Understanding Regression Analysis: A Comprehensive Guide to Unlocking Insights

Regression analysis offers a robust statistical method to uncover relationships, predict outcomes, and drive decision-making. At its core is the regression model, a powerful tool that enables data professionals to analyze patterns and trends. Whether you're a business professional, a researcher, or a data enthusiast, understanding how regression models work, can empower you to make data-driven choices with confidence. This guide covers the fundamentals of regression analysis, its importance, how it works, the types of regression models, common pitfalls, and tools you can use.

What is Regression Analysis?

Regression analysis is a statistical technique used to examine the relationship between variables. At its core, it seeks to determine how one or more independent variables influence a dependent variable. By modeling these relationships, regression analysis helps predict outcomes, understand causation, and identify trends.

For instance, a company might use regression analysis to determine how advertising spend (independent variable) impacts sales revenue (dependent variable). Similarly, researchers could explore how age and exercise frequency affect blood pressure levels.

Why is Regression Analysis Important?

Unveiling Relationships

Regression analysis goes beyond simple correlations. It helps uncover the strength and direction of relationships, revealing insights that are crucial for making informed decisions.

Predictive Power

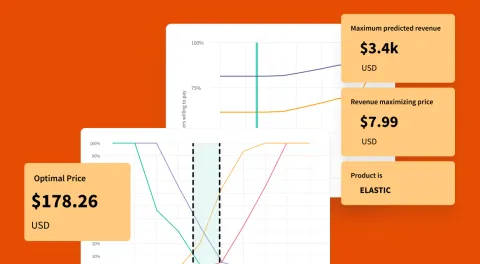

A major strength of regression analysis is its ability to forecast outcomes. Businesses can predict future sales, researchers can anticipate trends, and policymakers can assess the impact of new initiatives.

Optimization and Decision-Making

By quantifying relationships, regression analysis enables optimization. Marketers, for example, can allocate budgets more effectively by understanding which channels deliver the best ROI.

How to Use Regression Analysis

The process involves:

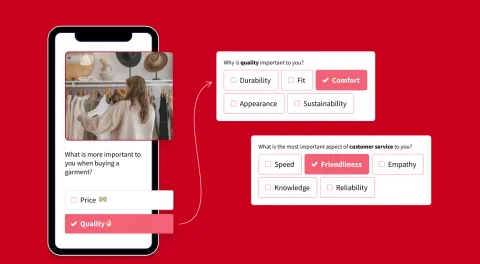

- Identifying your dependent variable (what you want to predict or understand).

- Selecting independent variables (potential predictors or influencers).

- Collecting and cleaning data.

- Using statistical software or tools to build and evaluate the regression model.

- Interpreting the results to drive actionable insights.

How Does Regression Analysis Work?

Dependent Variables

The dependent variable is the outcome you're trying to understand or predict. For example, sales figures, customer satisfaction scores, or disease incidence rates might be dependent variables.

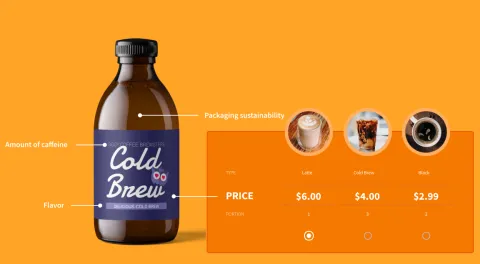

Independent Variables

Independent variables are the factors believed to influence the dependent variable. They could include price, marketing spend, customer demographics, or environmental factors.

Explore Related Content: Discover our deep dive into the concepts of independent and dependent variables.

Additional Variables

Sometimes, regression models involve additional variables that enhance understanding:

- Explanatory Variables: These clarify why relationships exist.

- Predictor Variables: Focused on forecasting outcomes, they refine the model’s predictive power.

- Experimental Variables: Introduced during controlled experiments to observe their effects.

- Subject Variables (Fixed Effects): Attributes inherent to the subjects being studied, such as gender or location, often controlled for in models to avoid bias.

How to 'Do' a Regression Analysis

- Define Your Objective: Clearly state what you aim to discover or predict.

- Prepare the Data:

- Collect relevant data points.

- Handle missing values and outliers.

- Normalize or transform data if necessary.

- Choose the Right Model: Decide which type of regression best fits your needs (e.g., linear, logistic).

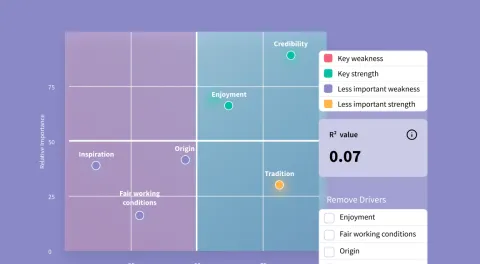

- Run the Analysis: Use statistical tools or software (e.g., SPSS, Python, R, or use automated Regression by SightX) to build the model.

- Evaluate Results:

- Examine coefficients to understand variable impact.

- Assess model fit using metrics like R-squared or AIC/BIC.

Interpret and Act: Translate findings into actionable insights for decision-making.

Types of Regression

1. Simple Linear Regression

This is the most basic form, involving one dependent variable and one independent variable. For example, a retailer might analyze how price changes affect product demand.

2. Multiple Regression

When multiple independent variables influence a single dependent variable, multiple regression is used. It’s often employed in marketing to assess the combined impact of price, advertising, and seasonality on sales.

3. Multivariate Regression

Multivariate regression extends the analysis to multiple dependent variables. For instance, a healthcare study might analyze how different treatments simultaneously impact patient recovery time and quality of life.

4. Logistic Regression

Logistic regression is used when the dependent variable is categorical (e.g., yes/no, success/failure). This is common in binary classification tasks like predicting customer churn or fraud detection.

Common Mistakes with Regression Analysis

- Ignoring Multicollinearity: When independent variables are highly correlated, it can skew results. Check for multicollinearity using Variance Inflation Factors (VIFs).

- Overfitting: A model that’s too complex may fit the training data perfectly but fail to generalize to new data. Use regularization techniques to mitigate this.

- Omitting Relevant Variables: Excluding important predictors can lead to biased results.

- Misinterpreting Correlation as Causation: Regression shows relationships, not causation. Be cautious in drawing conclusions.

- Neglecting Assumptions: Regression assumes linearity, homoscedasticity, and normality. Violating these can compromise model validity.

Regression Analysis Tools

Several tools are available for conducting regression analysis, ranging from statistical software to machine learning platforms:

- R and Python: These programming languages offer powerful libraries (e.g., scikit-learn, statsmodels) for regression analysis.

- SPSS and SAS: Popular in academia and industry for their user-friendly interfaces and robust statistical capabilities.

- Excel: Suitable for simple regression tasks, Excel provides a good starting point for beginners.

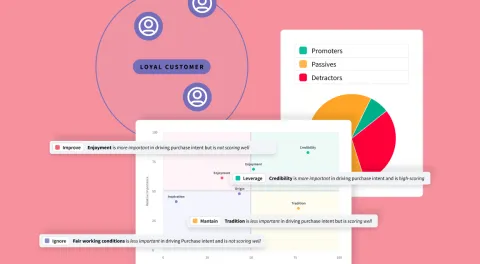

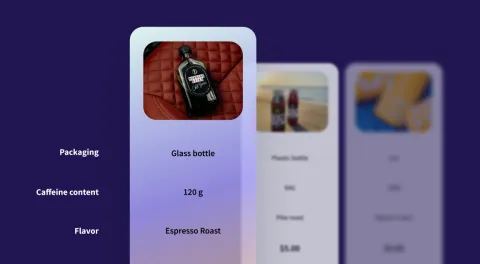

- SightX Enhancing Regression Analysis: SightX leverages cutting-edge technology to make regression analysis accessible, efficient, and actionable. With features like intuitive data visualization, automated insights, and seamless integration with survey tools, SightX empowers users to extract maximum value from their data.

Why SightX Stands Out

- Simplified Workflow: No need for complex coding—our platform handles the heavy lifting.

- Real-Time Insights: Instantly uncover patterns and relationships to drive decision-making.

- Quality Assurance: With built-in checks for data quality and assumptions, SightX ensures reliable results.

Regression analysis is a powerful tool that transforms raw data into meaningful insights. By understanding its mechanics, selecting the right type, and avoiding common pitfalls, you can harness its full potential. Whether you're predicting market trends, optimizing campaigns, or driving innovation, regression analysis is your key to informed decisions!