No matter your industry or field, setting clear, data-driven benchmarks is crucial for evaluating performance and setting goals for growth. Market research is a key benchmarking tool that enables companies to measure their progress against industry standards and competitors.

Today, we'll cover the essentials of benchmarking, explore why companies engage in this practice, and provide practical tips for setting effective benchmarks with market research.

What is Benchmarking in Market Research?

Benchmarking in market research involves comparing a company's performance, processes, and products against those of leading competitors or industry standards. This process helps identify areas for improvement, set performance targets, and track progress over time.

Leveraging market research helps businesses establish realistic and data-driven benchmarks that drive sustainable growth.

Why Do Companies Conduct Benchmarking Research?

Companies conduct benchmarking research for several reasons:

_Size=sm)_Color=Success.png) Identify Strategies That Work

Identify Strategies That Work

By studying top performers in the industry, companies can identify best practices and strategies that contribute to success.

Set Realistic Goals

Benchmarking provides a clear framework for setting measurable and achievable performance goals based on industry standards.

Gain a Competitive Advantage

Understanding where competitors excel helps companies identify opportunities to differentiate and gain a competitive edge.

Improve Efficiency

Benchmarking highlights areas where processes can be streamlined and efficiencies can be improved.

Measure Progress

Regular benchmarking enables companies to track their progress over time and make data-driven adjustments to their strategies.

Examples of Benchmarking Research

Concept Testing Benchmarks

Concept testing involves evaluating new product or service ideas to gauge their potential success in the market. Establishing concept benchmarks can help brands determine which concepts will resonate with consumers and achieve market success.

Competitive Analysis Benchmarking

Competitive analysis benchmarking involves comparing a company's performance metrics against those of key competitors. This can include financial performance, market share, product features, and customer satisfaction levels. Such benchmarks help companies understand their market position and identify areas for improvement.

Brand Benchmarking

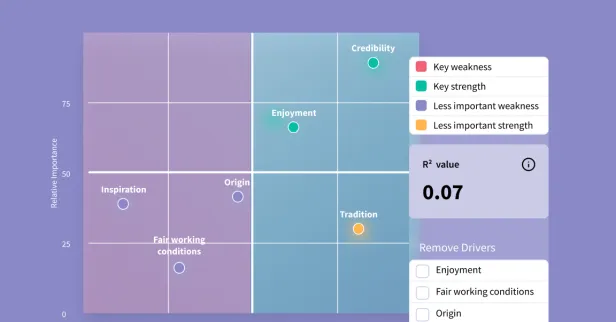

Brand benchmarking focuses on evaluating brand performance metrics, like brand awareness, perception, loyalty, and market positioning. By comparing these metrics against industry standards, companies can assess the strength of their brand and develop strategies to enhance brand equity.

Customer Satisfaction Benchmarking

Customer satisfaction benchmarking measures how satisfied customers are with a company's products or services compared to competitors. Metrics likeNet Promoter Score (NPS), customer retention rates, and satisfaction ratings are commonly used. These benchmarks help companies identify strengths and weaknesses in their customer experience.

Tips for Using Market Research Data to Set Benchmarks

1. Collect Enough Data

Make sure that you collect a sufficient amount of data to make your benchmarks reliable and representative. A large enough sample size is crucial for obtaining accurate and meaningful insights. This helps avoid skewed results and ensures that the benchmarks apply to a broader audience.

2. Target the Right Audience

When setting benchmarks, it's gathering data from the right audience is essential. This means focusing on your target market or customer segments that are most relevant to your business. Accurate targeting ensures that the benchmarks reflect the preferences and behaviors of your key consumers.

3. Gather Important Metrics from All Departments/Stakeholders Involved

Benchmarking should be a comprehensive process that involves input from all relevant departments and stakeholders. This includes marketing, sales, customer service, product development, and finance. Gathering a wide range of metrics ensures that the benchmarks are holistic and encompass all critical aspects of the business.

Conducting Benchmarking Research with SightX

With SightX, you can harness the power of GPT to conduct your own benchmarking market research and get accurate insights faster than ever before.

Our robust market research tools, paired with the speed and accuracy of AI, mean you can run faster studies that provide more relevant insights.

Curious? Learn more about the industry's first AI market research consultant.