One of the best ways to do this is through brand equity research.

Brand equity refers to the value that a brand adds to a product beyond its functional benefits. It encompasses various aspects of brand health, like awareness, perceived quality, loyalty, and preference.

Today, we'll examine brand equity, how it's measured, the methods used in brand equity research, and the essential questions to ask your market to gain deeper insights into your brand's equity.

What is Brand Equity?

Brand equity is the value added by brand recognition and a strong reputation. At its core, it's about how much people trust and like a brand, making them more likely to choose its products and even pay a premium.

Strong brand equity will positively affect sales, customer loyalty, and even the price people are willing to pay for products. So, when a brand has positive brand equity, it's seen as valuable and trustworthy in the eyes of consumers.

Aspects of Brand Equity

Awareness

Brand awareness refers to how consumers recognize and recall a brand. High brand awareness means people are likelier to choose your brand over competitors. It's the first step in building brand equity, as consumers must be aware of a brand to consider it in their purchasing decisions.

Perceived Quality

Perceived quality is the consumer's perception of a brand's overall quality and value compared to its competitors.

But don't get this confused with the objective quality of your products or services. Perceived quality refers to the public's opinion on the quality of your brand image and the reputation of your products.

It influences consumer trust and preference, impacting their willingness to pay a premium for the brand. High perceived quality often correlates with positive brand associations and greater customer loyalty.

Loyalty

Brand loyalty is the degree to which people consistently choose a particular brand over others. Loyal customers make repeat purchases and act as brand advocates, spreading positive word-of-mouth and influencing other potential customers. Building brand loyalty is essential for long-term profitability and sustainability.

Brand preference indicates how much consumers prefer a brand over competing brands. It reflects the consumer's choice when presented with alternatives. High brand preference usually results from positive experiences, perceived quality, and strong brand loyalty.

Preference

Brand preference indicates how much consumers prefer a brand over competing brands. It reflects the consumer's choice when presented with alternatives. High brand preference usually results from positive experiences, perceived quality, and strong brand loyalty.

Methods for Measuring Brand Equity

Brands use various methods for measuring equity, each offering unique insights into different aspects of the brand. Here are some commonly used methods:

Surveys

Surveys are a popular method for measuring brand equity. They can be used to collect quantitative data on brand awareness, perceived quality, loyalty, and preference. Surveys can be conducted online, via phone call, or in person, and they are an effective way to gather a large volume of data from a diverse audience.

Brand Trackers / Brand Health Tracking

Brand trackers are continuous research studies that monitor brand performance over time. They provide ongoing insights into brand health metrics such as awareness, loyalty, and preference. Brand trackers help in understanding long-term trends and the impact of marketing activities on brand equity.

Focus Groups

Focus groups involve a small group of consumers discussing their perceptions, experiences, and opinions about a brand. This qualitative method provides in-depth insights into consumer attitudes and behaviors. Focus groups are useful for exploring complex issues and gaining a deeper understanding of brand equity from the consumer's perspective.

Interviews

Interviews are one-on-one conversations with consumers that provide detailed insights into their perceptions and experiences with a brand. They can be structured, semi-structured, or unstructured and are effective for exploring specific aspects of brand equity in depth. Interviews allow for a more personalized understanding of consumer attitudes and behaviors.

Market Tracking

Market tracking involves monitoring market trends, competitor activities, and consumer behavior over time. It provides insights into how your brand is performing in the market relative to competitors and helps in identifying opportunities and threats. Market tracking data can be used to assess brand equity in the context of the broader market environment.

Brand Equity Questions to Ask Your Market

To understand your brand's equity, asking the right questions is essential. Here are some key questions to include in your brand equity research:

How familiar are you with [Brand Name]? This question assesses brand awareness and helps you understand the level of recognition your brand has in the market.

How would you rate the quality of [Brand Name] compared to other brands in the same category? This question measures perceived quality and provides insights into how your brand is viewed in terms of quality relative to competitors.

How likely are you to recommend [Brand Name] to a friend or colleague? This question evaluates brand loyalty and generates a Net Promoter Score (NPS), indicating the likelihood of customer advocacy.

Which brand do you prefer when purchasing [product category]? This question assesses brand preference and helps in understanding consumer choice within a specific product category.

What attributes do you associate with [Brand Name]? This question explores brand associations and provides insights into the key attributes that consumers link to your brand.

Have you purchased products from [Brand Name] in the past six months? This question measures recent purchase behavior and helps in assessing brand loyalty and usage.

What is your overall impression of [Brand Name]? This open-ended question allows consumers to express their overall feelings and impressions about your brand, providing qualitative insights into brand perception.

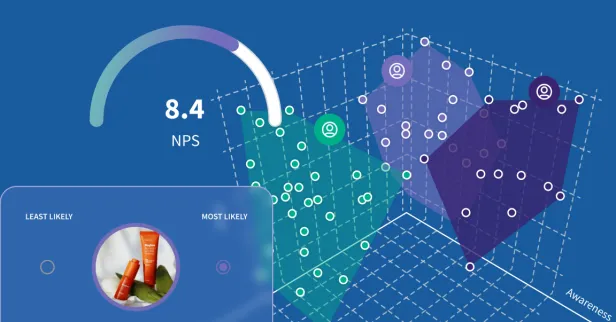

Measuring Brand Equity with SightX

We understand how important equity is to your brand. That's why we offer comprehensive tools that make conducting brand equity research faster, easier, and more accurate than ever before.

Here's how SightX can help you measure brand equity:

Brand Surveys & Trackers: Use generative AI to create custom studies that accurately measure various aspects of brand equity.

Competitive Intel: Benchmark your brand's performance against competitors to understand your relative position in the market and identify areas for improvement before they impact your bottom line.

Advanced Automated Analytics: Analyze survey data with advanced analytics to uncover trends, patterns, and correlations. Identify key drivers of brand equity and track changes over time.

Actionable Insights: Get actionable insights from detailed AI-generated reports and data visualizations. Use these insights to refine your brand strategy, improve market positioning, and drive business growth.

Let us show you how easy it can be to collect powerful brand insights.