It’s that eerie time of year when spooky tales come to life, and lurking in the shadows are the nightmares of every researcher: unreliable data, misleading insights, and the frightful mistakes that haunt even the most seasoned professionals. Like any good horror story, consumer research has its own share of terrifying pitfalls. A single misstep can turn well-intentioned studies into monstrous misadventures, leading brands down the wrong path with skewed insights and wasted resources.

In this Halloween edition, we’ll uncover the most spine-chilling errors that can plague consumer research efforts—errors that, if left unchecked, can send chills down your spine and leave your brand vulnerable to serious missteps. But fear not! We’ll also reveal strategies to expel these research demons, ensuring your insights remain sharp, relevant, and actionable. So, grab your flashlight as we descend into the dark underbelly of consumer research and learn how to emerge unscathed.

The Top Errors in Consumer Research

1. Poor Sampling Techniques

Sampling may seem straightforward, but getting it wrong can derail the entire research effort. Poor sampling techniques can mean targeting an irrelevant or unrepresentative group, leading to data that doesn't reflect the real attitudes of the intended audience. This happens often when researchers choose a convenience sample—relying on people who are easiest to reach rather than those who represent the population they're trying to study. A misaligned sample results in insights that don’t translate into effective marketing, product development, or brand strategy.

2. Asking Biased or Ambiguous Questions

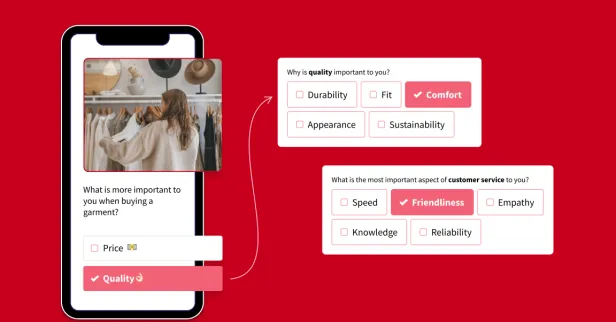

Crafting survey questions may seem easy, but subtle choices in wording can lead to biased or ambiguous responses. Biased questions often inadvertently prompt respondents to answer in a certain way. Ambiguous questions can confuse respondents, leading to unclear responses or even survey abandonment. Either case skews results and leaves researchers with an inaccurate picture of the target audience’s true views and behaviors.

3. Not Clearly Defining Research Objectives

Without clear objectives, research becomes a {corn} maze without a destination. When goals aren’t well-defined, it’s easy for researchers to drift away from what’s essential, including extraneous questions or wasting time on irrelevant insights. Clarity of purpose is critical in guiding every aspect of a research project—from question design to data interpretation.

4. Using Too Small of a Sample Size

A small sample size can severely limit the reliability of research findings. When the sample size is too small, it becomes difficult to generalize results to a broader audience. Small samples are also more prone to statistical anomalies, making the results unreliable or inconsistent. This often leads to misinformed decisions based on patterns that don’t represent the larger population.

5. Misinterpreting Data

Data interpretation requires skill and experience. Misinterpretation can stem from an incomplete understanding of statistical methods, a failure to contextualize findings, or confirmation bias. In the worst cases, misinterpreting data can lead companies to pursue unwise strategies that contradict what their audience wants or needs.

6. Failing to Consider the Target Audience Adequately

Consumer research is only valuable if it focuses on the people who will use the product or service. Failing to account for audience-specific preferences, behaviors, and nuances makes research results less actionable. For instance, not accounting for cultural or regional differences when researching a diverse audience can produce misleading insights.

7. Neglecting to Analyze Competitor Data

Competitor analysis offers context for interpreting consumer preferences and identifying market gaps. Skipping competitor analysis makes it easy to overlook potential threats or misunderstand consumer loyalty, and it also limits the research's strategic impact. Research without competitive context can miss critical insights, which might explain why certain market segments prefer one brand over another.

How to Combat These Errors

Avoiding these common errors involves a combination of precision, planning, and thorough analysis. Here’s how to ensure your research process is robust and produces high-quality insights.

1. Articulate a Well-Defined Objective

Clarity of purpose is the foundation of effective consumer research. Start by asking yourself: What exactly do I need to learn from this research? Clearly articulated objectives provide a roadmap, keeping every aspect of the study aligned with the end goal. For instance, if you’re looking to understand brand loyalty, your objective should focus on understanding factors that influence repeated purchases or brand recommendations.

2. Craft Appropriate Questions - In Both Syntax and for the Target Audience

Crafting questions with precision is essential to avoid misinterpretation and bias. The syntax of each question should be straightforward, neutral, and designed with the respondent's comprehension level in mind. Tailor your language to fit the audience’s demographics, whether that means adjusting for industry terminology, age, or cultural factors. Always test your questions with a small, representative group first to identify any areas of confusion or potential bias.

3. Understand the Audience

Knowing your audience on a deep level will keep your research focused and relevant. This goes beyond demographics—consider psychographics, preferences, and pain points as well. Building audience profiles before diving into the research process helps in designing questions and interpreting data in ways that are meaningful to the end-users of your insights. When your research reflects an understanding of the audience, it’s more likely to yield actionable findings.

4. Analyze Data Thoroughly and Thoughtfully

Analyzing data requires not just mathematical rigor but also context and curiosity. Employ statistical methods that match the data type and research objectives, and resist the temptation to cherry-pick data that supports preconceived notions. Review data from multiple angles:

- Trends over time: Examine how attitudes or behaviors evolve.

- Segmentation: Break down responses by demographic groups to identify any variations.

- Comparative analysis: Compare findings with external benchmarks or previous studies for validation.

Consistent, thorough analysis prevents small anomalies from skewing interpretations, helping you reach valid and actionable conclusions.

How SightX Supports Quality Input and Quality Output

At SightX, we understand that robust research demands more than data collection; it requires precision, relevance, and strategic interpretation. Here’s how we empower organizations to conduct high-quality consumer research and gain insights they can trust.

1. Advanced Sampling Capabilities: We help clients avoid poor sampling pitfalls by offering access to a wide range of panel providers and targeting options. This allows you to reach the right audience every time, whether you’re looking for niche groups or broader demographics. Our sampling solutions are designed to maximize representativeness, ensuring that findings are genuinely reflective of your target market.

2. Question Design Assistance: SightX supports the creation of surveys that are both insightful and user-friendly. With our expertise in survey design, you can count on unbiased, clear questions that encourage engagement and yield actionable answers. We assist in crafting questions that align with your audience’s level of understanding and avoid pitfalls like ambiguity and bias.

3. Audience Understanding Tools: With SightX, gaining a deep understanding of your target audience is easier than ever. Our platform provides audience segmentation tools that allow you to create detailed profiles and adapt research for cultural, behavioral, and psychographic nuances. This results in research that is fine-tuned to your audience’s unique characteristics.

4. Sophisticated Data Analysis Features: SightX offers advanced data analysis tools that help you go beyond basic insights. Our platform allows for segmentation, comparative analysis, and trend detection, giving you a comprehensive view of the data. You can dive deep into your findings, identify patterns, and understand audience behaviors on a meaningful level.

Through these solutions, SightX ensures that every step of the research process, from sampling to analysis, is aligned with industry best practices. Our platform takes the guesswork out of consumer research, providing the tools you need to conduct research with precision and confidence.

Conclusion

Consumer research is an invaluable tool, but only if it’s done correctly. Avoiding the biggest research mistakes requires careful planning, a deep understanding of the audience, and rigorous analysis. By steering clear of common pitfalls—like poor sampling techniques, biased questions, and a lack of clear objectives—you’ll produce insights that truly represent your audience.

So this Halloween season, let’s leave the scares to the ghosts and goblins—there’s no need for any data-driven frights in your research strategy!