How AI is Making it Harder to Forget about Customers in Go-to-Market Motions (Part 2)

This piece is the second in a three-part series exploring the ways AI makes it difficult to lose touch with consumers in go-to-market and product launch strategies. Specifically, we are investigating the excuses often used when organizations forget to center their customers, and how AI is making those excuses obsolete. To read part one, click here.

Excuse 2: “Adding sophisticated market research techniques throughout our go-to-market motion will be too slow and expensive.”

Another key reason the consumer often gets sidelined in product launches is that it has historically been very expensive and slow to leverage market research capabilities (beyond simple surveys) to fill blind spots. And if done cheaply and fast, the quality precipitously declines in inverse proportion.

But with generative AI, it’s no longer a matter of “speed, quality, cost … pick one”. It’s now “speed, quality, cost … pick three”.

Why? Because increasingly, users are able to use prompts to create studies in-platform within minutes. That same study, just a year ago, would only have been able to be created, deployed, and summarized by teams of researchers, with months-long timelines, with dozens of email exchanges and status update calls, at budget-busting costs.

If you’ve ever opened a >70 slide deck, a 100-page research report, or joined a weekly hour-long research project update call for the 13th week in a row, you may know what I mean. It’s not unlike eating a soup sandwich.

Let’s consider a few of these study designs that go beyond simple customer surveys,, and the implications of how AI is changing the game by improving speed, quality, and cost:

Pre-Launch De-Risking: Validate Ideas Before Significant Investment

Concept Testing

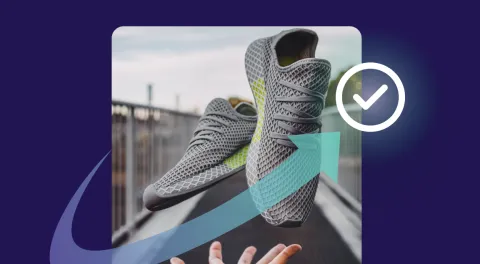

Traditionally, testing product concepts involved static mockups or physical prototypes. In the digital age, users were able to upload images or crudely sketched design concepts. Today, AI-powered platforms increasingly allow users to create ultra-realistic product simulations in seconds, for things that have never existed in the real world.

With simple prompts, users can gather immediate feedback on aesthetics, features, and messaging, refining a concept before significant investments are made in development. Results are summarized in seconds, and immediate next actions are clarified to improve concepts on behalf of prospective customers.

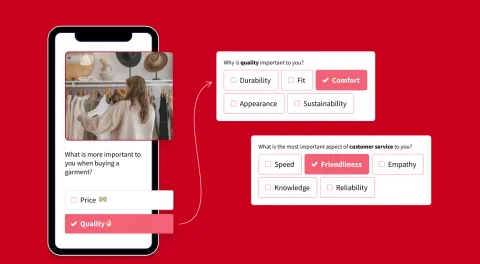

MaxDiff

Gone are the days of tedious surveys asking consumers to rank a long list of features. AI platforms are increasingly able to create sophisticated MaxDiff studies, where participants choose their most preferred and least preferred options from sets of product features, randomized intentionally based on participant demographics or on prompt-informed hypotheses about consumer differences.

This helps identify which features hold the most weight with a target audience, allowing product development efforts to be efficiently prioritized, and for product fit to be maximized relative to a wide range of possible options.

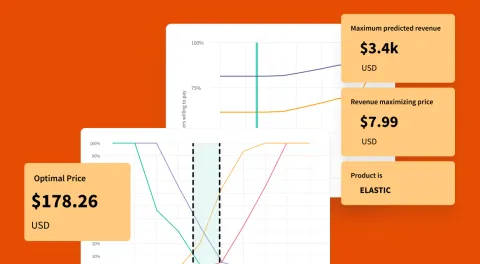

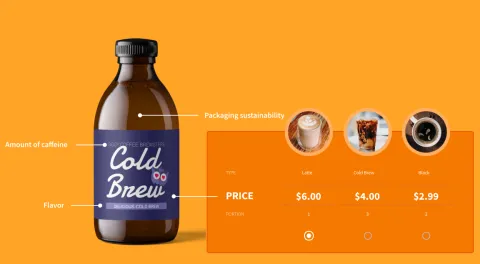

Conjoint Analysis

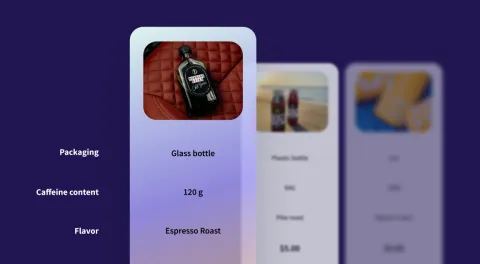

Imagine simulating real-world purchasing scenarios with countless product variations and pricing combinations, even when the concept has never existed.

AI platforms make this a reality through conjoint analysis and increasingly, AI-generated conjoint simulations. By understanding how price interacts with various features and configurations, both real and imagined, the optimal combination that drives conversions and maximizes customer satisfaction can be determined prior to incurring significant inventory expenditures.

Post-Launch Growth Acceleration: Refining Your Product on Behalf of Customers

Buyer Persona Development Through Segmentation

Consider for a moment how often your preferences as a customer are identical to everyone else in the market.

Not often, right?

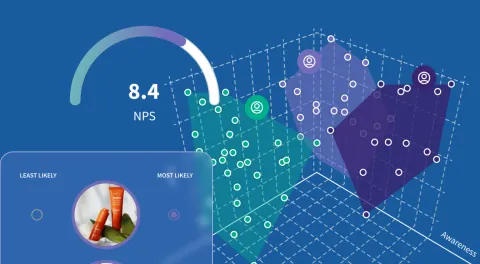

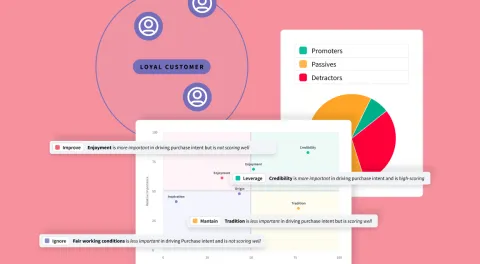

Audience segmentation brings to life non-obvious buyer personas who have different price points, product preferences, or unique keywords and language they use to search.

AI-powered platforms can analyze vast datasets to segment your audience into distinct groups with shared characteristics, often using unsupervised clustering algorithms. This allows for detailed buyer personas to be created, providing invaluable insights into their motivations, pain points, and preferred communication channels. Marketing efforts and product roadmaps can in turn be tailored to cater to specific customer needs, ensuring long-term product adoption and maximal reach.

TURF Analysis:

Understanding how different customer segments interact with your product and competitors is crucial for post-launch optimization.

AI allows for efficient TURF analysis, such as going beyond an approximate approach. Employing linear programming to assess every possible combination, enables users to find optimal solutions without approximations. It also can allow the identification of segments that are most susceptible to competitor offerings. This empowers users to tailor marketing messages and strategies for each segment, maximizing customer retention and acquisition, even as the market may shift as a result of variables such as competitor actions and macroeconomic conditions.

In conclusion, AI is increasingly helping consumer insights researchers leapfrog the speed and cost barriers traditionally faced in common GTM motions. And it’s allowing for a range of new product concepts to be comprehensively studied quickly, even when they’ve never existed. As prompt-driven imagery and video become more widely available in consumer insights platforms, things will only become faster and more cost effective, leaving GTM teams very little excuses for sidelining customers when bringing a new product or service to consumer markets. It’s an exciting time to be a researcher!

Stay tuned for part 3!