Uncovering Patterns in Survey Data: Understanding Trends

Survey data has long been utilized by businesses, researchers, and policymakers to understand consumer behavior, preferences, and emerging trends. However, gathering survey data is only the beginning of the journey. The real value lies in uncovering patterns and making sense of the trends that emerge. Let’s explore why identifying trends is crucial, how to systematically approach it, and dive into the methodology of using HACO (Has-A-Change-Occurred) charts to rigorously assess trends in your survey data.

Practice Looking at Trends in Your Survey Data

When it comes to analyzing survey data, there’s no substitute for actively looking at trends. A single snapshot of data offers valuable insights, but it’s the evolution of responses over time that tells the most compelling story. By regularly reviewing and analyzing trends in your data, you’ll uncover patterns that help answer key questions:

- Are consumer preferences shifting?

- Which demographic segments are experiencing changes in behavior?

- How are external events influencing survey responses?

Survey trends provide actionable insights that can guide decision-making. For example, noticing a steady rise in dissatisfaction scores for a specific product feature could highlight an area needing improvement. Similarly, identifying a new preference for sustainable products might suggest the need for innovation in your offerings.

Why Look at Trends?

- Spot Emerging Opportunities and Risks: Trends can reveal budding opportunities that may not be obvious from a static dataset. For example, an uptick in interest for eco-friendly packaging might signal a growing market for sustainable goods. On the flip side, declining customer satisfaction scores can act as an early warning system.

- Better Resource Allocation: By identifying which factors are driving changes in satisfaction or interest, you can direct resources more effectively.

- Evaluate Campaign Impact: Comparing survey responses before and after a marketing campaign can show whether the initiative influenced public perception.

- Support Strategic Decision-Making: Trends often correlate with larger shifts in the marketplace or consumer sentiment. Recognizing these changes early gives organizations a competitive advantage.

HACO Charts: Has-A-Change-Occurred?

For those seeking a more rigorous and data-driven way to assess trends, the HACO chart offers an excellent toolset. A HACO chart, also known as a control chart, is widely used in quality management and statistical process control to detect changes over time. It answers the fundamental question: Has a change occurred?

In the context of survey data, HACO charts can help you:

- Identify when a trend is statistically significant versus random variation.

- Detect shifts in customer sentiment or behavior that merit further investigation.

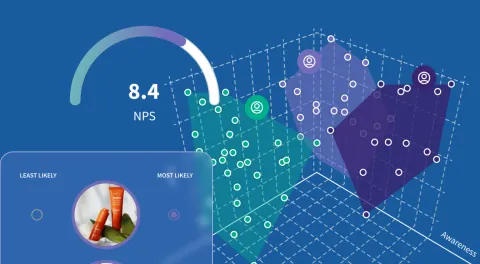

- Visualize changes in key metrics, such as satisfaction scores, purchase intent, or Net Promoter Scores (NPS).

The specific type of HACO chart we’ll focus on is the Individuals Moving Range (IMR) chart. This type of chart is both versatile and easy to implement, making it a practical choice for survey data analysis.

Steps to Create an IMR Chart

Creating an IMR chart requires following a structured process. Here’s a step-by-step guide:

- Select the Metric to Analyze

- Choose a key metric from your survey data, such as average satisfaction score, NPS, or percentage of respondents selecting a particular option.

- Ensure that the data is collected consistently over time (e.g., monthly or quarterly surveys).

- Plot the Individual Data Points

Start by plotting the metric values over time on a simple line graph. This will form the “Individual” component of the IMR chart.

- Calculate the Moving Range

- The moving range is the absolute difference between consecutive data points. For example, if your satisfaction scores are 7.8, 8.1, and 7.5 across three time periods, the moving ranges would be |8.1 - 7.8| = 0.3 and |7.5 - 8.1| = 0.6.

- Plot these moving ranges as a separate line graph beneath the Individual's chart.

- Determine the Control Limits

- Calculate the average (mean) of your data points and moving ranges

- Use the following formulas to calculate the control limits:

- Upper Control Limit (UCL) for Individuals: Mean + (3 * Moving Range Mean)

- Lower Control Limit (LCL) for Individuals: Mean - (3 * Moving Range Mean)

- UCL for Moving Range: 3 * Moving Range Mean

Note: LCL for Moving Range is typically set to zero, as ranges cannot be negative.

- Interpret the Chart

- In-Control Data: If all points fall within the control limits, your data is considered stable, with no significant change detected.

- Out-of-Control Data: Data points outside the control limits indicate a potential change. Investigate these anomalies to identify the underlying cause.

- Look for patterns, such as consecutive points trending upward or downward, even if they remain within the control limits. These can signal emerging trends.

- Contextualize Findings

Combine the insights from your IMR chart with external context. For example, if satisfaction scores drop after a product recall, the chart confirms the timing and significance of the event.

Real-World Application of IMR Charts

Let’s consider a real-world scenario. A company conducts monthly customer satisfaction surveys. Over the past year, the average satisfaction score has hovered around 8.0, but in the last three months, scores dropped to 7.5, 7.3, and 7.0.

Using an IMR chart:

- The Individuals chart reveals a downward trend in satisfaction scores.

- The Moving Range chart shows increasing variability between months.

- The drop to 7.0 falls outside the Lower Control Limit, signaling a statistically significant change.

Having this insight, the company investigates possible causes, such as changes in product quality or customer service, and implements corrective measures.

Best Practices for Trend Analysis

- Consistency is Key: Ensure that survey questions, methodology, and timing remain consistent over time to avoid introducing bias.

- Segment Your Data: Break down your data by demographic groups, geographic regions, or other relevant segments to uncover more nuanced trends.

- Visualize Effectively: Use clear, straightforward visualizations to make trends and patterns immediately apparent to stakeholders.

- Combine Quantitative and Qualitative Analysis:Numbers tell one side of the story, but open-ended survey responses can provide context and deeper understanding.

- Don’t Overlook Small Changes: Even subtle shifts can indicate the beginning of a larger trend. Track these changes over time to see if they grow in significance.

The Power of Detecting Trends

The ability to detect and understand trends in survey data provides a competitive advantage. Whether you’re refining a marketing strategy, improving a product, or responding to changing consumer sentiment, staying ahead of the curve is essential. By using tools like HACO charts, businesses can move beyond anecdotal observations to make data-driven decisions with confidence.

Start practicing trend analysis today, and don’t hesitate to dive deeper into methods like IMR charts. As you uncover patterns in your survey data, you’ll not only understand trends—you’ll lead them.