How to Conduct Consumer Insights Research

Understanding consumer behavior is essential for companies aiming to stay ahead of the curve. Consumer insights research serves as the compass that guides strategic decision-making, helping organizations uncover valuable insights into their target audience's preferences, motivations, and behaviors.

In this comprehensive guide, we delve into the intricacies of consumer insights research, exploring its significance, methodologies, and practical applications. By harnessing the power of consumer insights, businesses can unlock new avenues for growth, innovation, and customer-centricity.

What Are Consumer Insights?

Consumer insights are the data-driven observations you make from analyzing consumer behavior, attitudes, and preferences. These insights can provide an in-depth look at how people interact with your product, engage with your marketing, or perceive your brand.

What's the Difference Between Consumer Insights and Market Research?

Consumer insights focus on understanding individual consumer motivations and behaviors, offering a deeper understanding of needs and preferences, while market research provides a broader view of market trends and competition.

Together, they inform strategic decision-making and enable businesses to better meet consumer expectations.

It can help to think of it like this; market research answers the "what" – like market size, demographics, and trends – while consumer insights explores the "why" behind consumer actions. By deciphering the underlying motivations, aspirations, and pain points of consumers, businesses can better understand how to grow customer loyalty, expand their product’s reach, and build brand trust.

Why Do Consumer Insights Matter?

Consumer insights serve as a compass for businesses navigating the complex terrain of consumer preferences and behaviors, guiding them in developing products, services, and marketing strategies that resonate with their target audience. Moreover, consumer insights enable businesses to forge deeper connections with their audience, fostering brand loyalty and advocacy in an increasingly crowded marketplace.

Here are the ways your business can benefit from gathering and using consumer insights:

Understand Consumer Behavior

Consumer behavior is complex and constantly evolving, shaped by a multitude of factors including demographics, psychographics, and socio-economic trends. Consumer insights provide businesses with invaluable knowledge that allows them to evaluate and track their target audience's ever-changing motivations, behaviors, and preferences.

Anticipate Trends

By collecting consumer insights, businesses can gain a deeper understanding of emerging trends and shifts in consumer behavior. This enables them to anticipate market changes, identify new opportunities, and adapt their strategies accordingly, ensuring they stay ahead of the curve.

Identify Untapped Opportunities

Consumer insights shed light on unmet needs, pain points, and opportunities within a given market. Businesses can leverage this knowledge to innovate and develop products or services that address specific consumer demands, gaining a competitive edge and capturing market share.

Tailor Your Marketing Strategies

Consumer insights empower businesses to create targeted marketing campaigns that resonate with their audience on a personal level. By understanding the motivations and preferences of their target demographic, businesses can deliver tailored messages and experiences that drive engagement, loyalty, and conversions.

Improve Product Development

Consumer insights play a crucial role in product development, guiding businesses in refining existing offerings and developing new ones that meet consumer needs and preferences. By gathering feedback from consumers, businesses can identify areas for improvement, optimize features, and ensure their products resonate with their target audience.

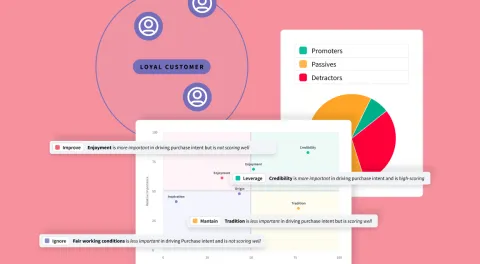

Foster Brand Loyalty

Building strong, lasting relationships with consumers is essential for long-term success. Consumer insights enable businesses to connect with their audience on a deeper level, fostering (much sought-after) brand loyalty and advocacy. By delivering personalized experiences, addressing consumer concerns, and consistently exceeding expectations, businesses can cultivate loyal customers who become brand evangelists.

Drive Business Growth

Ultimately, consumer insights are instrumental in driving business growth and profitability. By aligning products, services, and marketing efforts with consumer preferences and behaviors, businesses can increase customer satisfaction, drive repeat purchases, and attract new customers. This leads to sustainable growth, increased market share, and a stronger competitive position in the marketplace.

How Do I Gather Consumer Insights?

Surveys & Questionnaires

Surveys and questionnaires remain a staple tool for collecting quantitative data from consumers. Whether conducted online, via email, or in-person, surveys allow businesses to gather feedback on specific products, services, or marketing initiatives. By asking targeted questions, businesses can gain valuable insights into consumer preferences, opinions, and purchasing behaviors.

Focus Groups

Focus groups offer a qualitative approach to understanding consumer perceptions and attitudes. By convening a small group of individuals for in-depth discussions, businesses can delve into the underlying emotions and deeper motivations that drive consumer behavior. Focus groups provide rich insights that go beyond numerical data, offering nuanced perspectives and valuable anecdotes.

Use AI to Analyze the Data

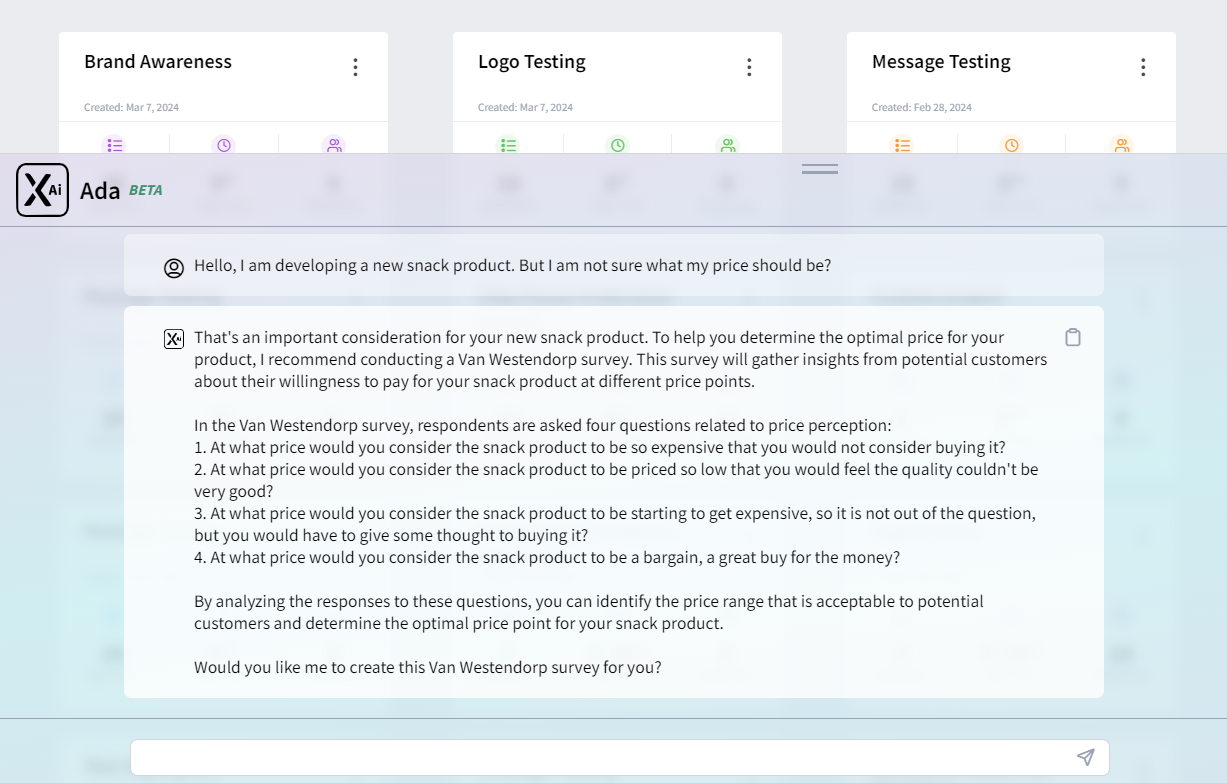

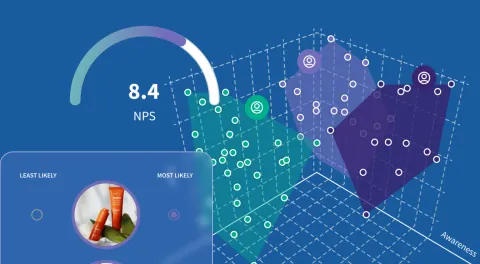

Advancements in artificial intelligence and machine learning have revolutionized the field of consumer insights research. By leveraging SightX's Generative AI Consultant, businesses can analyze vast amounts of consumer data with unprecedented speed and accuracy. SightX's AI-powered algorithms can uncover hidden patterns, trends, and correlations that human analysts might overlook, providing deeper insights into consumer behavior.

Consumer Insight Use Cases and Examples

Consumer insights serve as a goldmine of valuable data for businesses looking to understand their customers better and improve their overall experience. Here we’ll look at some practical ways businesses can leverage consumer insights to enhance their product offerings, optimize support processes, and develop self-service resources, all aimed at delivering exceptional customer experiences.

Example: Understanding Customer Needs and Preferences

A software company analyzes customer feedback and usage data to identify common pain points and areas for improvement in their product. Based on the insights, they release regular updates and enhancements, addressing customer concerns and adding new features that align with their users' needs and preferences. As a result, customer satisfaction increases, leading to higher retention rates and customer loyalty.

Example: Spotting Trends and Optimizing the Customer Journey

An e-commerce retailer analyzes customer purchase history and browsing behavior to identify trends in product preferences and shopping habits. Based on the insights, they optimize their website layout and navigation, making it easier for customers to find and purchase products they're interested in. Additionally, they personalize marketing campaigns and promotions based on individual customer preferences, increasing engagement and conversion rates throughout the customer journey.

Example: Streamlining Support Processes

A telecommunications company leverages customer insights to identify common questions and issues that customers face when setting up their internet service. Based on this insight, they developed a comprehensive self-service resource center, including FAQs, troubleshooting guides, and instructional videos, empowering customers to find answers and solutions independently. This reduces the volume of support inquiries and allows support agents to focus on addressing more complex issues, ultimately improving the overall customer support experience.

Example: Enhancing Product Development

A consumer electronics company collects feedback from customers through surveys and product reviews to identify areas for improvement in its latest smartphone model. Based on this insight, they make adjustments to the design and functionality of the phone, addressing common complaints and adding new features that align with customer preferences. As a result, the new smartphone receives positive reviews and generates high demand among consumers.

Example: Optimizing Marketing & Advertising Campaigns

Marketers utilize consumer insights to refine their digital marketing and advertising strategies. Through analysis of customer demographics and engagement metrics, they uncover that their target audience responds particularly well to influencer partnerships on social media platforms. In response, they reallocate a portion of their marketing budget to collaborate with relevant influencers who align with their brand values and resonate with their audience. As a result, they experience a significant increase in brand awareness, website traffic, and ultimately, sales.

AI Driven Consumer Insights with SightX

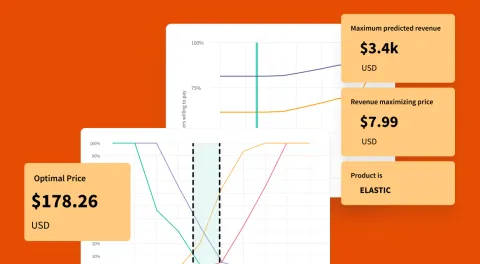

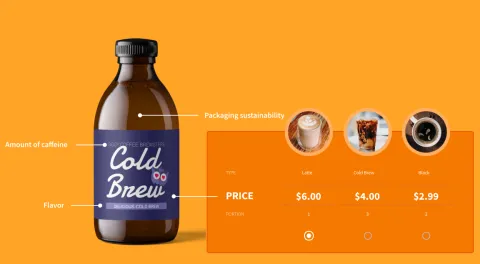

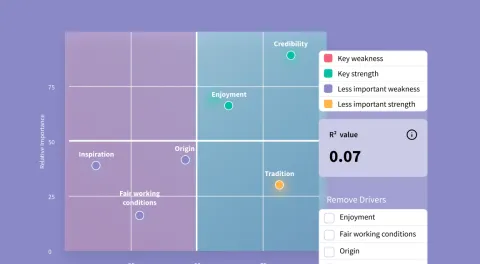

SightX is an AI-driven market research platform that offers you a single unified solution for product, brand, marketing, and pricing research. While powerful enough for insights teams at Fortune 500 companies, our user-friendly interface makes it simple for anyone to start, optimize, and scale their research.

And with our new Generative AI consultant, Ada, you can harness the power of OpenAI’s GPT to transform your marketing research and insights. Collaborating with Ada is like having an expert researcher, brilliant statistician, and ace marketer on your team, helping you ask the right questions, choose the best experiments, pick out key insights, and seamlessly apply them to your business.