

When done right, it can help you to turn casual buyers into full-fledged brand evangelists. But delivering a truly stellar experience doesn’t just happen by chance.

In fact, it requires a deep understanding of your customers, using research to uncover their experiences with your brand, and the ways you can better meet (if not exceed) their expectations. These efforts will ultimately help you grow your customer lifetime value, boost brand loyalty, and drive additional revenue.

Today, we’ll explore how you can use insights to transform your customer experience for the better. Diving into CX research, the importance of overall agility, and sharing some tips from our experts on ways to get better CX insights.

What is Customer Experience Research?

To put it simply, customer experience research seeks to understand the experience your customers have with your brand, products, or services. Its reach is far, extending to everything from your branding and advertising to your product design or store layout.

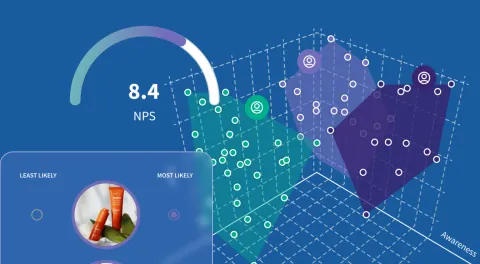

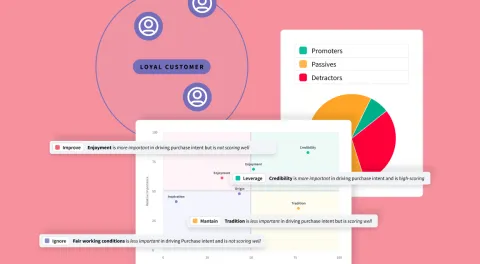

In practice, there are many ways to go about your CX research. You can collect data through strategically timed surveys delivered to correspond with your customer journey milestones, calculate your Net Promoter Score, and/or use natural language processing to analyze product reviews. Through your research, you will be able to better understand your customer's actual pain points, the challenges they face, and any needs that may be going unmet. Using that information to create as frictionless an experience as possible.

Why Does Agility Matter?

Agility may just be the key to successful CX research. IF you’re going to create a frictionless environment for your customers, you should also try to operate in one. And, it comes into play two ways: in how you conduct your research and how you apply the findings. We’ll start with the former.

Customer experience data is far from static. This means instead of conducting large-scale studies a few times a year, you’ll need to approach your research a bit differently. Instead, opting for small-to-medium-sized projects at a more regular cadence. Using online surveys distributed to your own audiences or panels is a popular approach for agile research. Similarly, using research platforms that automate the analysis process also makes frequent testing much more frictionless.

Now, for the latter.

Once you're getting insights on your customer’s experience regularly, you’ve got to apply them in a way that makes a real impact. Avoid data silos and work cross-functionally within your organization to make sure your insights quickly make it to every team or department that may be necessary to facilitate changes. This will help you to cut through any initial roadblocks, allowing you to act on your insights quickly.

How to Conduct Agile Customer Experience Research

Conducting agile CX research may seem daunting, but following this 6-step workflow can help you to get started.

![]() Define Your Goals & Set Research Objectives: Before conducting any customer experience research, it’s essential to gather all parties involved. Take time to set clear expectations for your project; what exactly are you looking to find out? How do you plan to use those insights once you have them? This will make all of the subsequent work much simpler.

Define Your Goals & Set Research Objectives: Before conducting any customer experience research, it’s essential to gather all parties involved. Take time to set clear expectations for your project; what exactly are you looking to find out? How do you plan to use those insights once you have them? This will make all of the subsequent work much simpler.

![]()

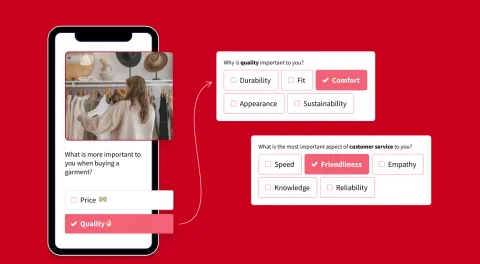

Ask the Right Questions: To get actionable data, you'll need to develop a good survey. One of the easiest ways to do that is to keep your audience in mind throughout the entire process. You’ll want to keep things concise- remember people are taking time out of their day for this. So, the best way to respect that time is by not taking up too much of it! In return, you’ll get a higher completion rate and better data. (For info on creating user-friendly surveys, check out this blog).

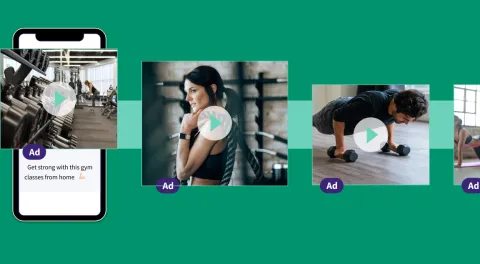

![]() Reach Your Audience at the Right Time: Before sharing your survey far and wide, identify some of the best touchpoints in your customer journey. These touchpoints can then serve to inform when you share your survey with customers. Maybe that time is post-trial activation, or after a customer service call. This will ensure you get more responses and users aren’t put off by a seemingly random survey.

Reach Your Audience at the Right Time: Before sharing your survey far and wide, identify some of the best touchpoints in your customer journey. These touchpoints can then serve to inform when you share your survey with customers. Maybe that time is post-trial activation, or after a customer service call. This will ensure you get more responses and users aren’t put off by a seemingly random survey.

![]() Dig into Your Data: When analyzing your data, you’re going to want to do a deep dive- not a shallow skim. If that sounds difficult, don't worry- it’s not. Using automated tools you can more easily test for significance, find correlations, spot patterns, and segment your respondents by demographic, geographic, behavioral, or psychographic data. Analyze the areas where your customer experience lacked to start improvement plans and look into the areas where you succeeded to understand what you’re doing right.

Dig into Your Data: When analyzing your data, you’re going to want to do a deep dive- not a shallow skim. If that sounds difficult, don't worry- it’s not. Using automated tools you can more easily test for significance, find correlations, spot patterns, and segment your respondents by demographic, geographic, behavioral, or psychographic data. Analyze the areas where your customer experience lacked to start improvement plans and look into the areas where you succeeded to understand what you’re doing right.

![]() Implement Your Insights Effectively: Make sure that all of your relevant findings get to each department that has played a role in your success or will need to be included in an improvement plan. And the sooner the better. By addressing customer feedback swiftly, you can avoid further negative experiences.

Implement Your Insights Effectively: Make sure that all of your relevant findings get to each department that has played a role in your success or will need to be included in an improvement plan. And the sooner the better. By addressing customer feedback swiftly, you can avoid further negative experiences.

![]() Go Back to Square One: The key to agility is ensuring you regularly conduct customer experience research, allowing you to constantly improve and adapt your CX strategy. Because customers are (hopefully) always having new experiences with your brand, this type of research is fluid and ongoing. So, make sure you take the time to revisit your goals every now and then to better serve your organization.

Go Back to Square One: The key to agility is ensuring you regularly conduct customer experience research, allowing you to constantly improve and adapt your CX strategy. Because customers are (hopefully) always having new experiences with your brand, this type of research is fluid and ongoing. So, make sure you take the time to revisit your goals every now and then to better serve your organization.

Getting Agile Customer Experience Insights with SightX

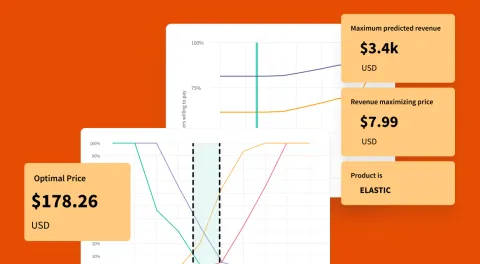

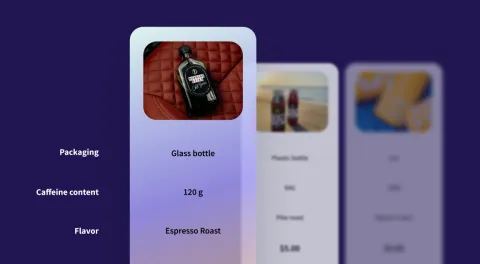

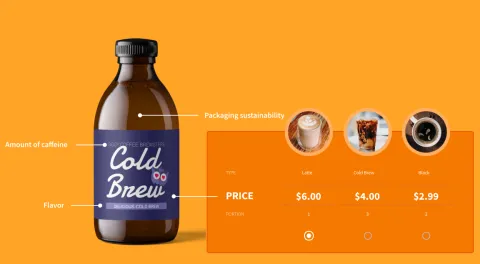

The SightX platform is the next generation of consumer insights tools: a single, unified solution for engagement, understanding, advanced analysis, and reporting. It helps insights and CX teams in any field to deliver unforgettable experiences tailored specifically to their customers' needs.

Remove the guesswork from your current CX strategy by going directly to the source. Start a free trial today!

Tip: Consider adding an optional open-ended text response after your NPS question- it allows customers to provide you with context surrounding their rating and can be analyzed with Natural Language Processing (NLP) for sentiment analysis.

Tip: Consider adding an optional open-ended text response after your NPS question- it allows customers to provide you with context surrounding their rating and can be analyzed with Natural Language Processing (NLP) for sentiment analysis.