Pricing is both an art and a science, requiring you to strike a delicate balance between profitability and people's willingness to pay.

Which is why conducting pricing research is crucial in the process of de-risking a product and successfully growing it once out on the market.

The Van Westendorp Price Sensitivity Meter provides a robust framework for assessing consumer willingness to pay and identifying price thresholds that maximize revenue and profitability.

This blog will briefly cover the origins, principles, applications, and best practices of the Van Westendorp Price Sensitivity Meter, equipping businesses with the knowledge and tools to leverage this powerful technique for pricing success.

Origins and Evolution of the Van Westendorp Price Sensitivity Meter

The roots of the Van Westendorp Price Sensitivity Meter can be traced back to the pioneering work of Peter Van Westendorp in the 1970s.

Originally developed to determine optimal pricing for consumer products and services, the methodology has since evolved into a widely used tool for market research and pricing strategy optimization.

Van Westendorp's seminal paper, "NSS-Price Sensitivity Meter: A New Approach to Study Consumer Perception of Prices," laid the foundation for the methodology, introducing the concept of price sensitivity thresholds and the four key questions used to elicit consumer responses. Over the years, the Van Westendorp Price Sensitivity Meter has been refined and adapted to various industries and contexts, cementing its status as a cornerstone of pricing research.

Understanding the Van Westendorp Price Sensitivity Meter Framework

At the heart of the Van Westendorp Price Sensitivity Meter lies a simple yet powerful framework consisting of four key questions:

1) At what price would you consider the product/service so expensive that you would not consider buying it? (Too expensive)

2) At what price would you consider the product/service to be priced so low that you would feel the quality couldn't be very high? (Too cheap)

3) At what price would you consider the product/service to be a bargain—a great buy for the money? (Cheap)

4) At what price would you consider the product/service to be getting expensive, but you would still consider buying it? (Expensive)

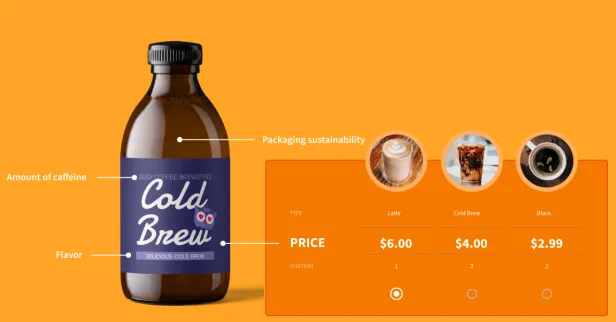

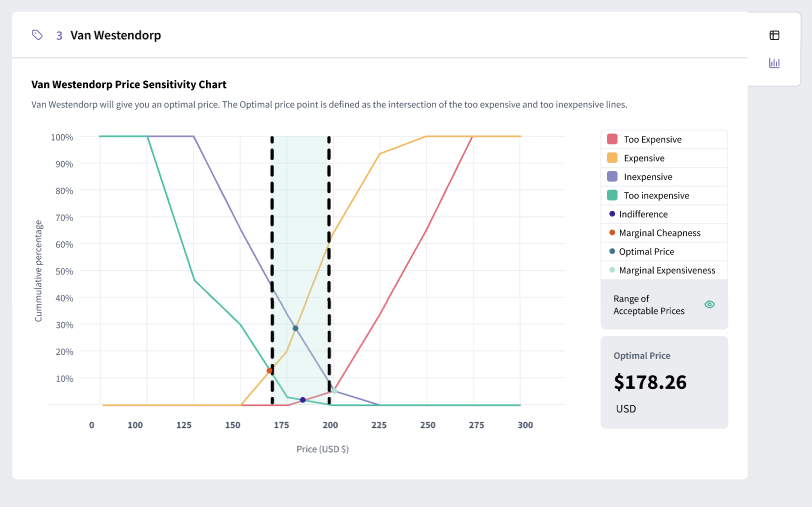

By asking respondents these four questions and analyzing their responses, you can construct a Price Sensitivity Meter graph that visualizes consumer perceptions of price and demand. Much like the one you see below:

The intersection of the "too expensive" and "too cheap" curves represents the optimal price range. In contrast, the "cheap" and "expensive" curves provide additional insights into consumer preferences and pricing thresholds.

Applications of the Van Westendorp Price Sensitivity Meter

The simplicity and versatility of the Van Westendorp Price Sensitivity Meter lends itself to a wide range of applications across industries and contexts. From new product launches to pricing strategy optimization, consumer insights managers can leverage this methodology to gain valuable insights into consumer preferences and willingness to pay.

Some typical applications of the Van Westendorp Price Sensitivity Meter include:

Pricing Strategy Development

Determine optimal price points and pricing tiers for products and services.

Market Segmentation

Identify price sensitivity differences among different consumer segments.

Competitive Pricing Analysis

Evaluate competitor pricing strategies and assess market positioning.

Product Portfolio Optimization

Determine pricing strategies for new products and assess the impact on existing product lines.

Best Practices for Conducting a Van Westendorp Price Sensitivity Meter Study

To ensure the accuracy and reliability of the results, follow best practices when conducting a Van Westendorp Price Sensitivity Meter study:

Clearly Define Objectives

Clearly define your research objectives before conducting the study.

Select a Representative Sample

Ensure that the sample size and composition are representative of the ideal customer profile or target audience.

Standardize Survey Administration

Consistently administer the survey to minimize bias and ensure reliability.

Interpret Results with Caution

Interpret the results with caution, taking into account potential biases and limitations of the methodology.

Validate Findings

Validate the findings through additional research or market testing to ensure their applicability in real-world scenarios.

Conducting Price Sensitivity Studies with SightX

Historically, research and insights work was costly, time consuming, fragmented, and not widely shared....so we decided to change that.

SightX is an AI-driven market research platform offering a single unified solution for product, brand, marketing, and pricing research. While powerful enough for insights teams at Fortune 500 companies, our user-friendly interface makes it simple for anyone to start, optimize, and scale their research.

With our new Generative AI consultant, Ada, you can harness the power of OpenAI's GPT to transform your marketing research and insights. Collaborating with Ada is like having an expert researcher, brilliant statistician, and ace marketer on your team, helping you ask the right questions, choose the best experiments, pick out key insights, and seamlessly apply them to your business.