And Their Implications for Consumer Insights Leaders

Four weeks into the COVID-19 pandemic and much has already been said about consumer behavior. However, not much has been reported about the psychology of people- their fears, hopes, stress management skills, and maybe, most importantly, the way they view the road ahead.

So, what’s to come after this is all over? What ‘normal’ will consumers go back to?

The following study was done across many industries, exploring the state of mind of those of us, sorry, all of us staying at home. It explores how this situation impacts our discoveries, health, coping, education, and consumption patterns. Responses were captured from 1,000 U.S. based consumers, representative of the general population.

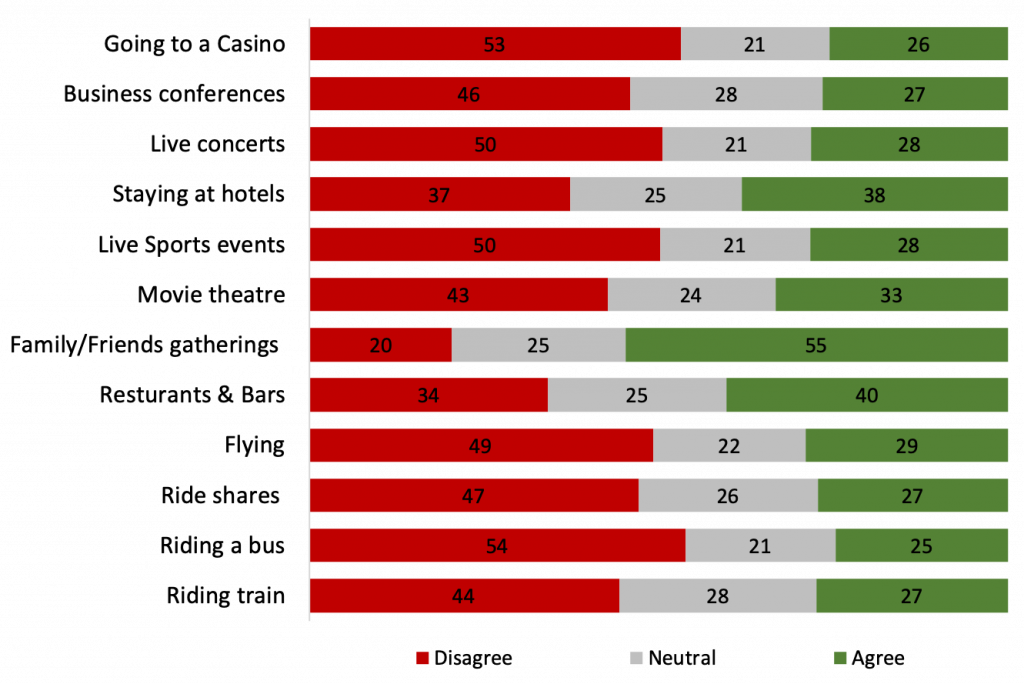

1. General Consumer Comfort Levels for Social Activities

When it comes to the concern of contracting Coronavirus, 66% of respondents reported being either concerned or really concerned. When asked about their mental health, consumers rated their stress and anxiety levels an average of 5.9 out of 10.

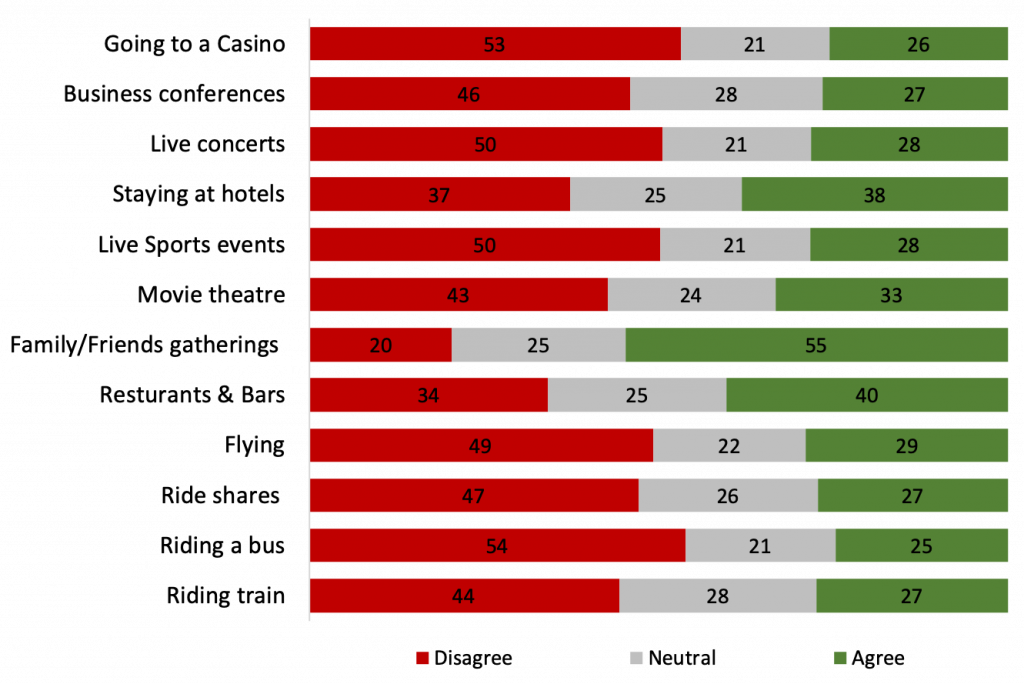

We then asked for their feedback in the following scenario: "when the CDC, Health Officials, and the Government announce that it is SAFE to stop social distancing and resume to our (new) normal lives, assuming your income is intact, we would like to ask you about the comfort you would feel with the following activities..."

Respondents were asked on a 5-point scale from Disagree to Agree to what extent they would be comfortable engaging in various activities.

I would feel comfortable going to/riding/flying, etc.

Gatherings of family and friends followed by going to restaurants and bars were the two activities that respondents reported they would feel most comfortable to resume once health officials announce it’s safe to do so.

As expected, activities that include large(er) crowds- like going to casinos, live concerts, or attending sporting events- were at the bottom of the comfortability list for the general U.S. population. While the level of discomfort remains consistently high across all age categories, younger respondents, ages 18 to 38 (Gen Z and Millennials), tended to report anywhere between 3% to 10% higher comfort levels.

Consumer Insight Implications: Target younger segments and small group events.

If your business involves a group setting, explore offerings you can provide to younger audiences, to the extent your business model allows it. Similarly, see what you can offer for small group events and gatherings.

2. Brand Advertising and Outreach

When we asked consumers if they think it is appropriate for brands to be advertising their products and services during this time, 61% thought it was appropriate, 32% felt ambivalent, and only 7% thought it was inappropriate. However, this is likely to evolve the longer the lockdown is in place.

Diving in deeper:

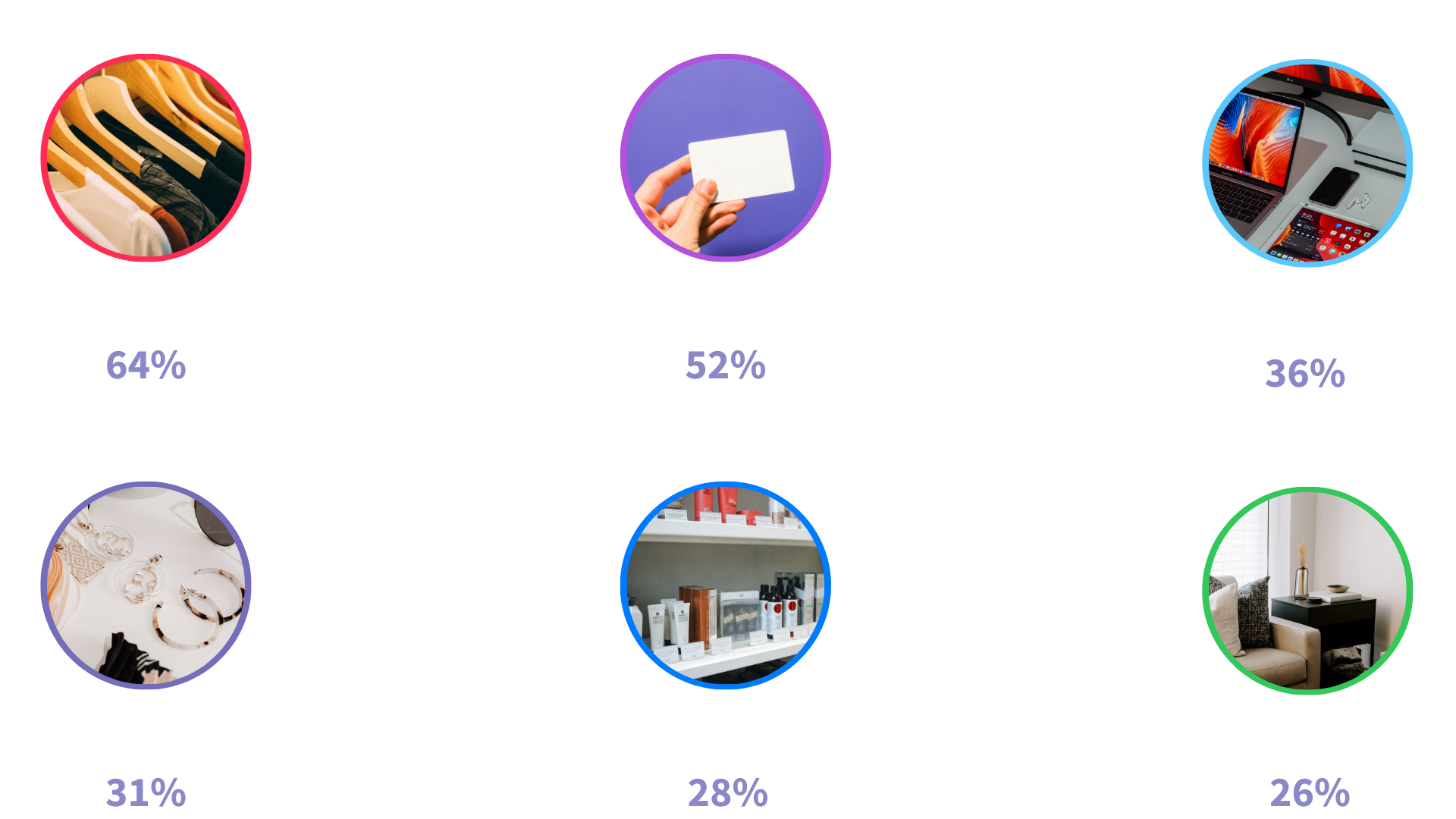

- 53% of consumers were interested in hearing about new product offerings

- 63% were interested to hear about any changes in pricing

- 55% were interested to learn more about new delivery options or offerings.

Consistent with these findings, when asked “What do you think are some of the best things brands can do for their customers at this time?” approximately 35% of respondents wrote about a brand’s capability and willingness to offer products and services that fit within the price they can afford (e.g. lower prices, discounts, new offers, etc.), followed by 10% voicing the need for brands to have or develop delivery options.

Many of the remaining open-ended answers included themes around making sure that brands have their products available, take care of their employees, offer coupons or discounts, and provide good customer service.

Consumer Insight Implications: Follow-up with choice-based studies

Getting the optimal pricing and product offering has always been critical, but now more than ever. As consumers have become more sensitive, it is now crucial for consumer insights teams to identify price sensitivity across various population segments and identify optimal offerings and attributions.

There are two ways brands can address this:

Conduct price sensitivity segmentation studies to include survey and/or CRM data.

OR

Conduct studies utilizing conjoint and max-diff experiments (ideally with an automated solution)

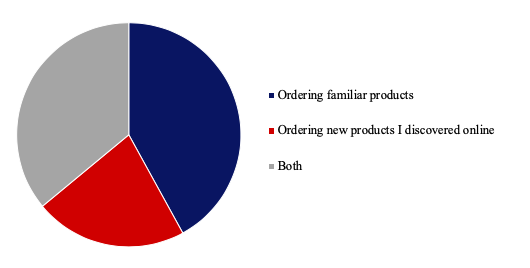

3. Alcoholic Beverage Shopping: A Time for Discovery

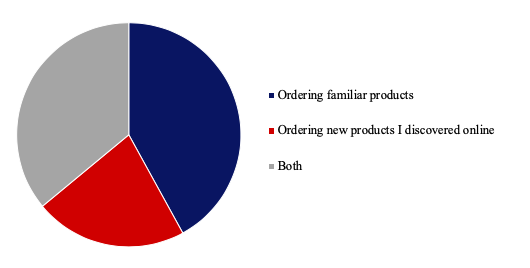

32% of respondents reported consuming more alcohol. Moreover, 29% reported shopping online for alcoholic beverages. Those on-line shoppers shared that they were shopping for both familiar and new products. Because, if you’re drinking more, wine not try something different?!

Consumer Insight Implications: What behaviors and products will stick?

On-line beverage shopping presents an opportunity for discovery, which is good news for the beverage industry. Perhaps it’s a coping mechanism, or maybe it’s the lack of access to bars and restaurants, coupled with newfound free time, that's facilitating some behavioral change.

As always, follow-up studies are key to digging into the why behind the changes we see. One insight only presents opportunities for more discovery and understanding of your segments.

4. Food: Potential New At Home Behaviors

Across all food categories (canned, perishable, frozen, shelf-stable, and bottled drinks) the results were more straightforward. In all categories, over 50% of consumers are still getting their products by physically going to a store.

The following three options for food purchasing were almost a tie across all categories: curbside pick-up from the store (13.8%), delivery through the store’s website(13.7%), and order from a website/app and shipped to your home (e.g. Amazon) (9%). 59% of consumers are still buying the same food items they were buying pre-COVID-19, but 25% of people were buying new items.

Consumer Insight Implications: What behaviors and products will stick?

Similar to the alcohol category, websites and apps are an increasingly viable option for grocery shopping. How many of these users are new to these apps? Will this behavior stick when they are more comfortable going out in public?

Finding out what items are being purchased, that weren’t before, could give some insights into how consumers are behaving at home and perhaps what new product ideas can meet those needs.

5. Health & Wellness

66% of respondents remain concerned about contracting the coronavirus in the upcoming three months. 50% report they are not likely to see their doctor in the next 4 weeks for routine check-ups for ongoing conditions or regular visits.

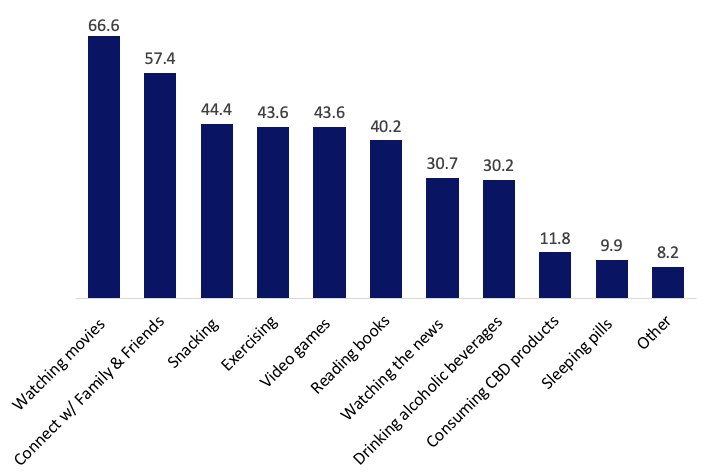

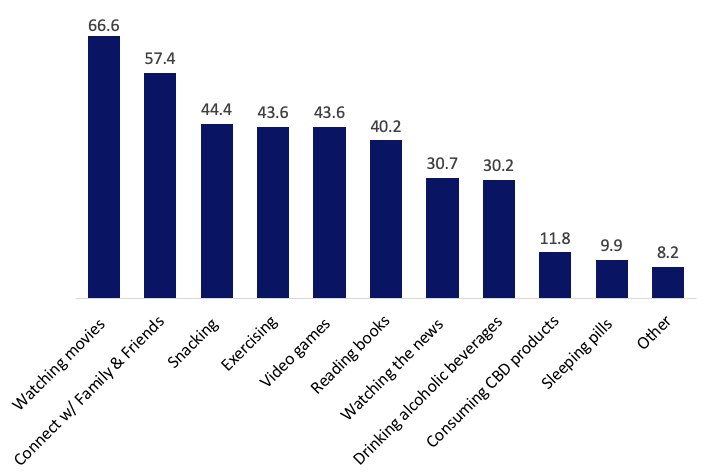

When we asked respondents to select all the activities that are helping them manage stress, watching movies was the most common activity (67%), followed by staying connected to family and friends (57%), and snacking (44%).

Lastly, 53% of respondents reported being comfortable with Telehealth/Telemedicine, suggesting that this trend will only continue to grow in popularity.

This is another data point that begs the question: what behaviors that were ‘corona-induced’ will take hold and maintain once the economy is back-up and running?

Consumer Insight Implications: Connection while being entertained is paramount.

While the media and entertainment industry is currently struggling in this environment, content is still king. Consumers still want to engage but have alternative ways of doing so. A follow-up to explore the various categories of entertainment content, across various audience segments would be worthwhile.

Unsurprisingly, snacking is a major method of stress management, yet many are still trying to stay healthy by exercising. Good luck folks! And please share your tips if you manage to balance the two! But, the fact that two of the highest reported activities are "snacking" and "staying healthy" suggests that many people may be seeking healthy options for snacking that can help them both manage stress and stay healthy.

Telemedicine also seems here to stay, and it will become important to understand all the human drivers, motivations, and challenges when it comes to adopting it at scale.

6. It is Time for Education

During troubling economic times, those who can afford it, tend to explore expanding their education and professional development to strengthen their resumes.

In the interest of better understanding the state of consumers’ career development, we asked “are you interested in pursuing further education/professional learning in the next 12 months?”

Slightly over 39% expressed a form of interest in either online or on-site learning. And 44% reported having a strong interest to start further education as a direct result of the current pandemic.

Consumer Insight Implications: The trend of online education will continue to accelerate. But the question remains: How fast and in what areas?

While there will be greater opportunities to develop relevant educational content, it will be important to segment and find your optimal users. The online experience will need to be one that meets the consumer where they are and with whatever topics they deem interesting.

7. Environment & Electric Vehicles

Prior to COVID-19, significant conversations were already happening in all industries around sustainability, the environment, and how to change the behavior of everyday consumers to become more environmentally friendly.

One of the leading categories remains to be electric vehicles. Unfortunately, 77% of respondents reported not being willing to buy an all-electric car if they needed to purchase one. The three biggest reasons preventing them from buying a car were:

1) Too expensive (52%)

2) No place to charge in my area (39%)

3) The car’s range on a single charge (33%)

However, the fourth reason people didn’t own an electric vehicle was that they didn’t have enough knowledge to feel comfortable purchasing one (32%).

Consumer Insight Implications: Educate the masses.

Changing consumer perceptions on electric cars still has a long road ahead. Pricing remains the number one challenge, whether it’s valid or not. But as the responses show, the onus now may be on the electric vehicle manufacturers to increase their educational outreach.

Only time will tell how we all, as consumers, will respond once we find ourselves back out in the economy- in whatever form that may take. The only thing we are certain of now is that we are uncertain.

So, we research. We engage people, ask questions, and do our best to understand with the hope we can offer educated guesses as to what the future holds.

In the meantime, stay safe, healthy, and reach out if we can help you navigate and understand this current environment and prepare for what's to come.