Exploratory Market Research 101: Methods, Tools, and Tips for Success

Unlike many other forms of market research, exploratory research is not simply about finding answers to specific questions. Instead, it's about uncovering problems and opportunities that might not be immediately apparent and noting them so you can dig into them in future studies.

This type of research is particularly valuable in the early stages of decision-making, helping you clarify goals and lay the groundwork for more detailed studies.

Today, we'll cover the essentials of exploratory market research, when and how to use it, discuss various methods, and weigh its pros and cons.

What is Exploratory Research, and How is it Used?

Exploratory research is a type of investigation conducted to gain a deeper understanding of a problem or situation that is not well defined.

Unlike conclusive research, which seeks to provide definitive answers, exploratory research is more about exploring the nuances and dimensions of an issue. It focuses on gathering insights and generating hypotheses rather than testing them.

Businesses use exploratory research in a variety of ways:

![]() Exploring the needs and preferences of their target audience to develop products that better meet market demands.

Exploring the needs and preferences of their target audience to develop products that better meet market demands.![]() Staying ahead of the curve by identifying emerging trends and sudden shifts in consumer behavior before they impact sales numbers.

Staying ahead of the curve by identifying emerging trends and sudden shifts in consumer behavior before they impact sales numbers. ![]() Developing more nuanced marketing messaging that speaks directly to the pain points of their target audience.

Developing more nuanced marketing messaging that speaks directly to the pain points of their target audience.

Overall, exploratory research is a vital step in the research process, setting the stage for more focused and conclusive studies that can drive strategic decision-making.

When to Use Exploratory Market Research

When You Need to Better Understand a Problem in Your Market

Exploratory research is particularly useful when you're facing a complex problem or challenge in your market that is not well understood.

For instance, if your sales have unexpectedly declined, exploratory research can help you uncover potential causes by examining factors such as changes in consumer preferences, actions taken by your competitors, or broader economic conditions. By gaining a clearer picture of the problem, you can develop more effective strategies to address it.

In such scenarios, exploratory research might involve:

![]() Conducting focus groups to gather diverse perspectives.

Conducting focus groups to gather diverse perspectives.![]() Interviewing industry experts for their insights.

Interviewing industry experts for their insights.![]() Analyzing secondary data to identify patterns and trends.

Analyzing secondary data to identify patterns and trends.

The goal is to piece together a comprehensive understanding of the issue, which can then inform subsequent research and strategic actions.

When You're Bringing a Groundbreaking/Innovative Product to Market

Launching a groundbreaking or innovative product can be particularly challenging, as it often involves venturing into uncharted territory. Exploratory research helps you navigate these challenges by providing insights into how potential customers might perceive your new offering.

Exploratory research can be vital for products that represent a significant departure from existing solutions, as they may require a shift in consumer behavior or attitudes. For example, if you're introducing a new technology that promises to revolutionize an industry, exploratory research can help you understand potential barriers to adoption, such as lack of awareness, skepticism about the benefits, or perceived complexity.

By addressing issues early on, you can refine your product and marketing strategies to meet customer needs and expectations better.

To Formulate a Formal Hypothesis

Before conducting conclusive research, it's necessary to formulate a clear and testable hypothesis. Exploratory research provides the preliminary data and insights needed to develop such a hypothesis.

For instance, if you are considering a new market segment for your product, exploratory research can help you identify key characteristics of this segment, such as demographic attributes, buying behavior, and preferences.

This preliminary understanding allows you to craft a focused hypothesis, such as "Customers in the new market segment prefer eco-friendly products over conventional alternatives." This hypothesis can then be tested through more rigorous and structured research methods, such as surveys or experiments, providing you with actionable data to guide your strategic decisions.

Ways to Conduct Exploratory Market Research

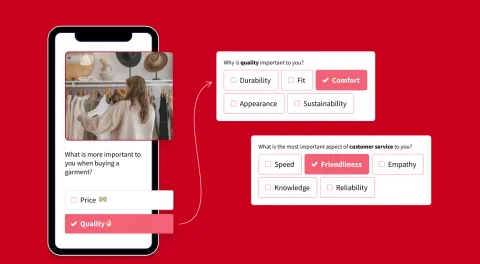

Surveys

Surveys are a versatile tool for exploratory research, allowing you to gather a broad range of information from a large number of respondents. You can use them to explore various aspects of your market, including customer preferences, behaviors, and attitudes. Surveys can be conducted online, via phone, or in person, and they can range from open-ended questions that elicit detailed responses to structured questionnaires that provide quantitative data.

Example: A company considering the launch of a new health drink might use surveys to explore consumer attitudes toward health and wellness, identify preferred flavors, and gauge interest in different product attributes, such as organic ingredients or low sugar content.

Studies/Experiments

Conducting studies or experiments can provide valuable insights into specific aspects of your market. These can range from controlled experiments to test reactions to new products to observational studies exploring real-world customer behavior. While more structured than other methods, studies and experiments can yield rich qualitative data.

Example: A retailer might conduct an experiment to compare the effectiveness of different packaging designs by observing customer reactions in a simulated shopping environment. This can help identify which design is most likely to attract attention and encourage purchases.

Focus Groups

Focus groups involve bringing together a small group to discuss a particular topic. This method allows for in-depth exploration of customer opinions, attitudes, and experiences. Focus groups can provide nuanced insights and generate new ideas through group interaction and discussion.

Example: A software company might organize focus groups to gather feedback on a new user interface design. Participants can discuss their experiences using the interface, highlighting any usability issues and suggesting improvements.

Interviews

Interviews are a direct way to gather detailed information from individuals. They can be conducted in person, over the phone, or online. Interviews allow for deep exploration of specific topics, providing rich, qualitative data to help you understand your market more deeply.

Example: A fashion brand considering a new line of sustainable clothing might conduct interviews with environmentally conscious consumers to understand their motivations, preferences, and willingness to pay a premium for sustainable products.

Observational Studies

Observational studies involve watching and recording how people behave in natural settings. This method provides insights into actual customer behavior as opposed to reported behavior. Observational studies can be particularly useful for understanding how customers interact with products or services in real-world environments.

Example: A coffee shop might conduct an observational study to see how customers navigate the store, what items they look at first, and how long they spend in different areas. This information can help optimize store layout and product placement.

Pros and Cons of Exploratory Research

Pros

- Low Cost: Exploratory research is generally less expensive than other types of research, making it accessible for businesses of all sizes. Methods such as surveys, focus groups, and interviews can be conducted with minimal investment, especially when leveraging online tools and platforms.

- Foundational: It provides a solid foundation for further research, helping to clarify and define the problem at hand. This foundational understanding is crucial for developing more focused and effective research strategies.

- Early Understanding: This type of research helps you gain an early understanding of your market, which can inform strategic decisions. By identifying potential issues and opportunities early on, you can adapt your strategies to better meet market needs.

- Flexibility: Exploratory research is flexible and adaptable, allowing you to explore various aspects of a problem as they arise. This flexibility is particularly valuable in dynamic markets where new trends and challenges can emerge quickly.

Cons

- Time-Consuming: Conducting thorough exploratory research can be time-consuming, particularly if it involves multiple methods. Gathering and analyzing qualitative data can require significant effort and resources.

- Qualitative Data: This type of research often yields qualitative data, which can be more difficult to analyze and interpret than quantitative data. While qualitative insights are valuable, they may not provide the concrete answers needed for certain strategic decisions.

- Smaller Samples: Exploratory research typically involves smaller sample sizes, which can limit the generalizability of the findings. While the insights gained can be rich and detailed, they may not be representative of the broader market.

- Less Concrete Insights: The insights gained from exploratory research are often less concrete and more open to interpretation, making it challenging to draw definitive conclusions. This can necessitate further research to validate findings and develop actionable strategies.

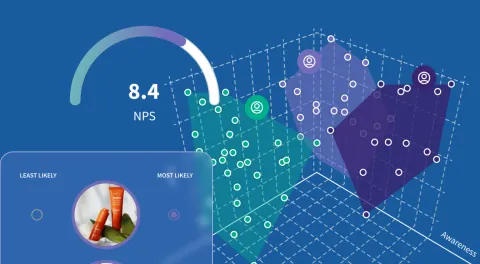

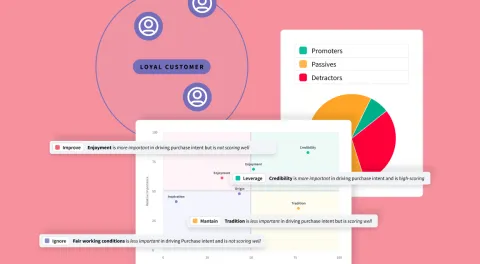

Conducting Exploratory Research with SightX

By infusing the power of generative AI with advanced market research studies and survey tools, SightX makes collecting insights a breeze.

![]() Create a fully customized survey, study, or experiment with a prompt.

Create a fully customized survey, study, or experiment with a prompt. ![]() Collect data from your target audience.

Collect data from your target audience. ![]() Receive fully analyzed and summarized results in seconds, revealing key insights and personalized recommendations.

Receive fully analyzed and summarized results in seconds, revealing key insights and personalized recommendations.

Let us show you how simple it can be to collect powerful insights with exploratory research.