What is Correlation Analysis? And How to use it in Market Research

While many may only recall correlation analysis from the days of high school and college statistics classes, market research professionals will recognize this as a staple of their analysis toolbox.

Yet, as popular as correlation analysis may be, correlations are often misunderstood, misinterpreted, and misused. So we’ve put together a helpful guide on the basics of correlation analysis.

What is Correlation Analysis?

Correlation analysis is a statistical technique used to determine whether there is a relationship between two variables. When applied to market research, it is a popular way to identify patterns and uncover trends in a data set.

Now, as the saying goes, it’s important to remember that correlation DOES NOT equal causation. Technically, the two can exist simultaneously. But, correlation is not an implication of causation. A correlation simply means there is a relationship between two variables, so that when one changes the other also changes. While causation means that one variable directly causes the other to change.

A great example to illustrate this difference is the correlation between sunburns and ice cream sales. The two events are related, but neither event technically causes the other. But hot weather causes both sunburns and ice cream sales to rise.

How to Measure Correlation

A correlation between two variables can either be positive or negative. To measure the degree to which two variables are correlated, we use a correlation coefficient known as Pearson’s Correlation Coefficient. The value of the coefficient is always between -1 and 1.

Positive Correlations

For positive correlations, both variables will either increase or decrease at the same time. For example, when an hourly employee works more hours, the amount of money they earn will also increase.

In terms of coefficients, a positive correlation is a value between 0.01 and 1, with 1 being the strongest positive correlation. On a graph this will be displayed as a scatter plot with points that are close together, showing a positive slope (up and to the right).

Negative Correlations

On the other hand, for negative correlations the relationship is inverse. Meaning that if one variable increases, the other must decrease- or vice versa. For example, the more money you spend, the less you will have.

Why Use Correlation Analysis?

Uncover Patterns and Relationships You Might Have Missed

You can use correlation analysis to better understand the degree, strength, and direction of the association between two variables in your research. By analyzing your research data, correlation analysis investigates variables in their natural setting, potentially bringing patterns and trends to light that you could have otherwise missed.

Source Topics for Future Research

When applied to your survey and experiment data, correlation analysis searches for naturally occurring relationships between variables. Identifying positive or negative correlations gives you a solid foundation for a follow-up study, exploring the relationships you’ve discovered. For example, if you discover a correlation between age and likelihood to purchase, you may want to consider investigating this further in a future study.

How to Use Correlation Analysis

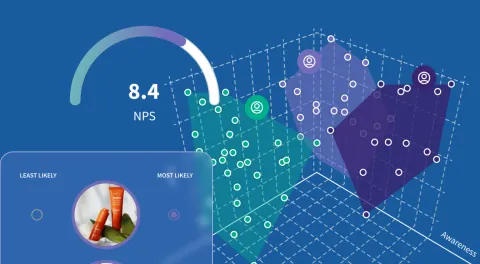

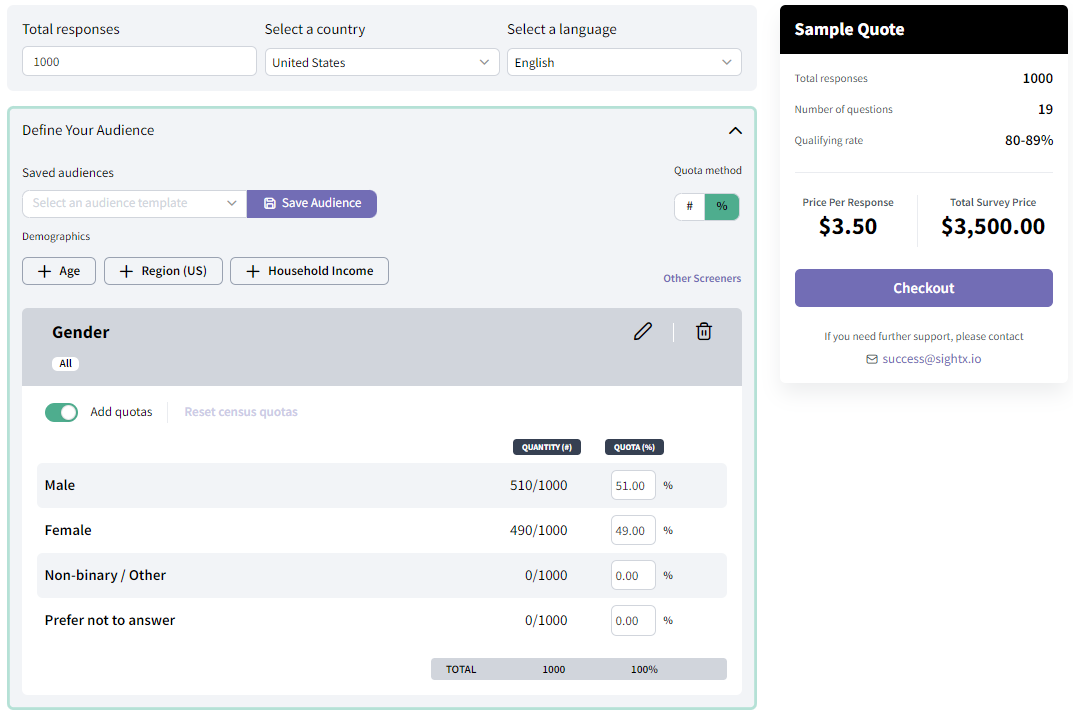

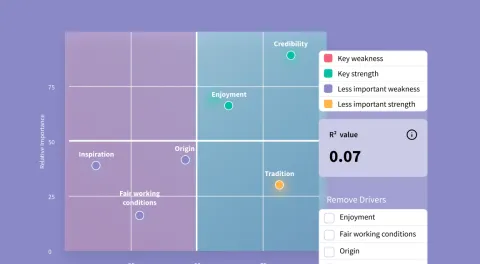

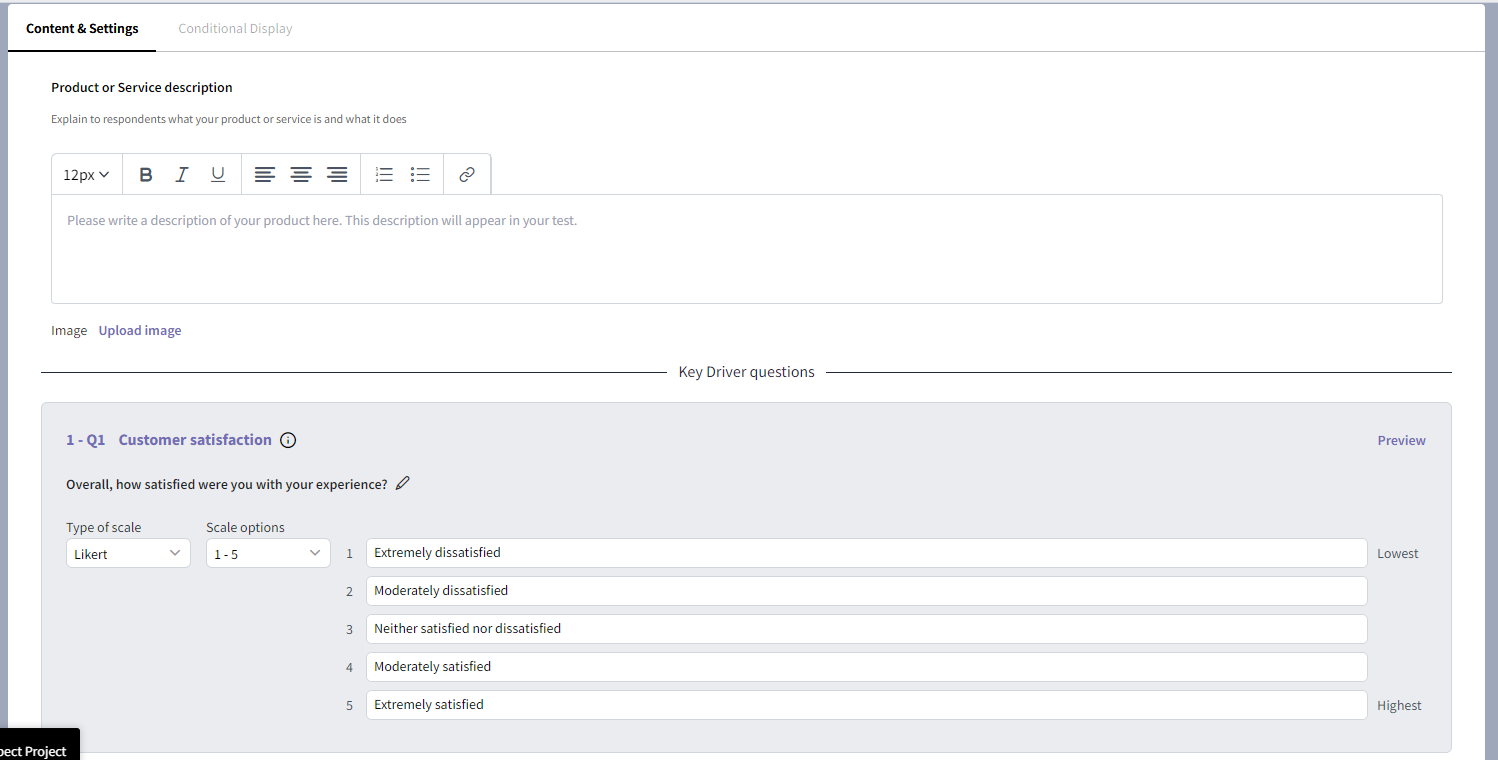

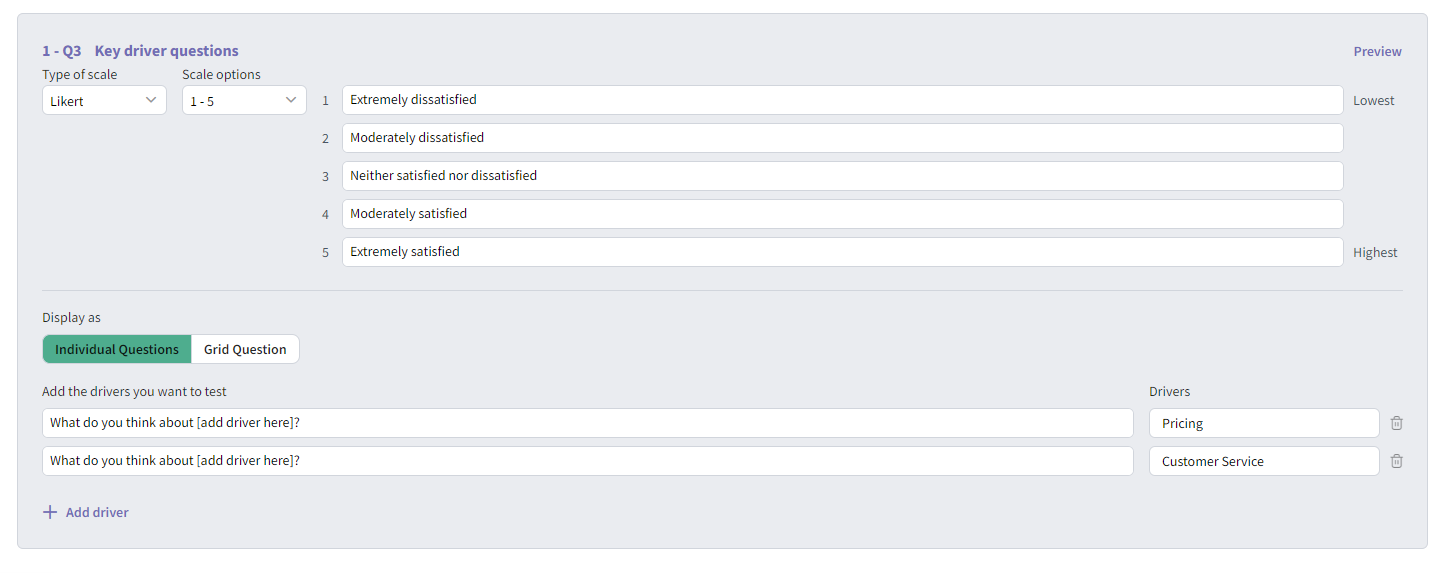

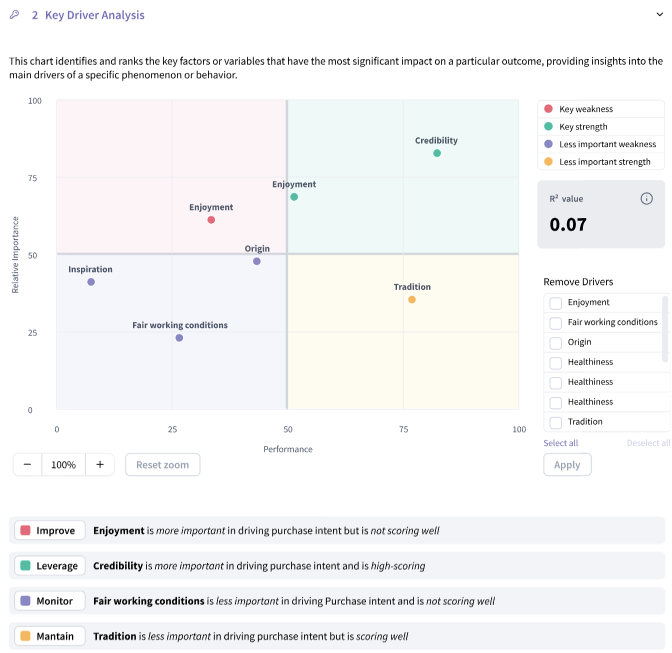

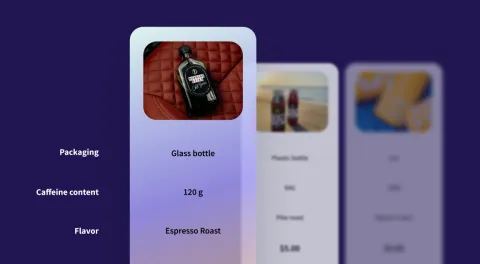

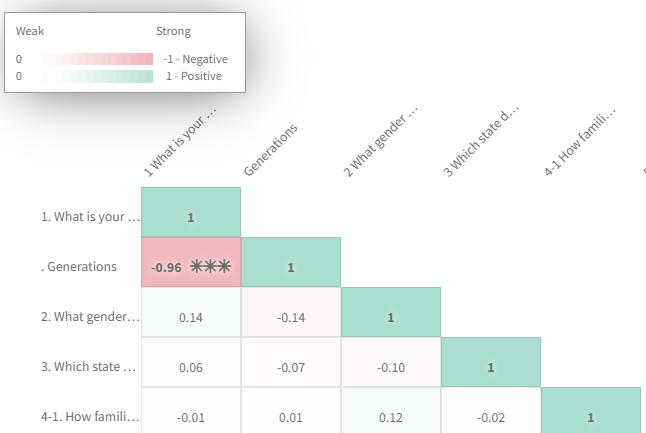

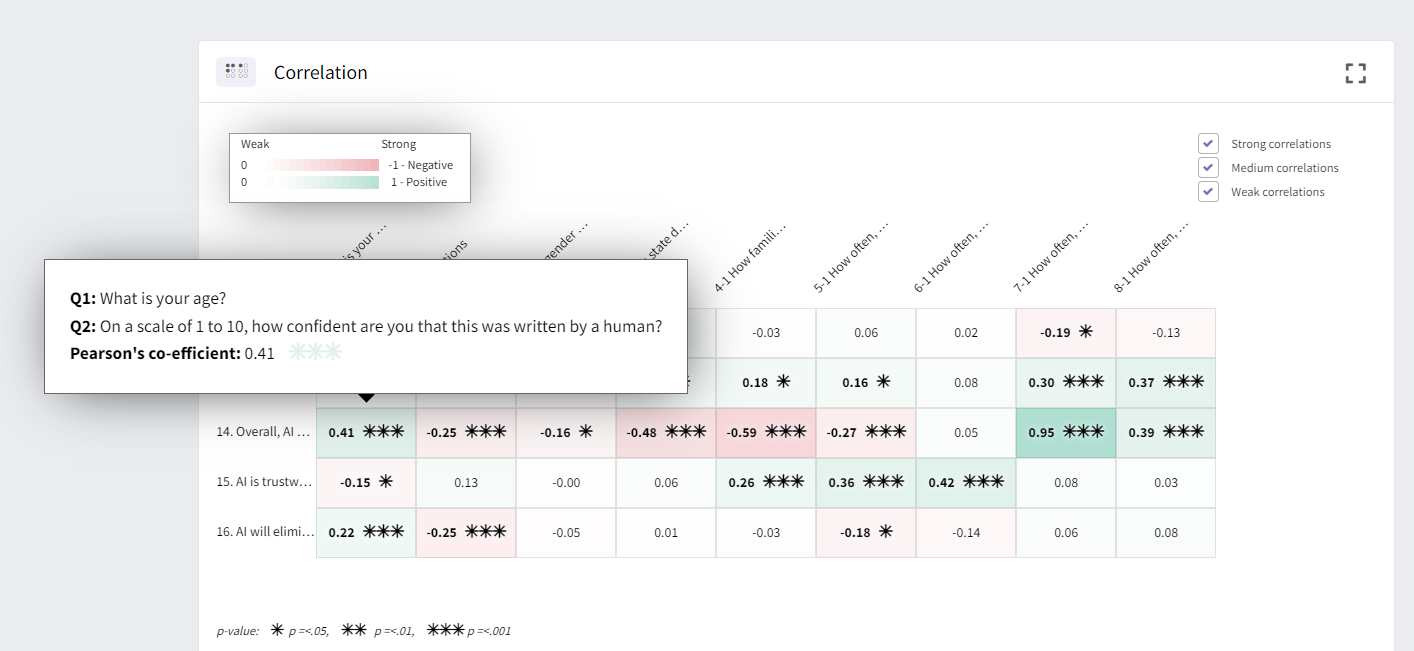

In the SightX platform, you can find Correlation Analysis within the Analyze section of the platform. This tool automatically scans each question in your survey, comparing each question (or variable) with every other question (or variable). The result? Something like the table below:

Green and red stand for positive and negative correlations. The darker the box, the stronger the correlation. And when hovered over, each box shows the variables being tested and Pearson’s coefficient value.

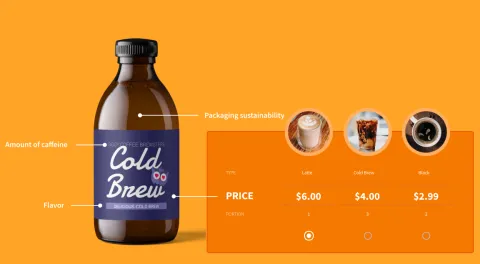

Correlation Analysis with SightX

The SightX platform is the only tool you'll ever need for market research: a single, unified solution for consumer engagement, data collection, advanced analysis, and reporting. While powerful enough for insights teams at Fortune 500 companies, the user-friendly interface makes it simple for anyone to start, optimize, and scale their research.

And with our new Generative AI consultant, Ada, you can harness the power of OpenAI’s GPT to transform your marketing research and insights. Collaborating with Ada is like having an expert researcher, brilliant statistician, and ace marketer on your team, helping you ask the right questions, choose the best experiments, pick out key insights, and seamlessly apply them to your business.