CASE STUDY

How Amplify Uses SightX to Win Big with Salty Snackers

The SightX Impact

Set Up Monthly Tracking for Shopper Perception and Behavior

Used Early Data Signals to Adjust Strategy and Avoid Risk

Uncovered Key Differences in Shopper Segments

Overview

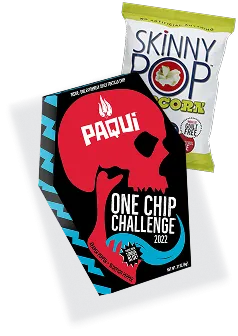

Amplify Snacks is redefining what better-for-you snacking looks like. With brands like Skinny Pop, Pirate’s Booty, and Paqui chips, they’ve built a portfolio of tasty, clean-label snacks made with simple, whole ingredients—proving that health and flavor don’t have to be a trade-off.

But as the snacking landscape grows more crowded, understanding shopper behavior has never been more critical. To go beyond surface-level data and get to the “why” behind purchase decisions, Amplify’s Insights team partnered with SightX. Through monthly tracking studies, they’ve stayed ahead of shifting preferences and gotten closer to their customers than ever before.

Download full case study

Download full case study

Too Many Choices, Not Enough Insight

Amplify’s Quest to Understand the Salty Snack Shopper

Amplify’s Category Management & Shopper Insights team found themselves at a roadblock. While they had been using typical syndicated data to inform them of “what” was happening in their market, they didn’t have much insight into the “whys” behind the shifts and fluctuations.

The team needed a way to better understand not only their customers, but more broadly, the “salty snack” shopper and how they made their buying decisions.

But there was a catch. According to their Director of Category Management, shopping for salty snacks can often be one of the most confusing in-store experiences.

If buyers can’t find what they’re looking for, it’s likely that they will just give up. Which makes understanding their needs, preferences, and decision making process crucial for the brand’s success. Even more so in today’s world where consumers have so many options, but never enough time.

Staying in Sync with SightX

How Amplify Keeps a Constant Pulse on Shoppers

In order to bring themselves closer to their ideal customers, the Amplify insights team set up a monthly tracker to find out where people shop, how they plan for their store trips, and whether they have brand preferences in mind when making their list.

With SightX’s campaign feature, the team only had to build their survey once, keeping all waves of the tracker within one project. Being able to analyze wave vs. wave or review all of the data in aggregate made it possible to understand behaviors and changes over time using trend analysis to see the ‘puts and takes’.

All of this gave them a competitive advantage by keeping a constant pulse on their target market.

Snacking Smarter

How Amplify Turns Shopper Data Into Retail Action

Since launching monthly trackers on the SightX platform, Amplify better understands its customers than ever before. They discovered that most brand decisions happen in-aisle, highlighting the importance of shelving, display, and packaging.

With automated analytics, they quickly identified key differences between grocery, convenience, and club shoppers—enabling tailored strategies for each. Amplify also shares insights with retail partners to guide innovation, assortment, and aisle flow.

Running consistent studies allows the team to track shifts in behavior tied to economic pressures. Now, they can spot early warning signs in survey data—well before they show up in traditional sales metrics.

“At the time, we didn’t really understand the shopper decision tree for buying salty snacks. That was ultimately what led us to SightX.”

— Kristi, Director of Category Management and Shopper Insights, Amplify

Unlock smarter research and faster innovation

Discover how SightX empowers brands to cut costs, boost agility, and make confident decisions with high-quality insights.