10 Concept Testing Questions to Ask Your Target Market

Launching a new product or service involves significant risk. Full stop.

The stakes are high, and the cost of failure can be substantial—not just in terms of financial investment, but also for your brand reputation and market share. To mitigate such risks, consumer insight leaders rely on tools like concept testing to assess the viability of their ideas by gathering feedback from their target market.

By understanding how potential customers perceive a concept, businesses can make informed decisions, refine their offerings, and increase their chances of success.

However, when it comes to concept testing, the quality of the feedback you receive is directly proportional to the quality of the questions you ask. Effective concept testing questions should be designed to elicit detailed, honest, and actionable responses. In return, the responses you receive should provide valuable insights into consumer preferences, potential pain points, and the overall market landscape.

The Importance of Asking the Right Questions

Concept testing is not just about validating an idea but about deeply understanding the market's needs, desires, and expectations. Asking the right questions during concept testing is crucial for several reasons:

![]() Identifying Consumer Preferences: The right questions help uncover what consumers truly want and need. This knowledge is invaluable in tailoring your product or service to effectively meet market demand.

Identifying Consumer Preferences: The right questions help uncover what consumers truly want and need. This knowledge is invaluable in tailoring your product or service to effectively meet market demand.![]() Highlighting Strengths and Weaknesses: By asking targeted questions, you can identify the strengths of your concept that should be emphasized and the weaknesses that need to be addressed. This ensures that you are not blindsided by potential issues post-launch.

Highlighting Strengths and Weaknesses: By asking targeted questions, you can identify the strengths of your concept that should be emphasized and the weaknesses that need to be addressed. This ensures that you are not blindsided by potential issues post-launch.![]() Understanding Competitive Positioning: Effective questions can reveal how your concept stands up against existing products or services in the market. This helps position your offering in a way that highlights its unique value proposition.

Understanding Competitive Positioning: Effective questions can reveal how your concept stands up against existing products or services in the market. This helps position your offering in a way that highlights its unique value proposition.![]() Mitigating Risks: Early identification of potential concerns or reservations allows you to address them proactively. This can save you from costly revisions or pivots after the product has already been launched.

Mitigating Risks: Early identification of potential concerns or reservations allows you to address them proactively. This can save you from costly revisions or pivots after the product has already been launched.![]() Optimizing Marketing Strategies: Insights gathered from concept testing can inform your marketing and communication strategies, ensuring that your messaging resonates with your target audience.

Optimizing Marketing Strategies: Insights gathered from concept testing can inform your marketing and communication strategies, ensuring that your messaging resonates with your target audience.![]() Enhancing Innovation: Feedback from potential customers can lead to innovative ideas and improvements that you might not have considered. This collaborative approach can result in a more refined and market-ready product.

Enhancing Innovation: Feedback from potential customers can lead to innovative ideas and improvements that you might not have considered. This collaborative approach can result in a more refined and market-ready product.

By prioritizing the right questions, you can transform concept testing from a routine validation step into a strategic tool for innovation and market success.

Ten Concept Testing Questions to Ask Your Market

The questions below are designed to help you gather the insights you need to make informed decisions and maximize the potential of your new product or service.

What is your first impression of this concept?

![]() Why it matters: First impressions are crucial as they can significantly influence consumer interest and engagement. This question helps you understand the initial appeal of your concept and whether it grabs attention right away. A positive first impression can increase curiosity and willingness to explore the product further. Conversely, if the first impression is negative or lukewarm, it can indicate that the concept needs significant adjustments before moving forward.

Why it matters: First impressions are crucial as they can significantly influence consumer interest and engagement. This question helps you understand the initial appeal of your concept and whether it grabs attention right away. A positive first impression can increase curiosity and willingness to explore the product further. Conversely, if the first impression is negative or lukewarm, it can indicate that the concept needs significant adjustments before moving forward.![]() Detailed insights: dive deeper by asking follow-up questions such as, "What specific elements contribute to your first impression?" and "How does the design/branding affect your initial perception?" This can help identify the aspects of your concept that create a strong impact and those that might need refinement.

Detailed insights: dive deeper by asking follow-up questions such as, "What specific elements contribute to your first impression?" and "How does the design/branding affect your initial perception?" This can help identify the aspects of your concept that create a strong impact and those that might need refinement.

How likely are you to purchase this product/service if it were available?

![]() Why it matters: This question directly measures purchase intent, providing an early indicator of the concept's potential success in the market. A high likelihood of purchase suggests strong market demand, while a low probability may indicate that the idea does not meet the needs or desires of the target audience.

Why it matters: This question directly measures purchase intent, providing an early indicator of the concept's potential success in the market. A high likelihood of purchase suggests strong market demand, while a low probability may indicate that the idea does not meet the needs or desires of the target audience.![]() Detailed insights: To gain a more nuanced understanding, consider asking follow-up questions such as, "What factors influence your decision to purchase?" and "What additional features or improvements would increase your likelihood of purchasing?" These questions can reveal specific areas for enhancement that could boost consumer interest and willingness to buy.

Detailed insights: To gain a more nuanced understanding, consider asking follow-up questions such as, "What factors influence your decision to purchase?" and "What additional features or improvements would increase your likelihood of purchasing?" These questions can reveal specific areas for enhancement that could boost consumer interest and willingness to buy.

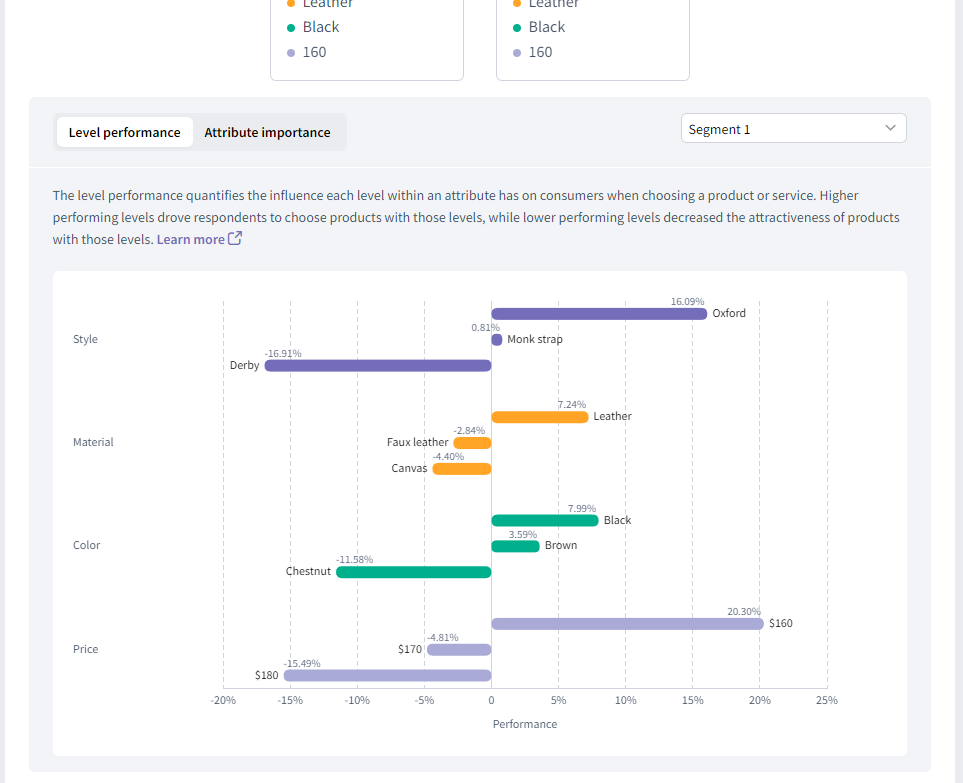

What features do you find most appealing about this concept?

![]() Why it matters: Identifying the features that resonate most with consumers helps you understand your concept's most attractive aspects. This information is crucial for emphasizing the right features in your marketing and development efforts.

Why it matters: Identifying the features that resonate most with consumers helps you understand your concept's most attractive aspects. This information is crucial for emphasizing the right features in your marketing and development efforts.![]() Detailed insights: Encourage respondents to rank the appealing features or explain why they find certain features attractive. You might ask, "Which feature stands out the most to you, and why?" and "How do these features compare to those of existing products you use?" These insights can guide you in prioritizing features that provide the most value to your target audience.

Detailed insights: Encourage respondents to rank the appealing features or explain why they find certain features attractive. You might ask, "Which feature stands out the most to you, and why?" and "How do these features compare to those of existing products you use?" These insights can guide you in prioritizing features that provide the most value to your target audience.

What features do you find least appealing or unnecessary?

![]() Why it matters: Understanding which features are seen as unappealing or redundant helps you streamline your product or service. This ensures you are using your resources effectively on elements that do not add value to your customers.

Why it matters: Understanding which features are seen as unappealing or redundant helps you streamline your product or service. This ensures you are using your resources effectively on elements that do not add value to your customers.![]() Detailed insights: Follow up with questions like, "What specifically makes these features unappealing or unnecessary?" and "How could these features be improved or replaced to enhance the overall concept?" This feedback can guide you in making targeted adjustments that improve your product's overall appeal and functionality.

Detailed insights: Follow up with questions like, "What specifically makes these features unappealing or unnecessary?" and "How could these features be improved or replaced to enhance the overall concept?" This feedback can guide you in making targeted adjustments that improve your product's overall appeal and functionality.

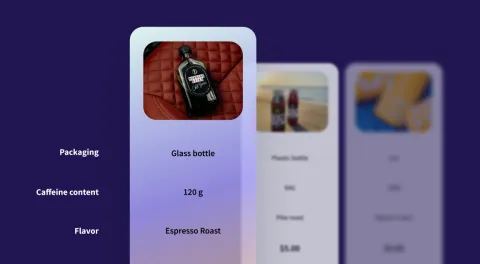

How does this concept compare to existing products/services in the market?

![]() Why it matters: This question provides insights into the competitive landscape and helps you understand where your concept stands in relation to current offerings. Knowing how your product compares can inform your positioning strategy and highlight areas for differentiation.

Why it matters: This question provides insights into the competitive landscape and helps you understand where your concept stands in relation to current offerings. Knowing how your product compares can inform your positioning strategy and highlight areas for differentiation.![]() Detailed insights: Ask respondents to elaborate on their comparisons by asking, "What specific advantages or disadvantages does this concept have compared to existing products?" and "What unique value does this concept offer that current products lack?" These responses can help you refine your value proposition and competitive strategy.

Detailed insights: Ask respondents to elaborate on their comparisons by asking, "What specific advantages or disadvantages does this concept have compared to existing products?" and "What unique value does this concept offer that current products lack?" These responses can help you refine your value proposition and competitive strategy.

What do you perceive as the main benefits of this concept?

![]() Why it matters: Identifying perceived benefits helps you understand the value consumers see in your concept. This information is critical for crafting compelling marketing messages and ensuring that your product meets the needs of your target audience.

Why it matters: Identifying perceived benefits helps you understand the value consumers see in your concept. This information is critical for crafting compelling marketing messages and ensuring that your product meets the needs of your target audience.![]() Detailed insights: Probe further by asking, "How do these benefits align with your personal or professional needs?" and "Can you provide examples of how these benefits would improve your daily life or work?" These detailed responses can help you understand your concept's practical applications and real-world impact.

Detailed insights: Probe further by asking, "How do these benefits align with your personal or professional needs?" and "Can you provide examples of how these benefits would improve your daily life or work?" These detailed responses can help you understand your concept's practical applications and real-world impact.

What concerns or reservations do you have about this concept?

![]() Why it matters: Addressing consumer concerns early in the development process allows you to mitigate risks and make necessary adjustments. Understanding reservations can help you refine your concept and increase its likelihood of success.

Why it matters: Addressing consumer concerns early in the development process allows you to mitigate risks and make necessary adjustments. Understanding reservations can help you refine your concept and increase its likelihood of success.![]() Detailed insights: To gain a comprehensive understanding, ask follow-up questions such as, "What specific aspects of the concept raise concerns?" and "How could these concerns be alleviated or addressed?" This detailed feedback can guide you in making targeted improvements that enhance consumer confidence and satisfaction.

Detailed insights: To gain a comprehensive understanding, ask follow-up questions such as, "What specific aspects of the concept raise concerns?" and "How could these concerns be alleviated or addressed?" This detailed feedback can guide you in making targeted improvements that enhance consumer confidence and satisfaction.

How would you improve this concept?

![]() Why it matters: Consumer suggestions for improvement can lead to innovative enhancements and increased market fit. This question encourages constructive feedback and opens the door to new ideas you might not have considered.

Why it matters: Consumer suggestions for improvement can lead to innovative enhancements and increased market fit. This question encourages constructive feedback and opens the door to new ideas you might not have considered.![]() Detailed insights: Encourage detailed responses by asking, "What specific changes or additions would make this concept more appealing to you?" and "How could this concept be adapted to better meet your needs?" These suggestions can provide valuable insights for refining and optimizing your product or service.

Detailed insights: Encourage detailed responses by asking, "What specific changes or additions would make this concept more appealing to you?" and "How could this concept be adapted to better meet your needs?" These suggestions can provide valuable insights for refining and optimizing your product or service.

Who do you think would most benefit from this product/service?

![]() Why it matters: Understanding the target audience helps you fine-tune your marketing strategies and identify primary customer segments. Knowing who will most likely benefit from your concept can inform your targeting and positioning efforts.

Why it matters: Understanding the target audience helps you fine-tune your marketing strategies and identify primary customer segments. Knowing who will most likely benefit from your concept can inform your targeting and positioning efforts.![]() Detailed insights: Ask respondents to describe the characteristics of the ideal user by asking, "What are the key traits or demographics of the people who would benefit most from this concept?" and "Why do you think this group would find the product particularly valuable?" This information can help you create detailed customer personas and tailor your marketing efforts accordingly.

Detailed insights: Ask respondents to describe the characteristics of the ideal user by asking, "What are the key traits or demographics of the people who would benefit most from this concept?" and "Why do you think this group would find the product particularly valuable?" This information can help you create detailed customer personas and tailor your marketing efforts accordingly.

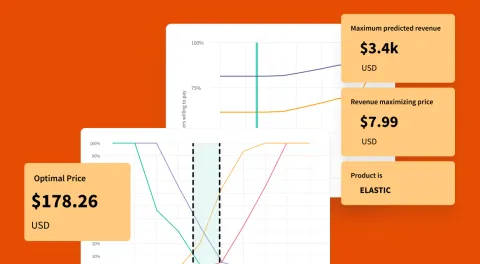

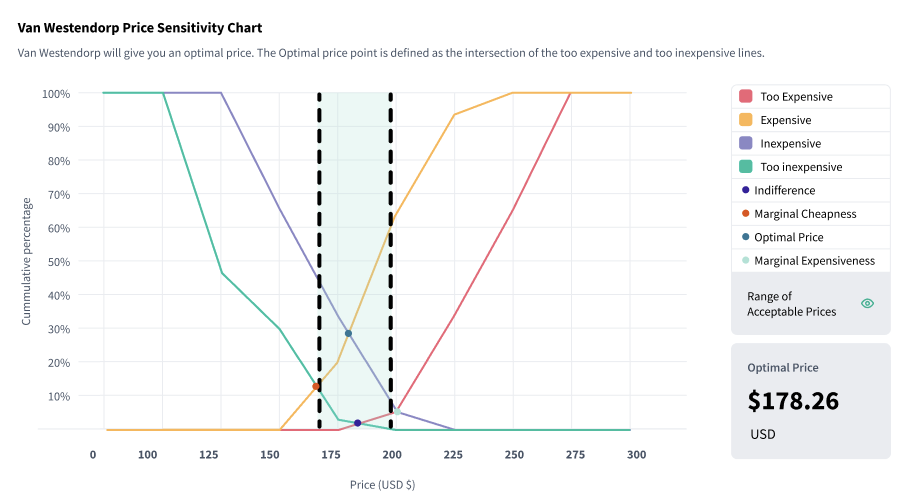

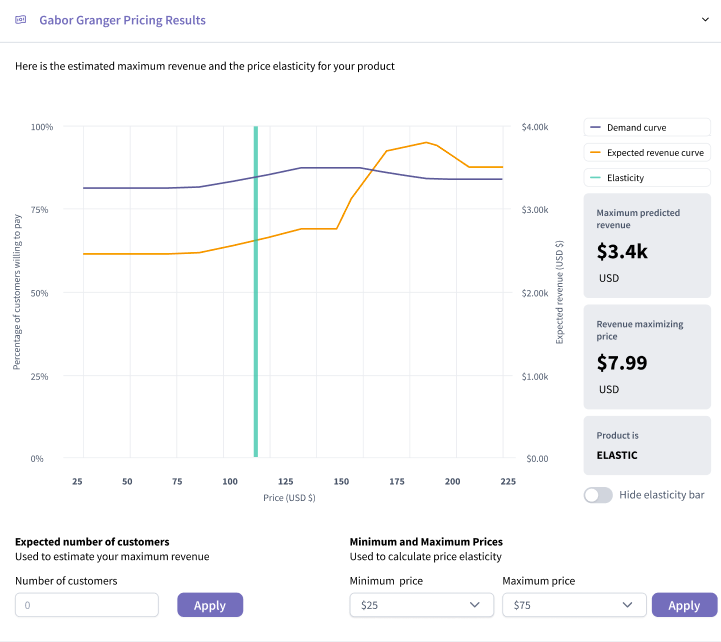

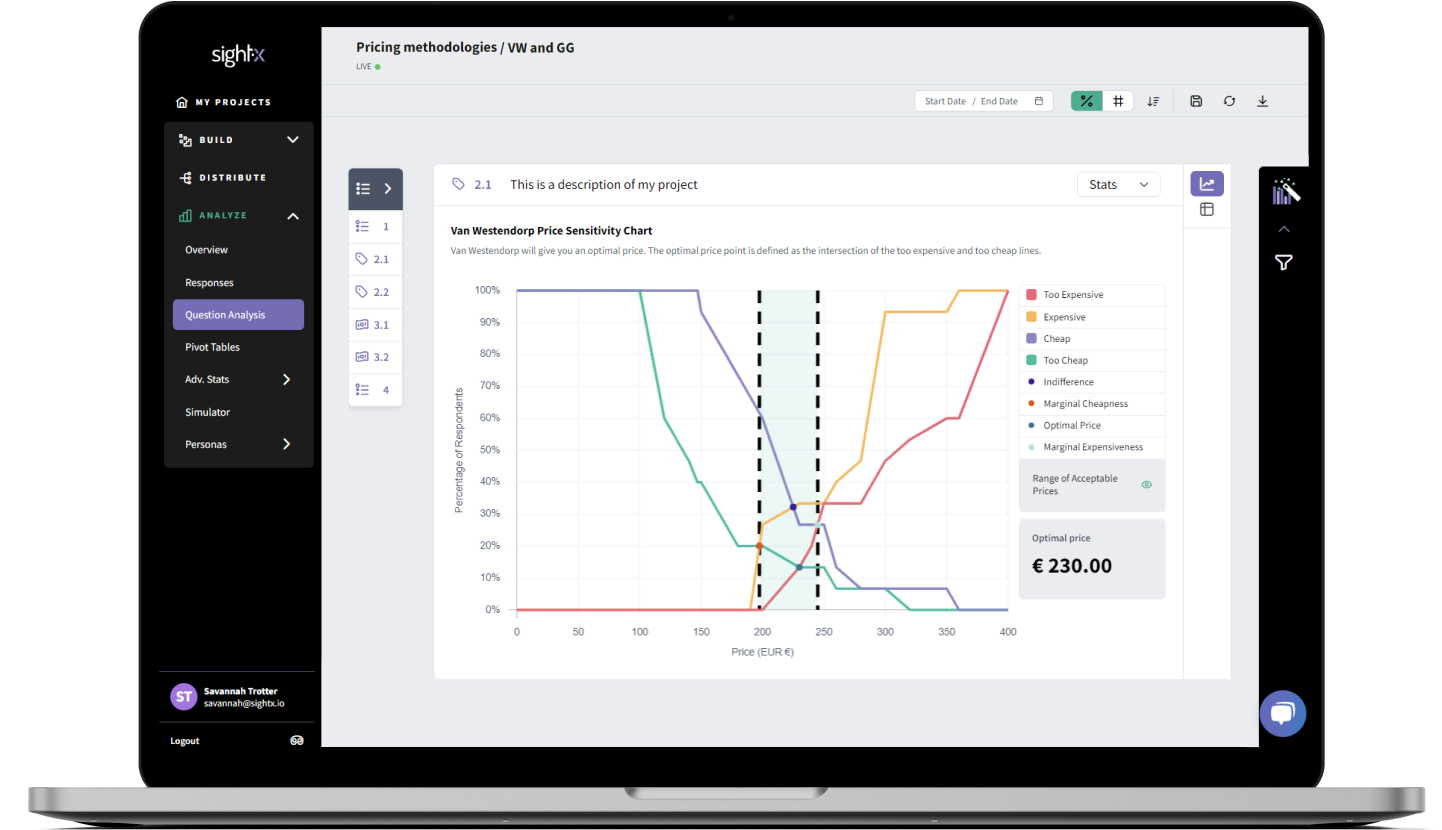

What price range would you consider fair for this product/service?

![]() Why it matters: Pricing can be a decisive factor in a product's success. Gaining insight into consumers' willingness to pay helps set competitive and acceptable price points that align with perceived value.

Why it matters: Pricing can be a decisive factor in a product's success. Gaining insight into consumers' willingness to pay helps set competitive and acceptable price points that align with perceived value.![]() Detailed insights: To gather more specific feedback, ask follow-up questions such as, "What factors influence your perception of fair pricing for this product?" and "How does the pricing compare to similar products you currently use?" This detailed input can help you develop a pricing strategy that maximizes market acceptance and profitability.

Detailed insights: To gather more specific feedback, ask follow-up questions such as, "What factors influence your perception of fair pricing for this product?" and "How does the pricing compare to similar products you currently use?" This detailed input can help you develop a pricing strategy that maximizes market acceptance and profitability.

Concept Testing with SightX

By asking the right questions, businesses can gain a deeper understanding of their target market, identify opportunities for improvement, and make informed decisions that increase the likelihood of success.

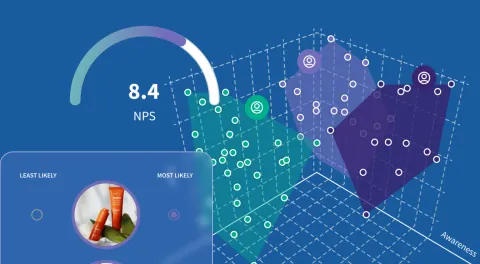

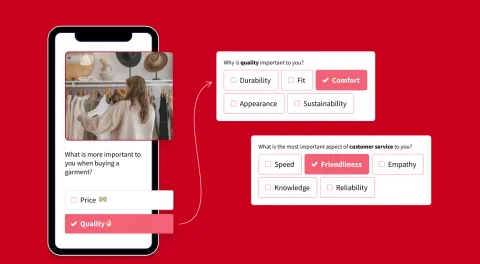

By infusing the power of generative AI with advanced concept testing survey tools, SightX makes collecting insights a breeze.

![]() Create fully customized concept tests with a prompt.

Create fully customized concept tests with a prompt.![]() Collect data from your target audience.

Collect data from your target audience.![]() Receive fully analyzed and summarized results in seconds, revealing key insights and personalized recommendations.

Receive fully analyzed and summarized results in seconds, revealing key insights and personalized recommendations.

Let us show you how simple it can be to collect powerful insights with concept testing.

.png)