What does “Brand America” stand for in 2025? In an era where values, politics, and price all compete for consumer attention, perception, not just product, is everything.

At this year’s Quirks NY, SightX Co-CEO and Co-Founder Dr. Naira Musallam unpacked the results of a sweeping global study that asked: How do consumers around the world perceive American brands? And perhaps more importantly: What drives them to trust, engage, purchase, or opt out entirely?

The study spanned the top 10 global purchasing markets ( Australia, Brazil, Canada, China, Germany, India, Japan, Mexico, UK, South Korea), and used Key Driver Analysis (KDA) and audience segmentation to examine the traits that influence consumer trust and purchase intent. The results weren’t just surprising, they were often counterintuitive.

Four Global Segments, And Some Unexpected Leaders

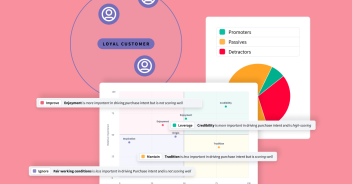

SightX identified four distinct consumer segments across countries:

- Brand Evangelists: highly loyal and trusting, even if price-sensitive

- Practical Fans: neutral to positive sentiment

- Balanced Appreciators: moderately high trust and positive sentiment

- Brand Skeptics: low trust, low loyalty, and less likely to buy

Countries like India, Brazil, and Mexico showed higher proportions of Brand Evangelists. Meanwhile, Canada, the UK, Germany, Australia, and Japan had notably high concentrations of Brand Skeptics. Perhaps most surprising? Canada, our closest neighbor, ranked among the most disillusioned markets.

Quality Wins. Price? Not So Much.

Across all countries and segments, quality stood out as the most powerful predictor of trust and purchase intent. Convenience came in second, followed by innovation and consistency.

But here's the twist: Price sensitivity didn’t correlate with lower purchasing. In fact, even price-sensitive consumers, like Brand Evangelists, were more likely to buy American products than those who were less price-aware. This flips a long-standing assumption in global marketing.

What Doesn't Drive Purchase (Even if We Think It Does)

Despite the hype around purpose-led branding, traits like "alignment with my personal values" and "recommendations from others" had little influence on trust or purchase behavior in the study. While consumers may rate values highly in isolation, KDA showed that values were not statistically predictive of actual buying decisions, at least not on a global scale.

One key nuance: For Brand Evangelists, emotional connection (“makes me feel good”) did drive purchase, and more so than even convenience.

It's Time to Rethink Global Strategy

This study offered a clear takeaway: there’s no single global perception of American brands. Instead, there are regional clusters of attitudes, each requiring distinct strategies. For example:

- In India, American brands are seen as fair and trustworthy.

- In Japan and Canada, skepticism is high, driven more by perception than product performance.

- In China and South Korea, category preferences (like tech vs. food) shift the equation even further.

Why This Matters

Whether you're a global marketer, brand strategist, or insights leader, the implications are clear:

- Quality and convenience must be prioritized across the board.

- One-size-fits-all messaging won’t work. Regional nuance matters more than ever.

- And while values might make for good headlines, they don’t necessarily translate to sales.

Want to dig deeper into the data?

Download the full report here.

You’ll get country-by-country breakdowns, KDA quadrant maps, and segmentation insights, all sourced from the SightX platform. Come learn how to run your own Key Driver Analysis to uncover what truly drives your customers!