Pricing is a critical aspect of any business strategy. The right price can drive sales, maximize profits, and enhance brand perception. However, the wrong price can lead to lost revenue and diminished market share.

Pricing analysis helps you determine the optimal pricing strategy by understanding consumer preferences, market conditions, and competitive dynamics. This blog will explore what a pricing analysis entails, the various methods used for it, and best practices for running an effective one.

What is a Pricing Analysis?

A pricing analysis evaluates and determines the most appropriate pricing strategy for a product or service. This involves assessing various factors such as customer willingness to pay, competitor pricing, market demand, cost structures, and overall market conditions. A pricing analysis aims to identify a price point that maximizes profitability while remaining attractive to customers.

Pricing analysis can be used to set initial prices for new products, adjust prices for existing products, or respond to market changes. It provides insights into how different pricing strategies might impact sales volume, revenue, and market positioning.

Pricing Analysis Methods

Several methods can be used to conduct a pricing analysis, each with its strengths and applications. Here are four commonly used methods:

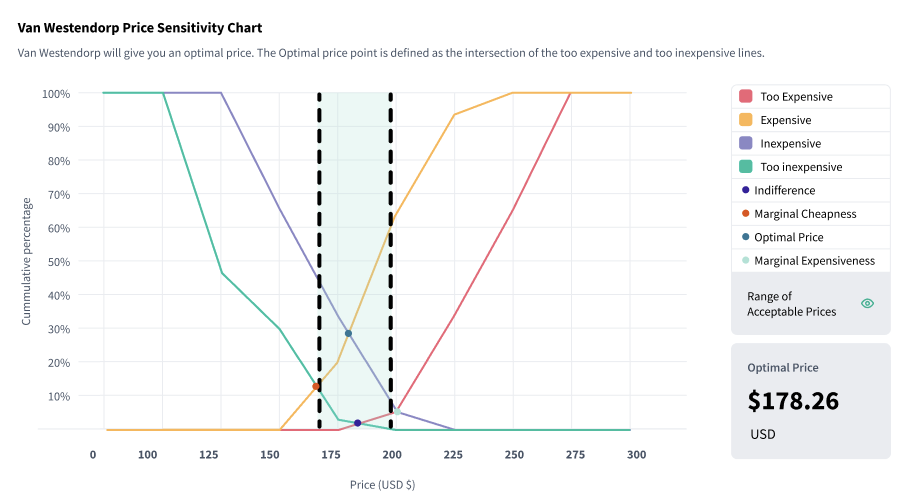

Price Sensitivity Testing (Van Westendorp)

The Van Westendorp Price Sensitivity Meter is a technique used to gauge customer perceptions of price points for a product or service. It involves asking consumers four key questions:

![]() At what price would you consider the product to be too expensive to consider?

At what price would you consider the product to be too expensive to consider?![]() At what price would you consider the product to be priced so low that you would question its quality?

At what price would you consider the product to be priced so low that you would question its quality?![]() At what price would you consider the product to be a good deal?

At what price would you consider the product to be a good deal?![]() At what price would you consider the product to be getting expensive but still worth it?

At what price would you consider the product to be getting expensive but still worth it?

By analyzing the responses, you can identify an acceptable price range that balances perceived value and affordability.

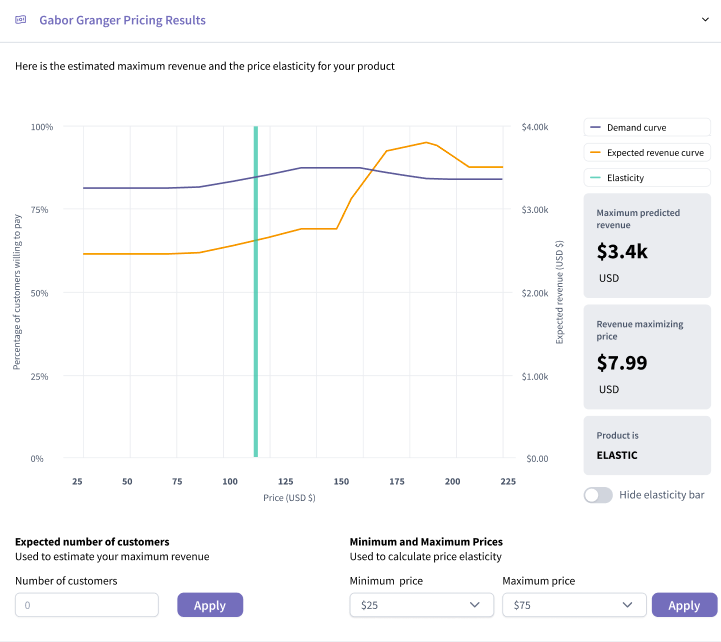

Price-Demand Analysis (Gabor-Granger)

The Gabor-Granger method involves presenting respondents with a series of price points for a product and asking how likely they are to purchase at each price. This helps you understand the relationship between price and demand, allowing businesses to estimate the potential sales volume and revenue at different price levels.

The key steps in a Gabor-Granger analysis include:

![]() Selecting a range of price points to test.

Selecting a range of price points to test.![]() Surveying a sample of the target audience.

Surveying a sample of the target audience.![]() Analyzing the responses to determine the price elasticity of demand and identifying the optimal price point that maximizes revenue.

Analyzing the responses to determine the price elasticity of demand and identifying the optimal price point that maximizes revenue.

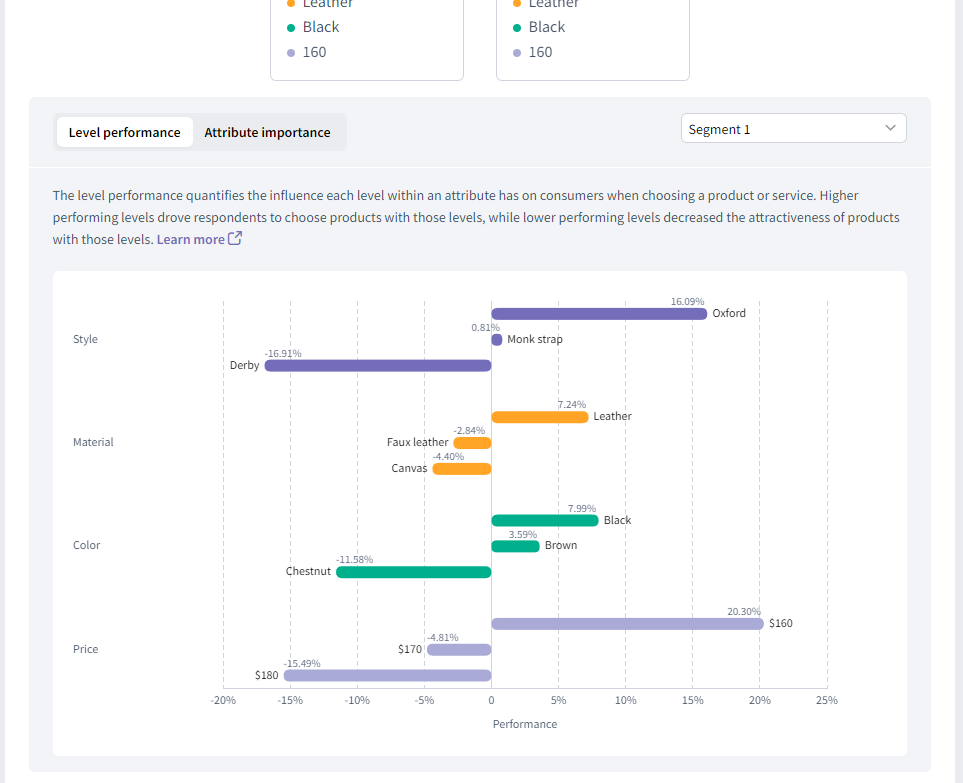

Conjoint Analysis

Conjoint analysis is a more complex method that assesses how customers value different attributes of a product, including price. It involves presenting respondents with a series of product configurations with varying attributes and prices and asking them to choose their preferred options. This helps in understanding the trade-offs that customers make and the relative importance of each attribute.

Conjoint analysis provides insights into:

![]() How different product attributes, including price, influence customer preferences.

How different product attributes, including price, influence customer preferences.![]() The perceived value of each attribute.

The perceived value of each attribute.![]() The optimal combination of attributes and price that maximizes customer satisfaction and willingness to pay.

The optimal combination of attributes and price that maximizes customer satisfaction and willingness to pay.

Price Rating (Concept Testing)

Price rating involves evaluating customer reactions to a proposed price within the context of a product concept. This method is often used in the early stages of product development to gauge potential customer acceptance and willingness to pay.

In a price rating survey, respondents are typically asked to rate how reasonable they find the proposed price for a given product concept on a scale (e.g., from "very expensive" to "very cheap").

This helps in understanding customer perceptions and identifying a price point that aligns with their expectations.

Six Best Practices for Running a Pricing Analysis

Define Clear Objectives

Before starting a pricing analysis, it's crucial to define clear objectives. What are you trying to achieve with the analysis? Are you setting an initial price for a new product, adjusting prices for existing products, or exploring different pricing strategies? Clearly defined objectives will guide the selection of the appropriate methodology and ensure that the analysis aligns with your business goals.

Select the Right Audience

The success of a pricing analysis depends on obtaining accurate and relevant data from the right audience. Identify your target market and ensure that your survey sample represents this audience accurately. Consider factors like demographics, purchasing behavior, and geographic location to ensure the insights gathered apply to your target customers.

Choose the Right Tool

Selecting the right tool for your pricing analysis is essential. The different methods covered above are suited to different objectives and can even be complementary. This means you'll need to find a platform that has a robust set of pricing analysis tools.

Analyze Differences Between Market Segments

Market segments can vary significantly in their price sensitivity, preferences, and willingness to pay. Analyzing these differences is crucial for developing a pricing strategy that caters to different customer groups. Segment your data based on relevant criteria such as age, income, purchase frequency, and geographic location, and analyze how each segment responds to different price points.

Account for External Factors

External factors such as market trends, economic conditions, and competitor pricing can significantly impact your pricing strategy. Ensure that your analysis accounts for these factors to provide a more comprehensive view of the pricing landscape. Stay updated on industry trends, monitor competitor pricing, and consider macroeconomic conditions that might influence consumer behavior.

Iterate and Refine

Pricing analysis is not a one-time activity; it requires continuous iteration and refinement. Regularly review and update your pricing strategy based on new data, market changes, and customer feedback. Conduct follow-up surveys to track the effectiveness of your pricing decisions and make adjustments as needed to stay competitive and meet customer expectations.

Conducting Your Own Price Analysis with SightX

SightX's AI-powered tools make pricing analysis easier, faster, and more accurate than ever before.

By infusing the power of generative AI with advanced price analysis tools, you can:

![]() Create fully customized price analysis studies and experiments with a prompt, like: "I need to find the ideal price point for my product. Create a Gabor-granger study."

Create fully customized price analysis studies and experiments with a prompt, like: "I need to find the ideal price point for my product. Create a Gabor-granger study." ![]() Collect data from your target audience.

Collect data from your target audience.![]() Receive fully analyzed and summarized results in seconds, revealing key brand insights and personalized recommendations.

Receive fully analyzed and summarized results in seconds, revealing key brand insights and personalized recommendations.![]() Whether it's understanding the price sensitivity in your market, exploring demand fluctuations, or finding the ideal price point, SightX offers a comprehensive suite of pricing research features designed to streamline the process and deliver results fast.

Whether it's understanding the price sensitivity in your market, exploring demand fluctuations, or finding the ideal price point, SightX offers a comprehensive suite of pricing research features designed to streamline the process and deliver results fast.

Let us show you how simple it can be to collect powerful pricing insights.