Customer segmentation is a powerful technique that allows businesses to break down their target market into smaller, more manageable groups. This enables companies to deliver highly personalized experiences and tailor marketing efforts to better suit the needs, preferences, and behaviors of specific customer groups. In this guide, we will walk through the essential steps of mastering customer segmentation for effective, targeted marketing.

Step 1: Define Your Objectives for Segmentation

Before diving into the complexities of customer segmentation, it's crucial to understand why you're segmenting your audience in the first place. This step sets the stage for the entire process.

Understanding the Why

Segmentation helps businesses achieve several objectives. Whether you're looking to improve marketing effectiveness, target specific customer groups, or optimize product offerings, segmentation plays a key role. Businesses need to define clear goals to make segmentation actionable.

For instance, if your goal is to improve your marketing campaigns' effectiveness, segmentation can help you craft personalized messages that resonate with different customer segments. Similarly, if your aim is to optimize product offerings, segmentation allows you to identify which segments have a stronger demand for certain products, thus enhancing product development and inventory management.

Set Clear Goals

To ensure your segmentation efforts are aligned with business objectives, set measurable goals. For example:

- Increase Conversion Rates: By targeting the right segments with the right messages, businesses can increase the likelihood of converting prospects into customers.

- Enhance Customer Experience: By personalizing interactions based on customer segments, companies can improve overall satisfaction and retention.

- Develop Targeted Campaigns: Craft campaigns tailored to the interests and needs of different customer segments, maximizing the relevance and impact of marketing efforts.

Example: Take the example of an e-commerce store specializing in fitness equipment. By segmenting their customer base into groups such as professional athletes, casual fitness enthusiasts, and beginners, they could create distinct marketing campaigns targeting each group’s specific needs. Professional athletes may be interested in high-end, specialized equipment, while beginners might prefer affordable, easy-to-use products. This tailored approach helps increase engagement and ultimately boosts conversion rates.

Step 2: Collect Relevant Customer Data

Once you’ve defined your objectives, the next step is gathering the necessary data to segment your customers effectively. Customer data is the foundation of all segmentation efforts.In whi

Where to Gather Data

There are multiple sources where businesses can collect customer data:

- CRM Systems: These systems store historical data and customer interaction records, offering valuable insights into customer behavior and preferences.

- Surveys and Feedback: Surveys, interviews, and social listening help gather in-depth insights directly from customers. These can reveal attitudes, pain points, and motivations.

- Analytics Tools: Tools like Google Analytics can provide data on website traffic, user behaviors, and engagement patterns.

- Social Media Insights: Platforms like Facebook, Instagram, and LinkedIn provide demographic data and user behaviors, which can be instrumental in refining segments.

Types of Data to Focus On

The data you collect can be categorized into three major types:

- Demographic Data: Includes basic characteristics such as age, gender, income, and family size.

- Behavioral Data: Reflects customer actions like browsing patterns, previous purchases, or engagement with marketing content.

- Psychographic Data: Focuses on attitudes, interests, lifestyles, values, and motivations.

Data Privacy Considerations

It’s essential to handle customer data with care, ensuring compliance with privacy regulations like GDPR (General Data Protection Regulation). Always obtain consent before collecting personal information, and implement strong data protection measures to safeguard customer privacy.

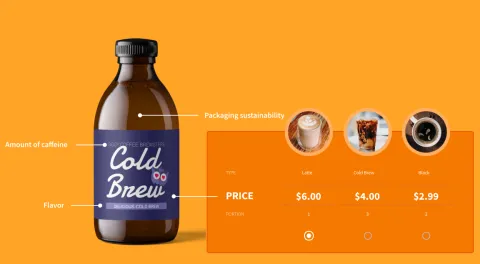

Step 3: Choose the Right Segmentation Criteria

Now that you have the necessary data, the next step is to choose the criteria by which to segment your customers. The most effective segmentation strategy will depend on your business objectives and the data available.

Demographic Segmentation

This is one of the most common segmentation strategies, involving dividing customers based on fundamental characteristics like age, gender, income, or family size. It’s an effective method when targeting broad groups that share similar traits.

Geographic Segmentation

Segmentation based on geographic location includes factors such as country, region, city, or even climate. Geographic segmentation helps tailor marketing messages based on local preferences, cultural nuances, and regional trends.

Psychographic Segmentation

Psychographic segmentation groups customers based on their values, interests, attitudes, and lifestyles. This type of segmentation is particularly useful when trying to appeal to customers on a deeper emotional or psychological level.

Behavioral Segmentation

This method divides customers based on their behaviors, including purchasing patterns, brand loyalty, and engagement. Behavioral segmentation is highly valuable for creating targeted campaigns that address specific customer actions.

Firmographic Segmentation (for B2B)

For B2B companies, firmographic segmentation is crucial. It categorizes customers based on company size, industry, revenue, and other business-related factors. This helps B2B businesses target other companies that would benefit most from their products or services.

Choosing the Right Criteria

The key to effective segmentation is choosing criteria that align with your business goals. For example, if you’re targeting young professionals, demographic and psychographic segmentation will likely be most effective. If you want to optimize product offerings, behavioral segmentation could be the best choice.

Step 4: Analyze and Organize Data into Segments

Once you’ve gathered the necessary data, it’s time to analyze it and organize it into meaningful segments. This step involves using various analytical techniques and tools to uncover patterns and groupings.

Data Analysis Techniques

- Cluster Analysis: Cluster analysis helps identify natural groupings within your data based on specific characteristics. This technique uses algorithms to analyze customer behaviors and segment them accordingly.

- Segmentation Models: RFM (Recency, Frequency, Monetary) models, which analyze customer purchase history, are a common way to segment customers. Predictive analytics can also be used to forecast future behaviors based on past data.

Tools for Analysis

To conduct segmentation analysis, you can use:

- Google Analytics: Offers valuable insights into website behaviors, helping you segment customers based on interactions.

- Customer Data Platforms (CDPs): These platforms integrate various data sources, making it easier to organize and analyze customer data.

- Excel or Google Sheets: For basic segmentation work, spreadsheets are a simple yet effective tool.

- Advanced Tools: Platforms like Salesforce, HubSpot, and Tableau provide deeper analysis and visualization capabilities.

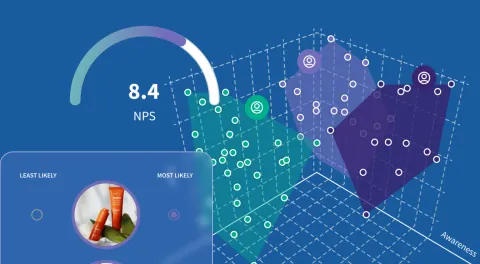

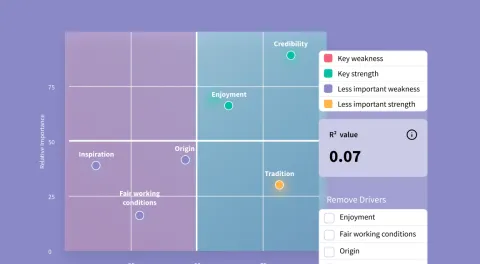

Visualizing the Segments

Once your data is segmented, it’s important to visualize the results. Charts, graphs, and tables can help stakeholders understand how customer groups are organized and guide decision-making processes.

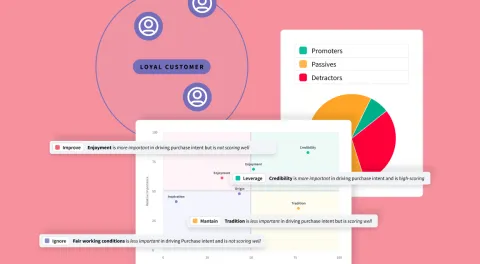

Step 5: Create Customer Personas

Customer personas are fictional characters that represent each segment. They’re created using data and insights about the target audience, allowing businesses to visualize their customers and create tailored strategies.

What is a Customer Persona?

A customer persona is a detailed profile that includes demographic details, behaviors, motivations, goals, and challenges for a specific segment.

How to Build Personas

When building personas, include:

- Name and Background Information: Give your persona a name, job title, and basic background details.

- Demographics, Behaviors, and Needs: Include age, gender, interests, buying behaviors, and pain points.

- Goals and Challenges: Understand the persona’s goals and how your product or service can help address their challenges.

Why Personas Matter

Personas help businesses humanize their customers, making marketing efforts more focused, empathetic, and personalized. By tailoring messages to specific personas, companies can improve customer engagement and retention.

Example Persona

For an online fitness brand, an example persona could be “Fitness Fiona,” a 29-year-old, health-conscious woman who loves yoga and running. She seeks affordable, eco-friendly fitness gear and values sustainability.

Step 6: Test and Validate Your Segments

Segmentation is an ongoing process, and it’s important to test and validate your segments to ensure they remain relevant and actionable.

Why Testing is Important

Testing helps ensure your segments are effective. It’s critical to verify that your segmentation strategy produces actionable insights that can improve marketing efforts.

A/B Testing and Experimentation

Use A/B testing to experiment with different approaches for each segment. For example, you can test various email subject lines or product offerings to see which resonates most with each segment.

Customer Feedback

Customer feedback is invaluable in refining segments. Survey customers regularly to gauge how well your segmentation aligns with their needs.

Adjustments

As customer behavior and market trends evolve, so should your segments. Regularly revisit and adjust your segmentation strategy as necessary.

Step 7: Implement Your Segmentation Strategy

Once you’ve validated your segments, it’s time to put your segmentation strategy into action.

How to Apply Segments in Marketing

Use segmentation to create personalized campaigns, offers, and communications:

- Targeted Email Campaigns: Personalize email content based on customer data.

- Content Customization: Offer tailored content or products for different segments, such as custom landing pages, blog posts, or advertisements.

Sales Strategy

Sales teams can use segmentation to prioritize high-value customers and develop targeted sales strategies.

Customer Service

Tailor customer service efforts based on segments. For example, premium customers may expect more personalized support, while casual customers may prefer self-service options.

Step 8: Monitor and Adjust Segmentation Over Time

Customer segmentation is a dynamic process, and it’s essential to monitor and adjust your segments continuously.

Continuous Monitoring

Review your segments regularly to ensure they are still relevant. Monitor performance metrics such as conversion rates, customer satisfaction, and retention.

Key Metrics to Track

Track metrics like conversion rates, retention rates, customer lifetime value (CLV), and engagement rates to assess the effectiveness of your segmentation strategy.

How to Evolve Segments

Adapt your segments based on changes in customer preferences, behaviors, or market conditions. Use automation tools and AI-driven segmentation platforms to stay agile.

To sum up, mastering customer segmentation is a powerful way to enhance marketing efforts, increase customer satisfaction, and boost sales. By following these step-by-step guidelines, businesses can implement effective segmentation strategies tailored to their goals. Start by defining your objectives, gathering relevant data, and choosing the right segmentation criteria. Over time, test, monitor, and adjust your segments to ensure they remain effective. Happy segmenting!

Related Content