What is Message and Claim Testing? How to Effectively Do Both [Bonus: Free Survey Template]

We live in a noisy world, constantly bombarded by advertising and branded content. This makes finding a way to cut through the noise and effectively communicate with your target market harder than ever before.

Whether you're drafting copy for an upcoming ad campaign or developing claims for your product, you've got to find language that intrigues, entices, and engages consumers.

Message testing allows you to do just that, by eliciting direct feedback from those you want to reach. Ultimately helping you discover the most appropriate messaging for your branding, sales, and marketing collateral.

What is Message and Claim Testing?

Message and claims testing is a type of market research aimed at evaluating how the language you use to communicate about your product, service, or brand resonates with an audience. And much like the name implies, it allows you to test your messaging (or copy) for your product, advertising, website, and more.

Why Should I Use Messaging Testing?

As any marketer would tell you: not all copy is created equally.

While your marketing, product, or sales teams may use certain words or phrases to describe and promote your offerings- that doesn’t necessarily mean it's the same language used by your target market.

Message testing allows you to break out of your internal echo chamber and evaluate the messaging and product claims your teams create. The data you gather can give you insights into your customers' actual pain points, challenges, and preferences- allowing you to better speak directly to each.

In the long run, message testing will help you understand what actually resonates with consumers and what falls flat.

How to Effectively Test Your Messaging

There are many ways to test your message, like:

Live A/B testing your ad, landing page, email, or website copy

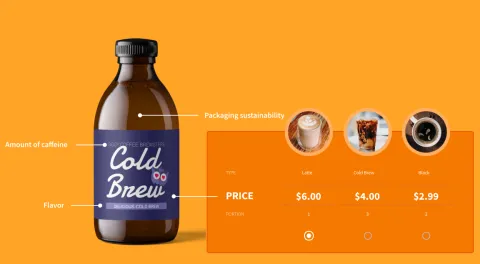

Concept testing your copy with a panel of your target buyers

And for apps or SaaS products, user testing is a great way to evaluate your copy

Both live A/B and user testing have their place, but concept testing is especially helpful as it allows you to test your messaging or product claims before investing significant time or ad budget.

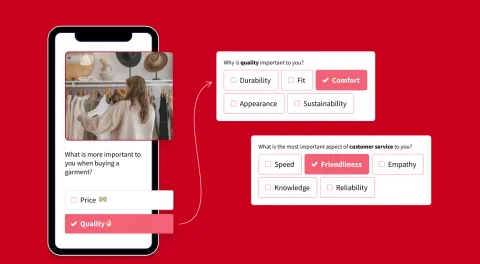

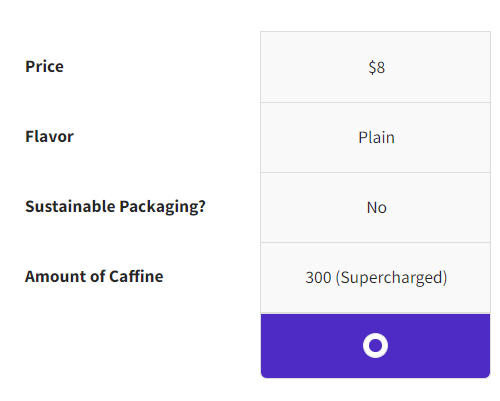

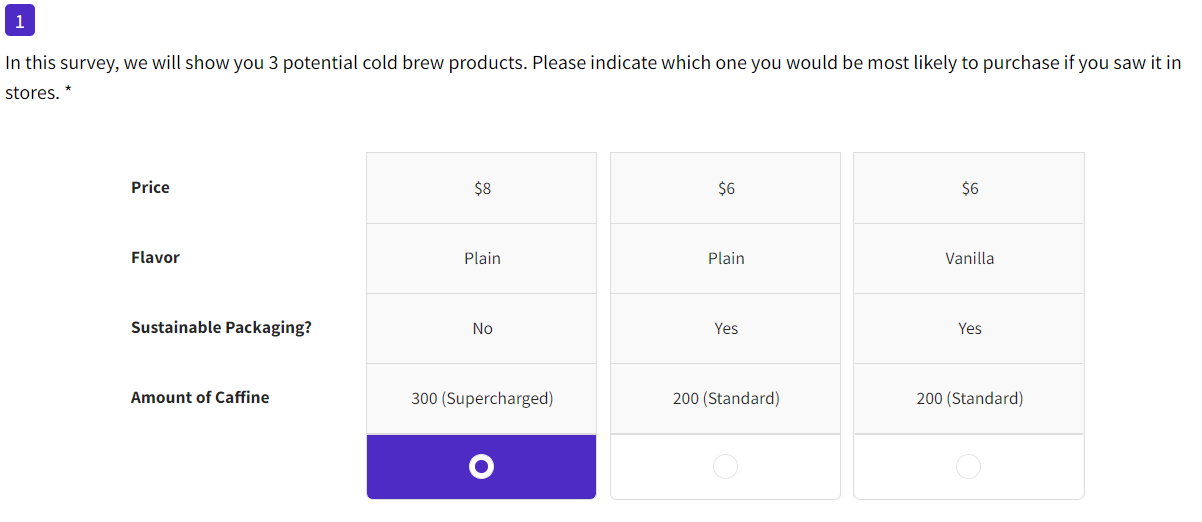

When running a message testing concept test, you’ll need to include the right mix of questions and experiments. We'd suggest starting with a concept test and focusing on areas like:

Likes and dislikes for each of your messaging options

_Size=sm)_Color=Success.png) The believability, uniqueness, and clarity of your claims and copy

The believability, uniqueness, and clarity of your claims and copy

_Size=sm)_Color=Success.png) How well the messaging fits your brand or product

How well the messaging fits your brand or product

_Size=sm)_Color=Success.png) And how relevant the brand messaging is to respondents

And how relevant the brand messaging is to respondents

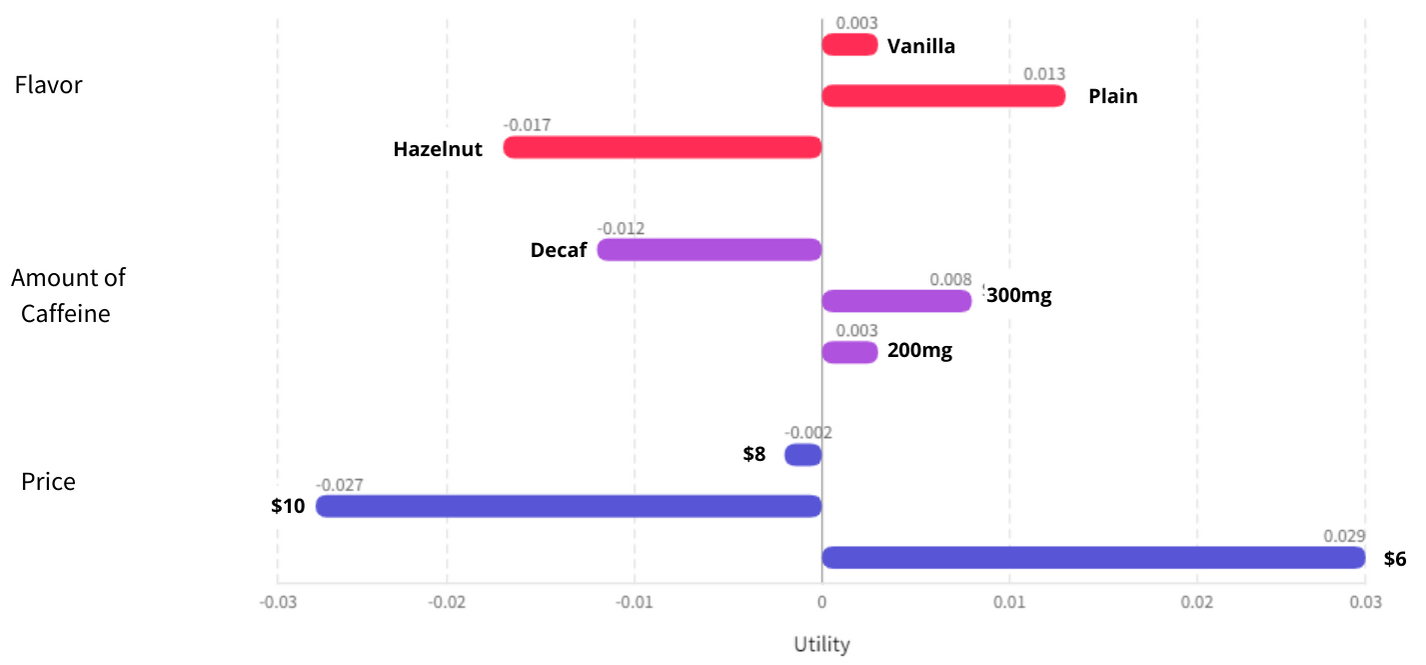

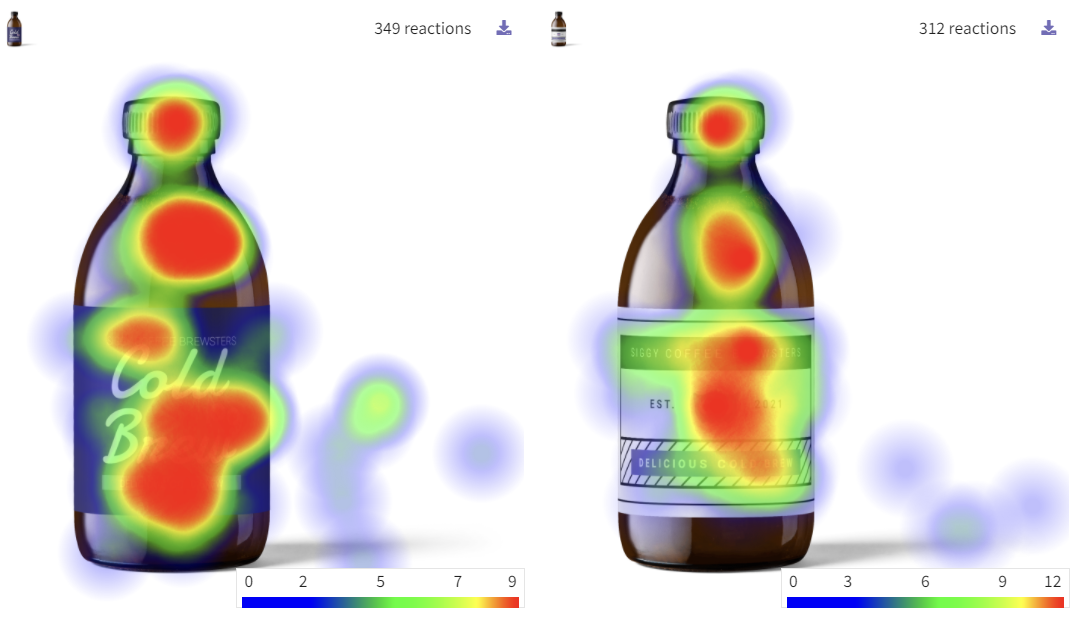

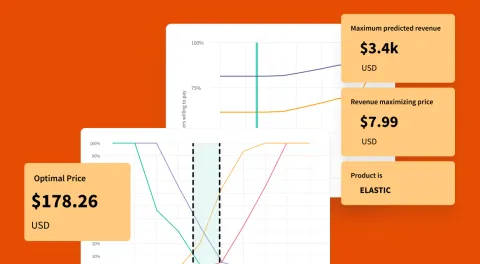

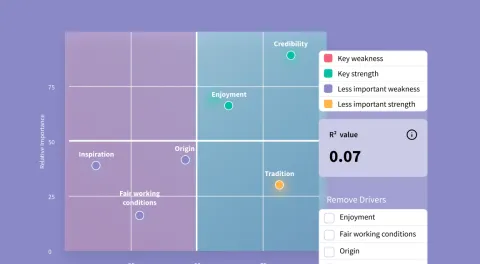

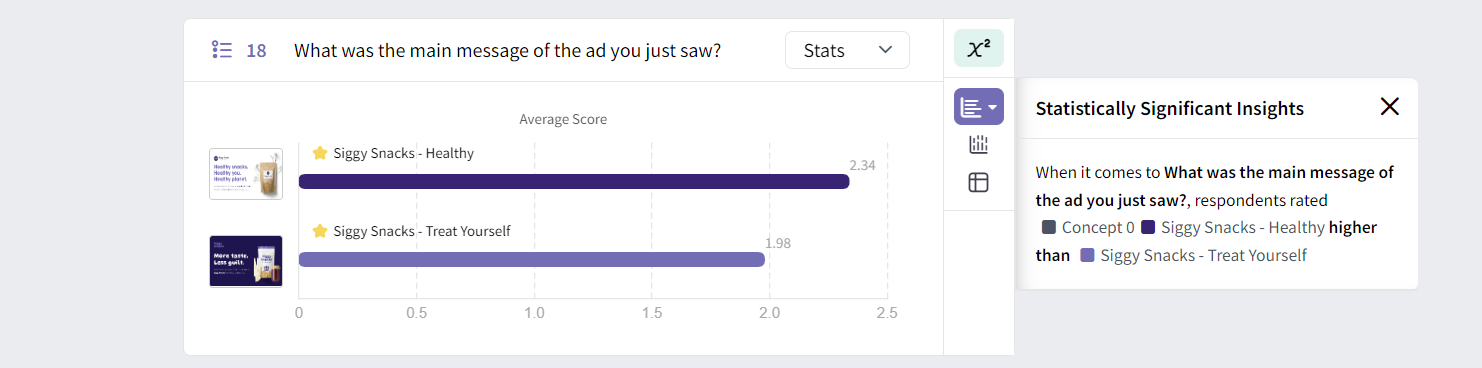

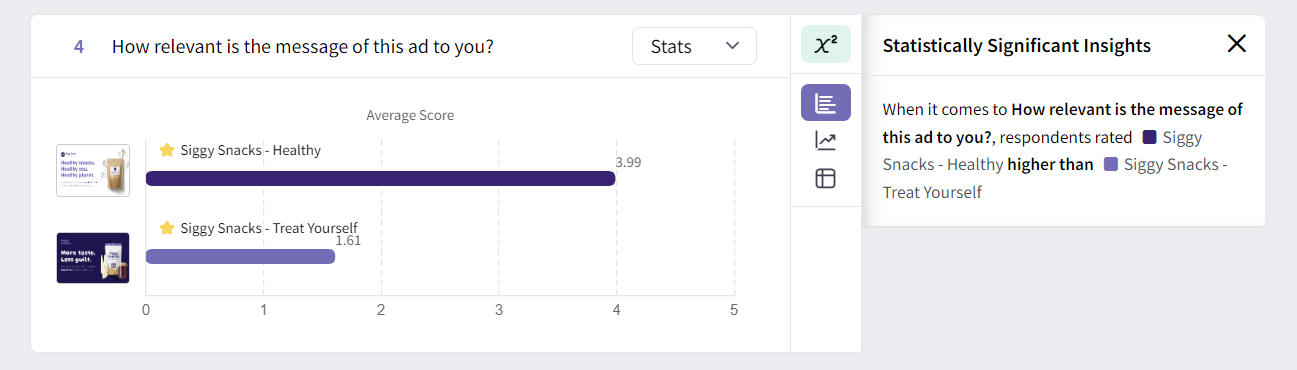

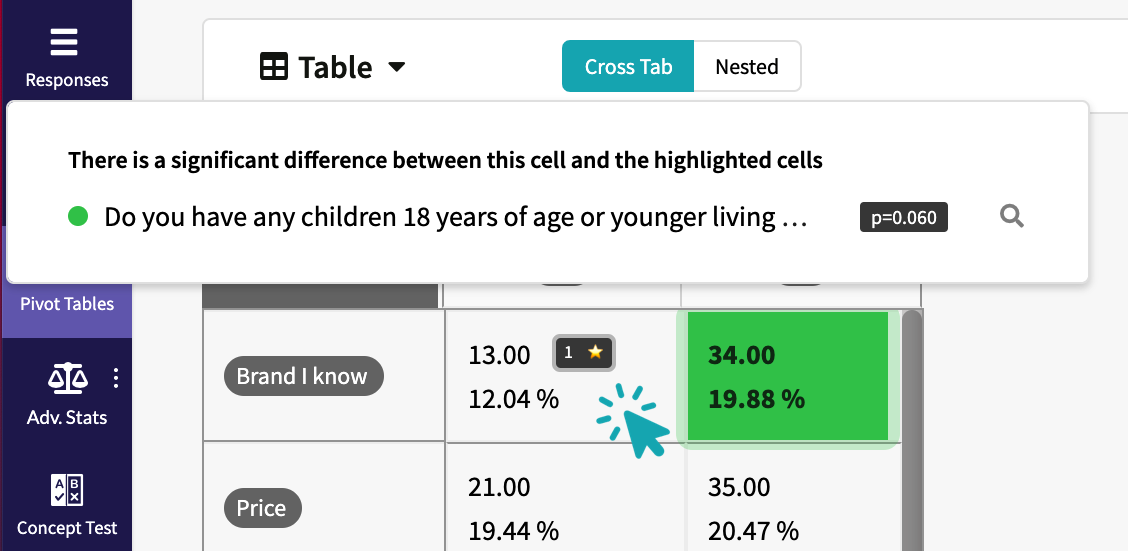

Once your survey data is collected, you can check the results to see which concepts respondents preferred. And, in cases where the results aren't quite so clear-cut, you can use tools like automated significance testing to pick out the truly meaningful differences between your messaging concepts. Your results might look something like this:

You can also use automated segmentation analysis to create personas based on data from behavioral or psychographic questions- allowing you to tailor your messaging based on consumers beliefs, values, or habits instead of using traditional demographic segmentation methods.

If you're ready to optimize your messaging and claims, use the link below to get our expertly crafted messaging testing template:

Common Questions for Testing Messaging

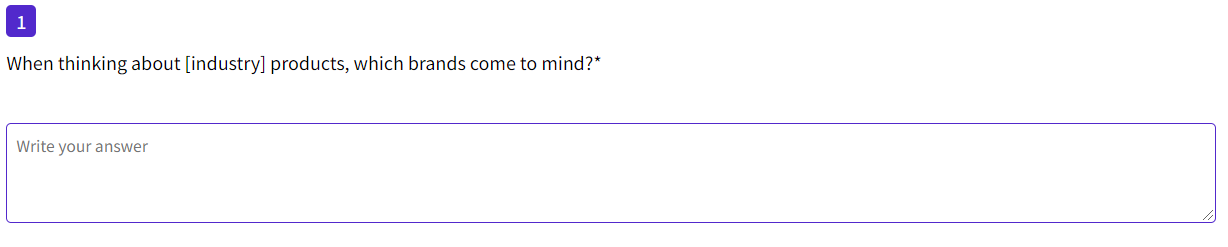

When it comes to running a message testing survey, there are many questions you can ask your audience. Some of the most popular include:

"Do you feel this message is believable?"

No matter how great your messaging sounds, it has got to be believable for consumers to engage. This question will help you understand whether the messaging you're testing would be credible in the real world.

"How unique is this message?"

Uniqueness is another important factor to consider in your messaging. This question will give you a better understand of how unique your messaging points are to your target audience.

"What adjectives would you use to describe the message? "

For this question, you will want to pre-fill your answer options with both positive and negative adjectives, like; boring, innovative, exiting, modern, etc. This will help you understand how consumers perceive your messaging style.

For more message testing questions, use the button above to get our free messaging testing survey template!

Message testing with SightX

The SightX platform is the next generation of market research tools: a single, unified solution for consumer engagement, understanding, advanced analysis, and reporting. It allows insights, marketing, and CX teams start, optimize, and scale their insights workflow.

But, SightX isn’t just great tech. All of our survey templates are developed by in-house research and insights experts. Our research team knows all of the industry best practices, along with some tips and tricks for getting the best data out of your surveys.

If you're ready to test your messaging and claims, get started with a free trial today!

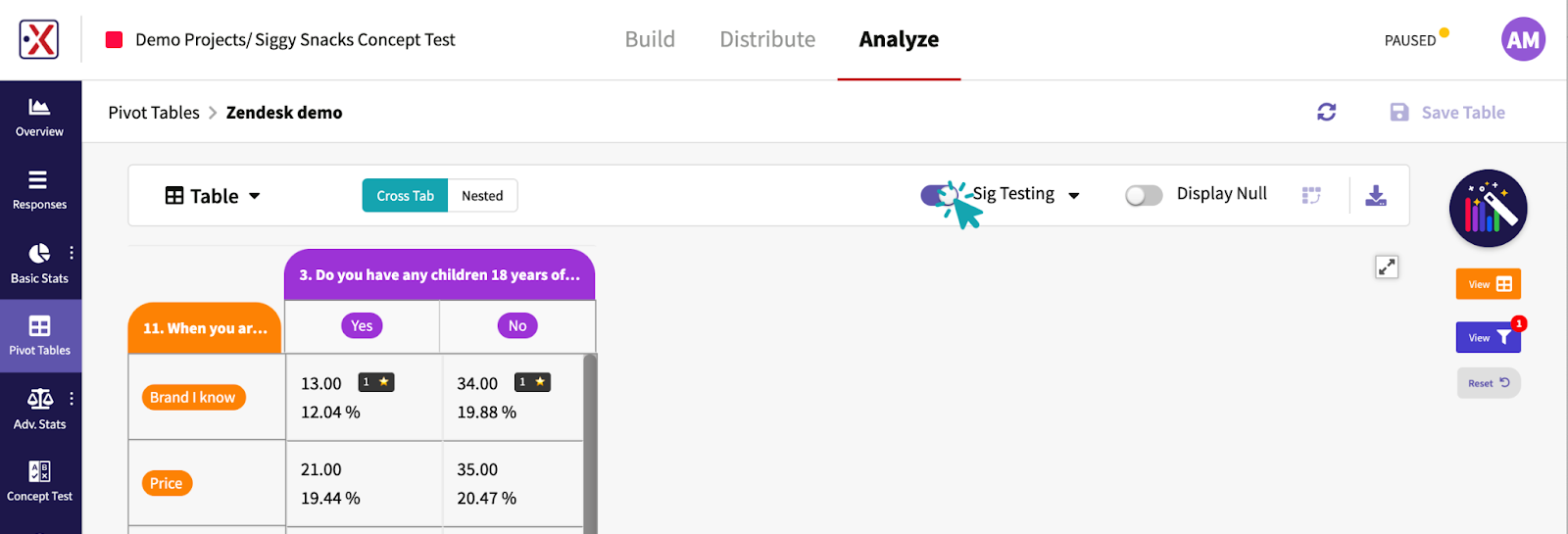

We always suggest using the industry standard 95% as the confidence level default. However, you can change your confidence level when needed in the SightX platform.

We always suggest using the industry standard 95% as the confidence level default. However, you can change your confidence level when needed in the SightX platform. .gif)

Hidden Brain

Hidden Brain Work Life with Adam Grant

Work Life with Adam Grant TED Radio Hour

TED Radio Hour  Conversations for Research Rockstars

Conversations for Research Rockstars Ologies

Ologies Snap Judgment: Spooked

Snap Judgment: Spooked

.png)