What is Brand Equity? And How Can You Create It?

Think about some of the biggest brands in the world. Apple, Nike, Starbucks, or Google might have come to mind.

These brands are instantly recognizable, seen as more valuable than competitors, and have many enthusiastic fans. To put it succinctly, they have brand equity.

In this piece, we will take a closer look at brand equity, its many aspects, the weight it carries, and what you can do to build your own.

What is Brand Equity?

Brand equity is the value added by brand recognition and a strong reputation. At its core, it's about how much people trust and like a brand, making them more likely to choose its products and even pay a premium.

Brand equity can affect things like sales, customer loyalty, and even the price people are willing to pay for products. So, when a brand has positive brand equity, it's seen as valuable and trustworthy in the eyes of consumers.

Aspects of Brand Equity

As you might have guessed, brand equity isn't a single metric; but a combination of many factors. These include:

Brand Awareness

Before you can even begin to think about building brand equity, you'll need to create brand awareness. If you want to become the behemoth in your market, you will first need people to know and recognize your brand.

Perceived Quality

Don't get this confused with the objective quality of your products or services. Perceived quality refers to the public's opinion on the quality of your brand image and the reputation of your products.

Brand Loyalty

Brand loyalty can take time to build, as people have positive experiences with your products and company. Building brand loyalty can increase sales as you retain more and more repeat customers.

Brand Preference

It's no secret that we all have (sometimes strange) brand preferences. Sometimes, people prefer a brand simply because it is the cheapest in the category. But often, the reasoning is far more complex. It could be the quality of the products, funny brand messaging, or childhood nostalgia.

Why is Strong Brand Equity Important?

No matter your company's size, building (and maintaining) brand equity is crucial to your success. Why? Because it represents the overall value and reputation of your brand.

Positive brand equity makes it much easier to attract new customers, who are often willing to pay a premium for your offerings. Some other significant benefits of building strong brand equity include:

Market Share Growth

It takes work to stand out in a competitive market. But having strong brand equity definitely makes it easier. When consumers recognize your brand, they are much more likely to buy from you. In fact, research shows that consumers are 2.5 times more likely to choose a brand they recognize over a lesser-known competitor.

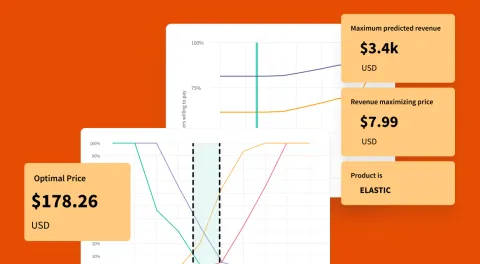

Increased Profits

It's no secret that brands with high equity can command price premiums. When people know, prefer, and trust a brand, they are not only willing to seek it out but also willing to pay more for it.

Market Resilience

We've seen enough economic downturns and market turbulence in the last decade to know that anything can happen (global pandemic included). In these situations, having stellar brand equity puts you in a safer position by holding a larger market share from the outset and greater consumer loyalty.

Examples of Great Brand Equity

Apple

Apple has one of the most substantial brand equities in the world. People often associate Apple with a sleek design, cutting-edge technology, high-quality products, and a premium experience, which has built immense loyalty for their brand.

Coca-Cola

Coca-Cola is ubiquitous with soda. In fact, many use the word "coke" when referring to the entire category.

Coca-Cola has built an iconic brand over decades, with a distinct logo and color palette that is recognizable worldwide. Coca-Cola has successfully crafted a brand image centered around happiness and togetherness, making it both a beloved brand and a cultural staple.

Starbucks

Starbucks has created a global empire based on more than just coffee, but about experiences. From its distinct logo to seasonal flavors, Starbucks has made an emotional connection with customers centered around community, quality, and indulgence.

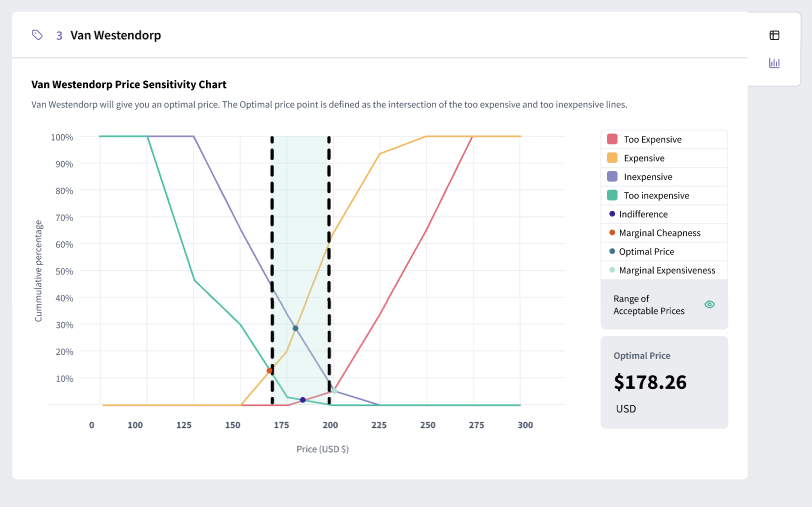

How to Measure Brand Equity

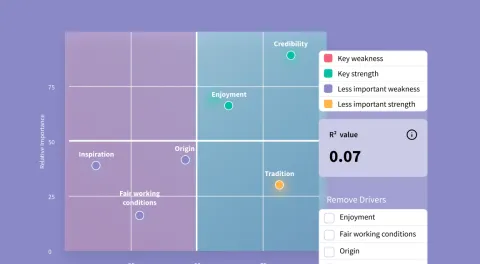

When trying to assess your brand equity, there are a few key drivers you can use. These include:

Consumer Data

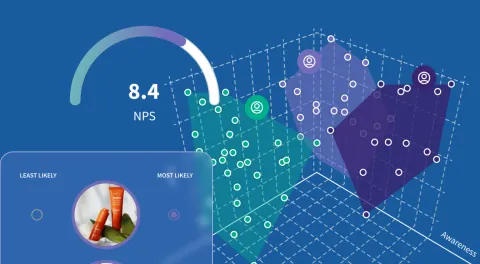

To understand where you stand, you need to know how consumers feel about your brand and how that impacts their purchasing behavior. You can use surveys or brand tracking to measure brand relevance, sentiments, perception, or value with your target market.

Social media listening and text analysis tools can also be helpful ways to gather data on consumer sentiments.

Financial Performance

A healthy balance sheet is one of the most apparent indicators of positive brand equity. With strong brand equity, you should see higher revenue and lower customer acquisition costs.

Brand Health Metrics

A healthy brand is much likelier to be resilient and withstand potential market turbulence. Your brand's health is a measure of multiple metrics- like awareness, loyalty, perception, etc. To learn more about brand health tracking, check out our guide here.

How to Create Brand Equity

To successfully build brand equity, you will need to work on many aspects of your brand over a period of time. For your brand to have equity, people must recognize it, see it as high quality, prefer it, and remain loyal.

So, how can you get to that point? Aside from having a stellar product and great services, here are a few tips:

Understand Your Audience

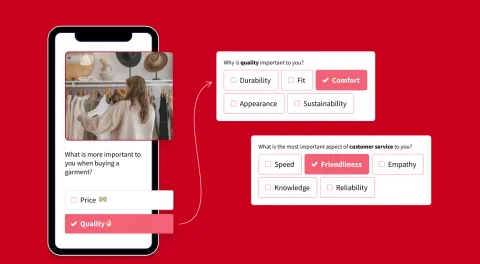

Start by conducting some market research to understand your target audience's needs, preferences, and perceptions. This will give you insights into what they expect from your brand, ways you can improve your image, and where you currently stand.

Create Brand Awareness

Once you know more about your target audience, you can start working on being in front of them more often. There are many ways to do this, including:

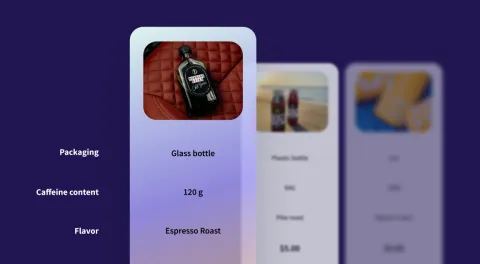

![]() Using consistent logos, messaging, and design themes to make recognition simple.

Using consistent logos, messaging, and design themes to make recognition simple.

![]() Keeping an active social media presence by posting frequently and regularly interacting.

Keeping an active social media presence by posting frequently and regularly interacting.

![]() Optimizing your website for SEO to appear organically when people search for your category.

Optimizing your website for SEO to appear organically when people search for your category.

A![]() dvertising across multiple platforms and mediums.

dvertising across multiple platforms and mediums.

Build Solid Relationships with Your Customers

Once customers know your brand, you'll need their trust to form a strong relationship. Customers want to know that you will deliver on your promises. When you prove that, not only will their sentiments towards your brand be positive, but they are more likely to tell their family and friends about your company.

Incentivize Loyalty

Brand loyalty is a powerful aspect of brand equity. Once customers have formed an emotional bond with your brand, they will make repeat purchases. By rewarding that loyalty with deals, offers, and exclusive access to experiences or new products, customers will be even more likely to remain loyal to your brand.

Monitor and Adapt Strategies

As time goes on, continuously monitor your brand performance, customer feedback, and market trends to identify areas for improvement and adaptation. Flexibility and responsiveness are essential for maintaining brand relevance and competitiveness over time.

Measure and Build Brand Equity with SightX

Historically, research and insights work was costly, time-consuming, fragmented, and not widely shared.

So we decided to change that.

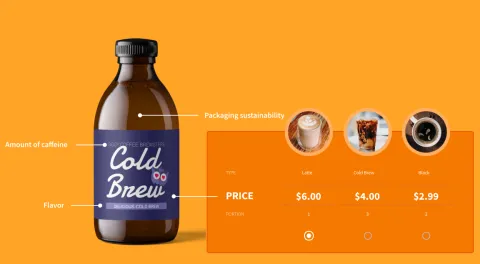

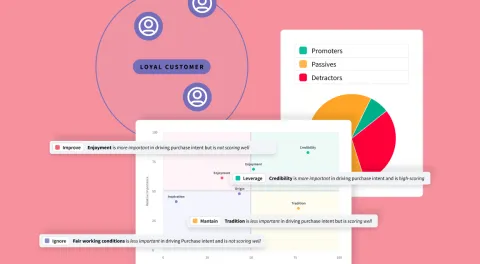

SightX is an AI-driven market research platform offering a single unified solution for product, brand, marketing, and pricing research. While powerful enough for insights teams at Fortune 500 companies, our user-friendly interface makes it simple for anyone to start, optimize, and scale their research.

With our new Generative AI consultant, Ada, you can harness the power of OpenAI's GPT to transform your marketing research and insights. Collaborating with Ada is like having an expert researcher, brilliant statistician, and ace marketer on your team, helping you ask the right questions, choose the best experiments, pick out key insights, and seamlessly apply them to your business.