Concept tests are one of the most valuable insights tools available to you, which explains why it's the most popular experiment on the SightX platform!

When you make concept testing a regular part of your product development strategy, not only will you be more confident in your launches. But you'll also avoid costly mistakes.

Find out how to use concept testing throughout your product development life cycle:

What is Concept Testing?

Concept testing is a market research methodology that provides insights into the viability of your ideas, products, or services before you invest significant resources.

Concept testing involves presenting your product designs or prototypes to a carefully selected sample of your target audience and collecting feedback on key measurements like appeal, relevance, and purchase intent.

For product development, you can use concept testing at nearly every stage of your workflow.

By engaging with consumers early on, you can identify your product's strengths, weaknesses, and areas for improvement, finding data-backed ways to differentiate your new product. Later in your development cycle, you can use concept testing to refine your product's packaging, messaging, or marketing collateral.

Types of Concept Testing

Comparison Testing

Comparison testing is exactly what you'd expect. Respondents are shown two or more concepts and compare them by simply selecting their favorite or using ranking or rating-scales questions.

The results of a comparison test are often clear and simple to understand. Which makes it easy to determine which of your concepts is the winner.

But comparison tests have drawbacks. One major issue is a lack of context. Comparison testing gives little insight into why one concept was selected over the others.

Monadic Testing

With monadic testing, your sample (pool of respondents) is separated into groups. Each group sees only one concept, meaning there is no comparison, simply an in-depth evaluation of the concept shown.

Because respondents are only shown a single concept, this method makes it possible to get in-depth insights without the drawbacks of a lengthy survey. So, instead of simply understanding which concept won, you can better understand how consumers feel about the elements of each.

But, once again, there are some drawbacks. You'll need a larger sample size to break respondents into groups, which can drive up your cost and time-to-insights.

Sequential Monadic Testing

Much like monadic testing, sequential monadic testing requires you to split your audience into groups. But instead of only showing one concept to each group, respondents evaluate all of your concepts in random order. Each group is asked the same follow-up questions at the end of the rotation.

As each group evaluates all concepts, the required sample size for a sequential monadic test is smaller- reducing costs. It also allows you to test multiple ideas in a single round, making it quite efficient.

But, as you guessed it, this methodology isn't foolproof. The survey length can be lengthy because respondents see all of your concepts. This ultimately affects the completion rate and can even cause respondent fatigue, leading to poor data quality.

Proto-Monadic Testing

As the name might suggest, proto-monadic testing combines sequential monadic and comparison testing. This method has respondents examine multiple concepts and then choose the one they prefer.

Ultimately, proto-monadic testing allows you to confirm that the winner of your comparison test is compatible with the in-depth insights gained on individual concepts.

How to Use Concept Testing in Your Product Development Cycle

Concept testing typically involves a few key steps, each crucial to successfully gathering, analyzing, and applying consumer feedback.

We'll illustrate the process through an example. Let's say the team at a CPG company wants to test ten new flavors of ice cream to identify the top three flavors consumers will likely buy.

The first step in the process is concept creation, where the CPG company will generate potential flavor concepts to test.

Once flavor concepts have been developed, the next step is audience selection, where the team identifies a representative sample of their ideal target audience to participate in the concept testing process.

After audience identification, it is time to develop the concept test study. Questions in this survey may cover topics like consumer attitudes, preferences, purchase intent, and demographic information, among others.

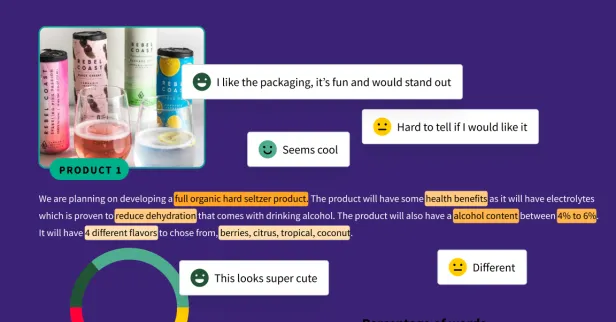

The actual Stimuli within the concept test (aka what the respondents in your sample see/interact with) may include prototypes, mock-ups, descriptions, or visual representations of the concepts being tested.

Once the surveys and stimuli have been designed, it is time to collect data to gather insights. The team can set up the experiment to expose participants to all concepts (Sequential study) or randomly assign participants to one of the concepts to evaluate in-depth (Monadic test). Because they are testing a relatively large number of concepts, the team chooses a monadic test.

With the data, the team can see which flavors had the highest appeal and purchase intent rating from their target market, allowing them to easily choose their new three flavors.

Best Practices for Concept Testing in New Product Development

To ensure the reliability and validity of your concept testing data, you should adhere to a few best practices. These include:

1. Define clear research objectives

Before conducting any concept test ng, you should be able to clearly define your research objectives and know your criteria for success. This will help ensure the testing process is focused and aligned with the business's goals.

2. Select an appropriate sample size and composition

The sample size and composition of the test group are critical factors that can impact both the reliability and validity of your concept testing results. You can use resources, like our knowledge hub, to get recommendations on how many respond to your surveys or specific experiment needs.

3. Design clear and concise tests and stimuli

Both your concept test and stimuli should be designed in a way that effectively communicates the concepts being tested and elicits meaningful feedback from participants. Questions should be clear, concise, and easy to understand. At the same time, the concepts themselves (stimuli) should accurately represent the product ideas you want to test.

4. Analyze data rigorously

Once data has been collected, you will want to look at the data overall. However, you should also filter/cut your data in a way that enables you to look at different segments. When seeking meaningful differences between the concepts, where relevant, make sure you run tests for statistical significance. Some platforms, like SightX, will run this automatically on your concept testing data.

5. Integrate concept testing throughout the product development process

For real success, concept testing should be integrated throughout your product development process. Early and iterative concept testing allows you to optimize and perfect your product throughout its development.

The benefits of concept testing are wide-ranging and extend across your entire organization. In new product development, concept testing provides valuable insights into consumer preferences, enabling brands to bring better products to market.

For insights managers, concept testing enables you to collaborate with other teams within your organization, like innovation or marketing, and develop well-thought-out strategies that resonate with your target market.

Product Concept Testing with SightX

SightX is an AI-driven market research platform offering a unified solution for product, brand, marketing, and pricing research. While powerful enough for insights teams at Fortune 500 companies, our user-friendly interface makes it simple for anyone to start, optimize, and scale their research.

With our Generative AI consultant, Ada, you can harness the power of OpenAI's GPT to transform your marketing research and insights. Collaborating with Ada is like having an expert researcher, brilliant statistician, and ace marketer on your team, helping you ask the right questions, choose the best experiments, pick out key insights, and seamlessly apply them to your business.